EXECUTIVE SUMMARY

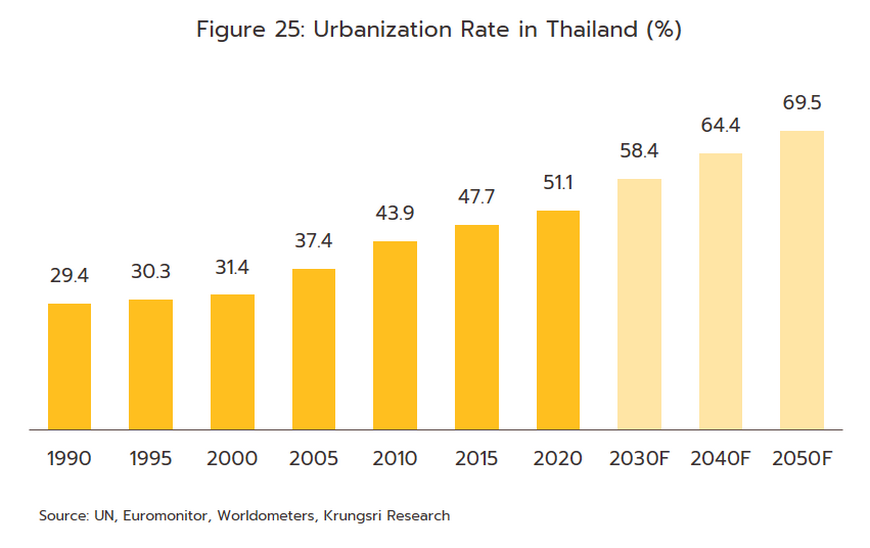

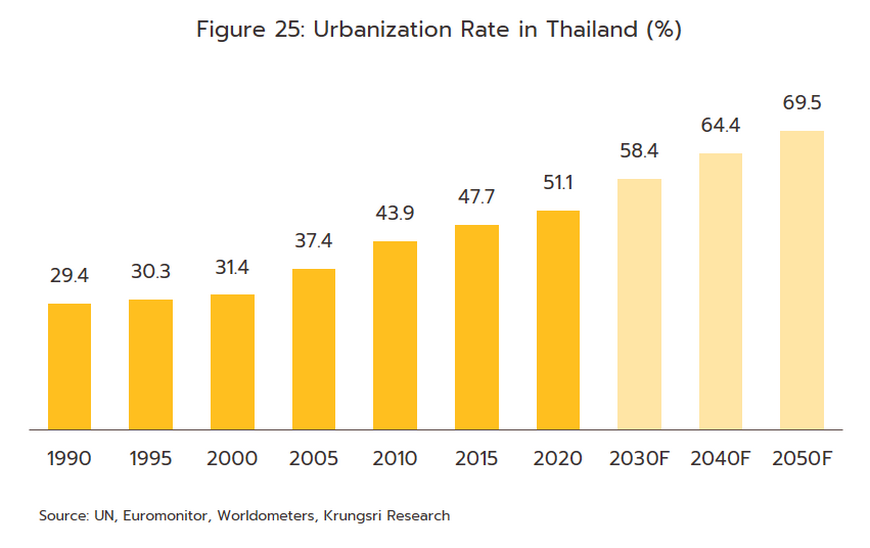

Sales of ready-to-eat food will increase through 2022-2024. The domestic market, the main source of income for the industry, will be buoyed by sales of instant noodles, as weak spending power encourages consumers to turn to low-cost foods. Sales of chilled and frozen food are also expected to rise with the spread of modern trade outlets, of which are the main distribution channel. In addition, ongoing urbanization is also encouraging consumers to adopt lifestyles that place a greater premium on convenience and speed, which will naturally translate into stronger sales of ready-to-eat meals.

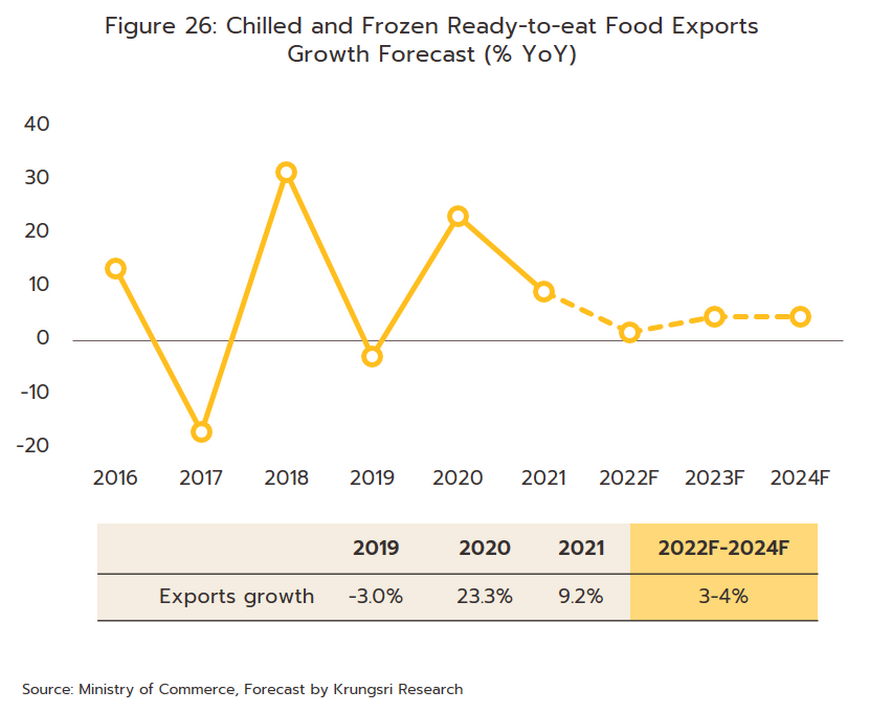

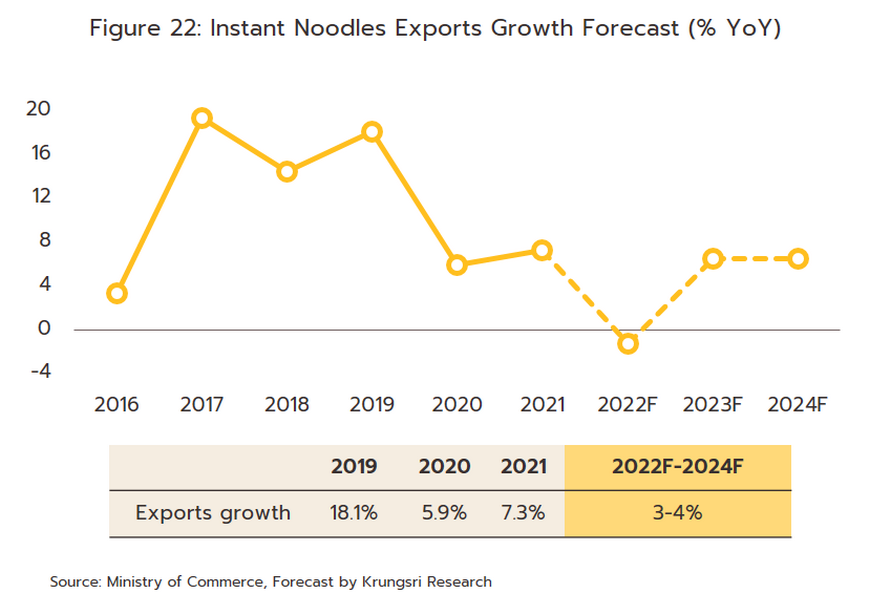

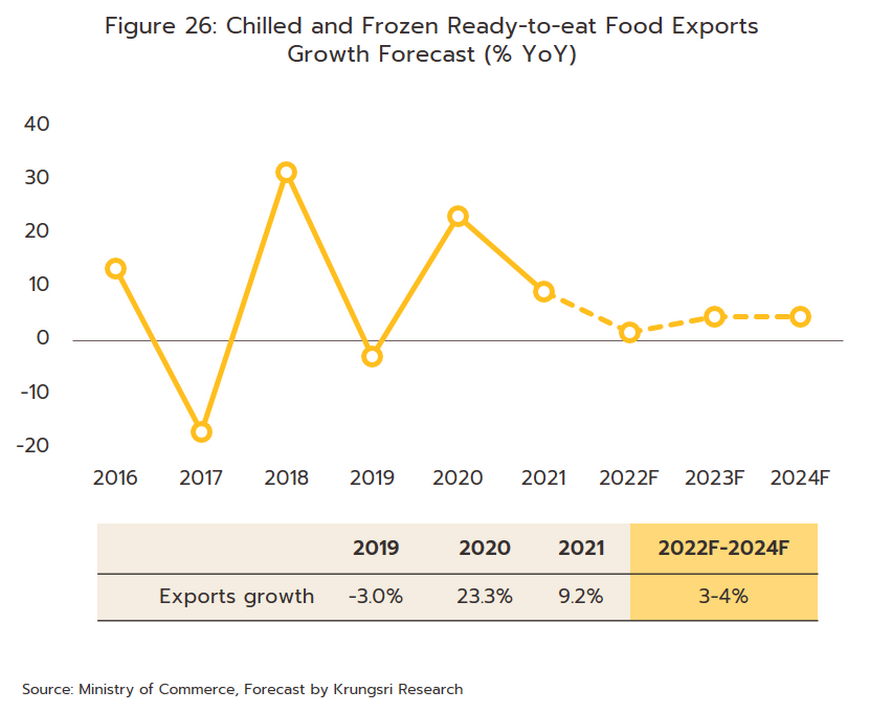

Exports are also expected to perform well in the coming period. Overseas sales of instant noodles will benefit from the easing of the Covid-19 pandemic and with this, the reopening of border crossings between Thailand and its neighbors and the relaxation of checks on goods in transit. However, exports of chilled and frozen ready-to-eat food will likely grow at a slower pace through 2022 due to the economic slowdown of Thailand’s trading partners, especially in the US and Europe. Exports growth will move faster over 2023 and 2024, supported by growing public concern with personal health and the widespread perception of Thai food as being both healthy and tasty. Unfortunately, the impact of the war in Ukraine on the cost of crude and of cereal crops may erode manufacturers’ profits, though this will be most notable in 2022.

Krungsri Research view

Overall, players in the ready-to-eat food industry will see continuing growth in income over the three years from 2022 to 2024. The domestic market for instant noodles will enjoy only relatively low rates of expansion, but in 2023 and 2024 growth in export markets will pick up. The domestic and export markets for frozen ready-to-eat foods will benefit from the continuing expansion in the number of modern trade retail outlets and from the steady increase in rates of urbanization, while internationally, Thai products remain popular with consumers. However, manufacturers are exposed to the risk of ongoing increases in the cost of inputs, and on top of this, they may also have to contend with the possibility of the Thai government imposing a salt tax on their products, which would then further increase costs and erode profitability.

-

Manufacturers of instant noodles: Players’ income will rise with what is likely to be an only slow economic recovery that will help players since as long as the economic outlook remains uncertain, consumers will likely try to cut their expenses by increasing purchases of instant noodles. However, competition is stiff in this segment, and this is forcing manufacturers to develop and release a steady stream of new products, while other types of ready-to-eat products and alternative foods also threaten to steal market share. Production costs (especially for wheat and palm oil) are expected to continue to rise through 2022 on the continuing impacts of the Ukraine war but over 2023 and 2024, supply should expand and so cost pressures should begin to ease. In the meantime, though, the price of instant noodles is controlled by the government and so it is difficult for manufacturers to pass on higher costs to consumers. In addition, the government is actively considering introducing a tax on the sodium content of processed food. This is likely to be implemented in 2023 or 2024 and if this happens, this would then add to production costs and so undercut the ability of manufacturers to generate profits. On the other hand, exports should see stronger rates of growth thanks to what are currently only low levels of consumption of instant noodles in many countries, though in particular in the major export targets of Cambodia and Myanmar.

-

Manufacturers of frozen ready-to-eat food: Income is expected to rise solidly, supported by strength in the domestic market that will come from the continuing expansion in the number of modern trade outlets, increasing rates of urbanization, a diversification of the food types on sale, and the impact of sales promotions and price discounts organized by modern trade retailers as they look to attract new customers. Exports will see some weakness in 2022 as economies slow in the major export markets of Europe and the US, but the segment will rebound to growth in the following two years, helped further by the fact that in many countries, Thai food is now viewed favorably in terms of its flavor and quality. Nevertheless, challenges will persist, in particular from: (i) the impact of the Russia-Ukraine war on the cost of both HDPE and agricultural inputs, which will add to production costs in 2022 before these ease in 2023 and 2024; and (ii) a tightening of controls and checks on food imports, including the need to meet HACCP, GMP, ISO 9001-2000 and halal standards, and additional requirements for food labeling and supply chain tracing and accountability. These may then require additional investment to cover the cost of overhauling production processes.

OVERVIEW

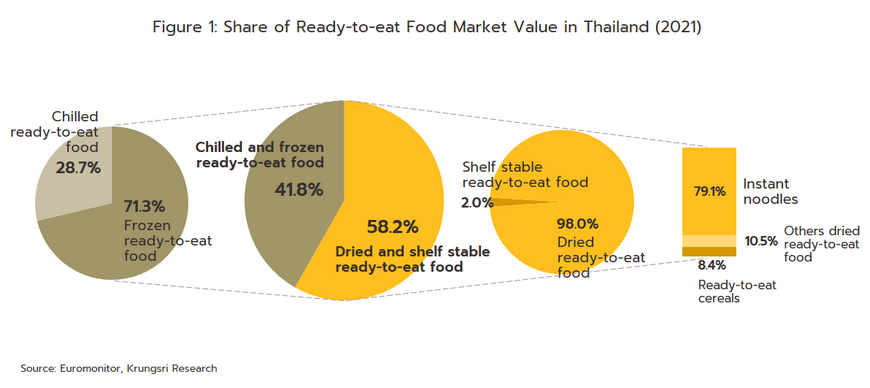

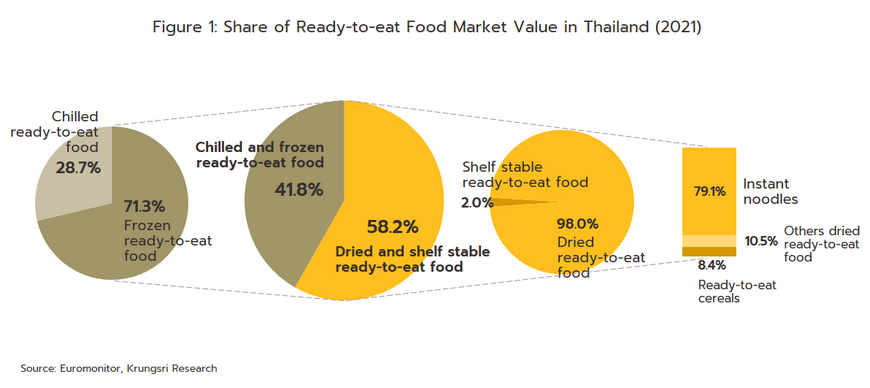

Ready-to-eat food is food that has been processed in such a way that it is preserved or had its shelf life extended and that has been put into a state that makes it easy to consume. Ready-to-eat food can be split into two main categories, according to the processing and preserving techniques that have been used (Figure 1).

1) Dried and shelf-stable ready-to-eat food: This segment represents 58.2% of the value of the domestic market for ready-to-eat food, though almost all of this is accounted for by sales of dried ready-to-eat foods (98.0% of the combined value of dried and shelf-stable ready-to-eat food). 79.1% of the value of this segment comes from sales of instant noodles. These products are favored by consumers because they have a long shelf life and can be stored at a wide range of temperatures without spoiling or undergoing a change in their flavor. The remaining 2.0% of the segment’s value comes from shelf-stable ready-to-eat foods. Thanks to their special packaging, these goods have an extended shelf life even when kept at room temperature, though they also retain many of the qualities of freshly prepared food.

2) Chilled and frozen ready-to-eat food: Sales of these products account for 41.8% of the value of the domestic market for ready-to-eat foods. Chilled ready-to-eat foods (28.7% of the value of combined sales of chilled and frozen ready-to-eat foods) is typically stored at 4-7 degrees Celsius and may be kept for 3-7 days. By contrast, frozen ready-to-eat foods (71.3% of the segment’s value) need to be stored below -18 degrees Celsius because this low temperature impedes the activity of bacteria, thus allowing frozen food to be kept safely and without loss of quality for up to 18 months. Chilled and frozen meals also have the advantage of being available in a wider range of food styles than are other types of ready-to-eat foods.

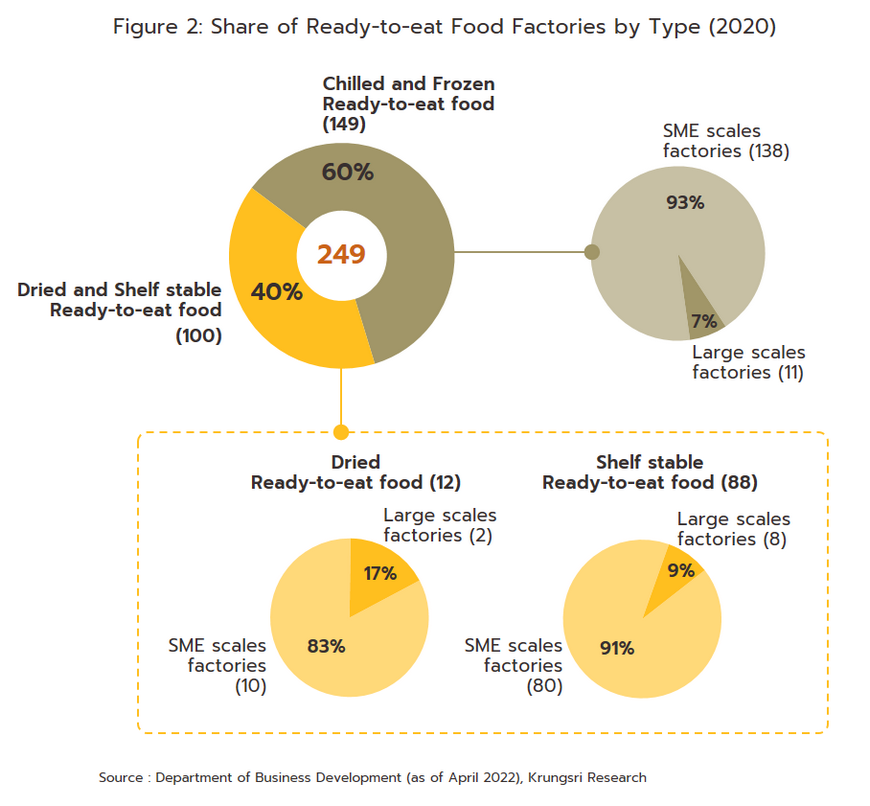

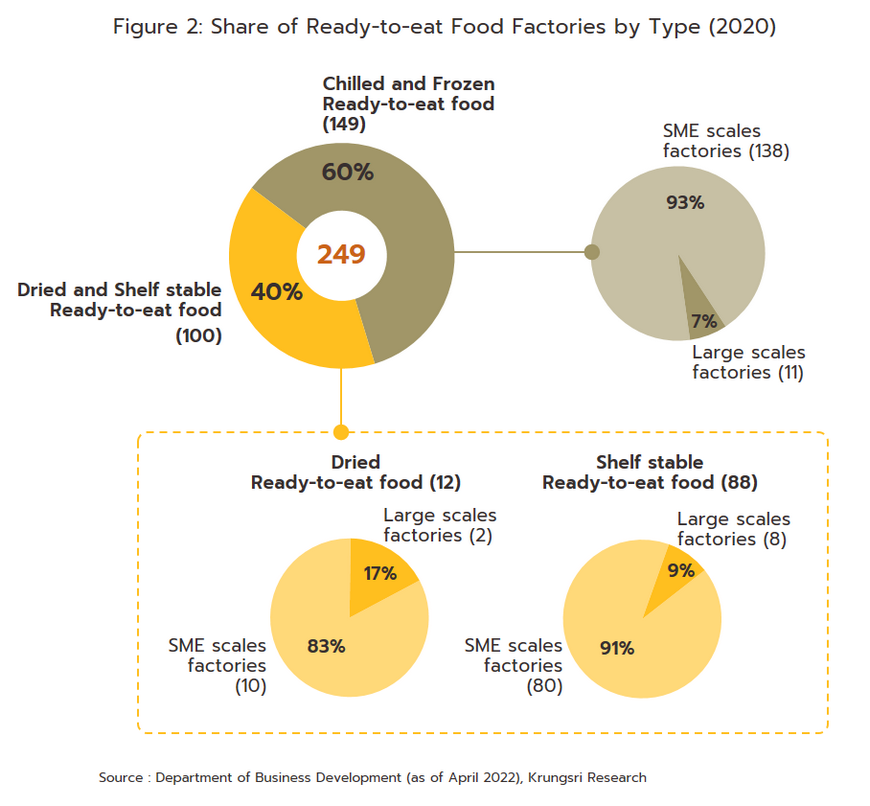

As of 2020 (the latest data available), there were 249 facilities producing ready-to-eat food registered with the Department of Business Development, the majority of which were SMEs. These can be split into: (i) 100 (or 40%) produced dried and shelf-stable ready-to-eat foods, 12 of these made dried ready-to-eat foods, mostly instant noodles. Within this, 10 (or 83%) were SMEs, the remainder being large-scale operations. On the other hand, 88 factories produced shelf-stable ready-to-eat foods, and 80 of these (91%) were SMEs. (ii) 149 sites (60% of the total) produced chilled and frozen ready-to-eat food, with 138 of these (93%) being SMEs (Figure 2).

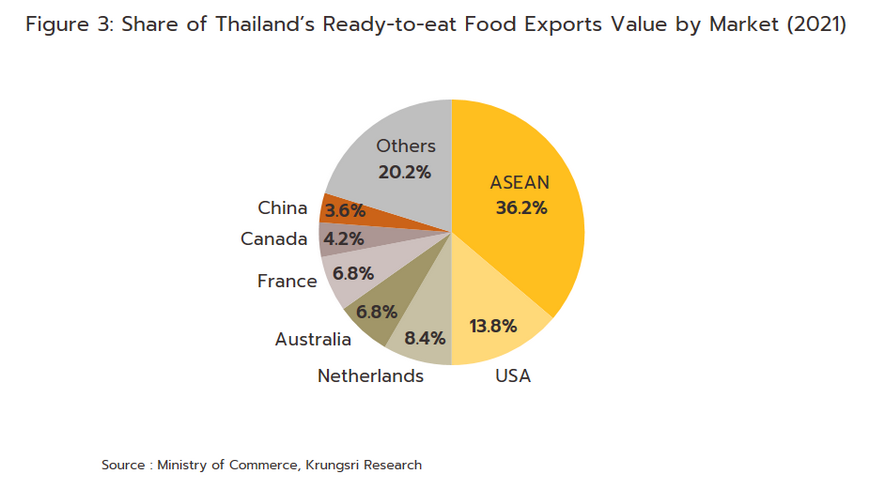

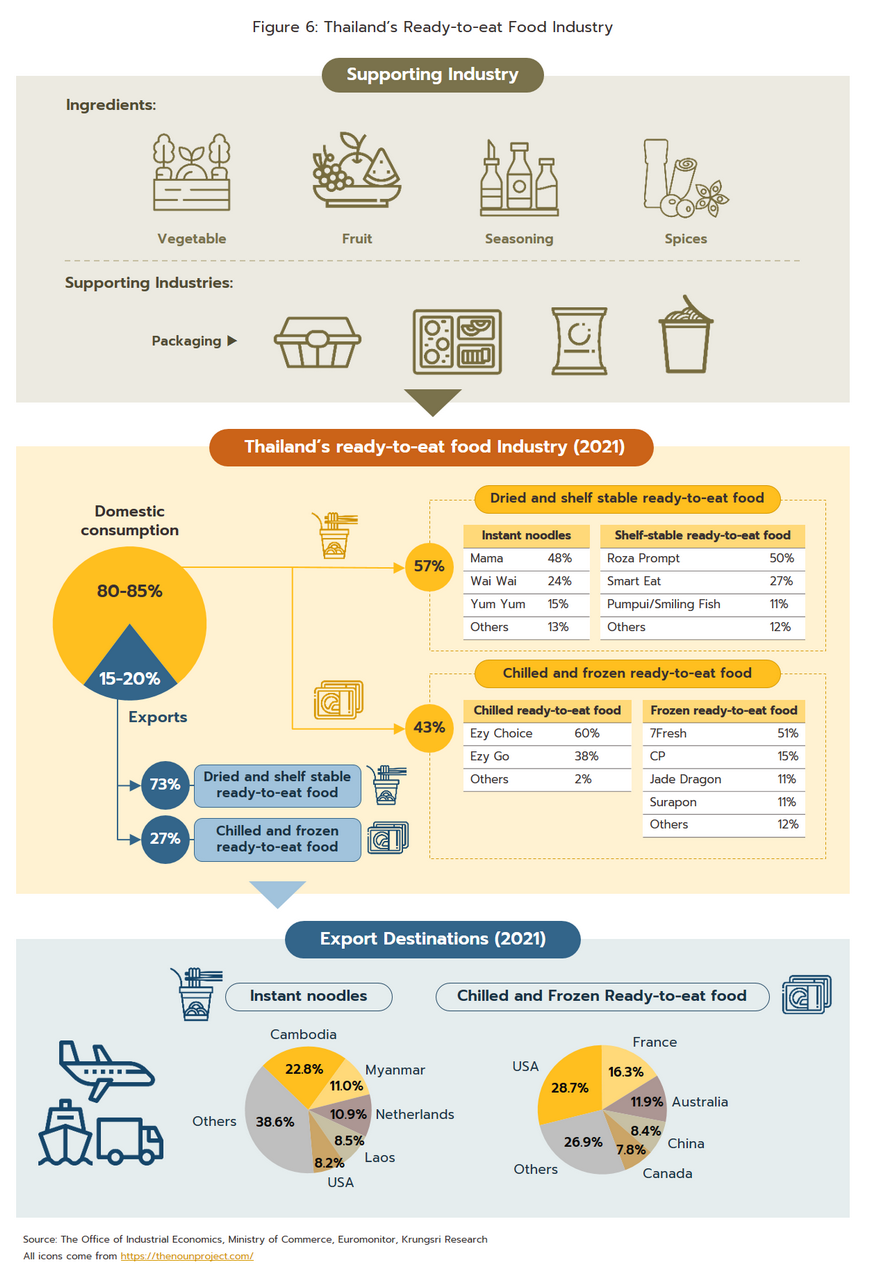

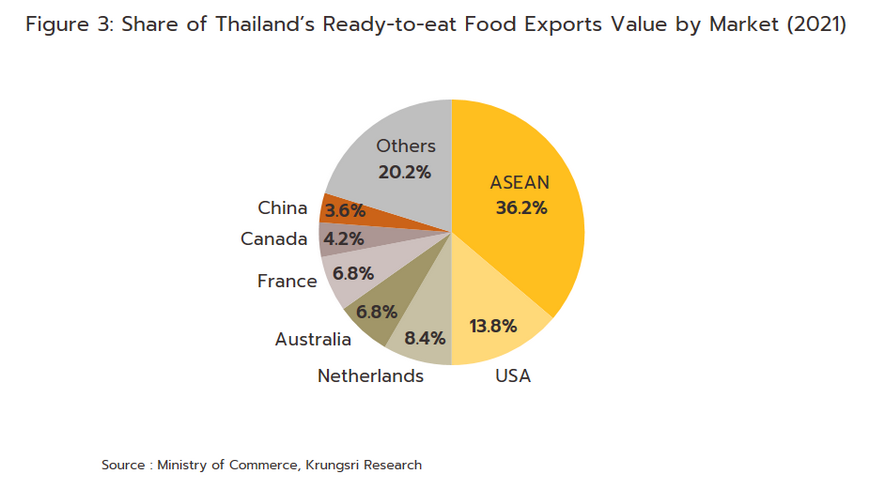

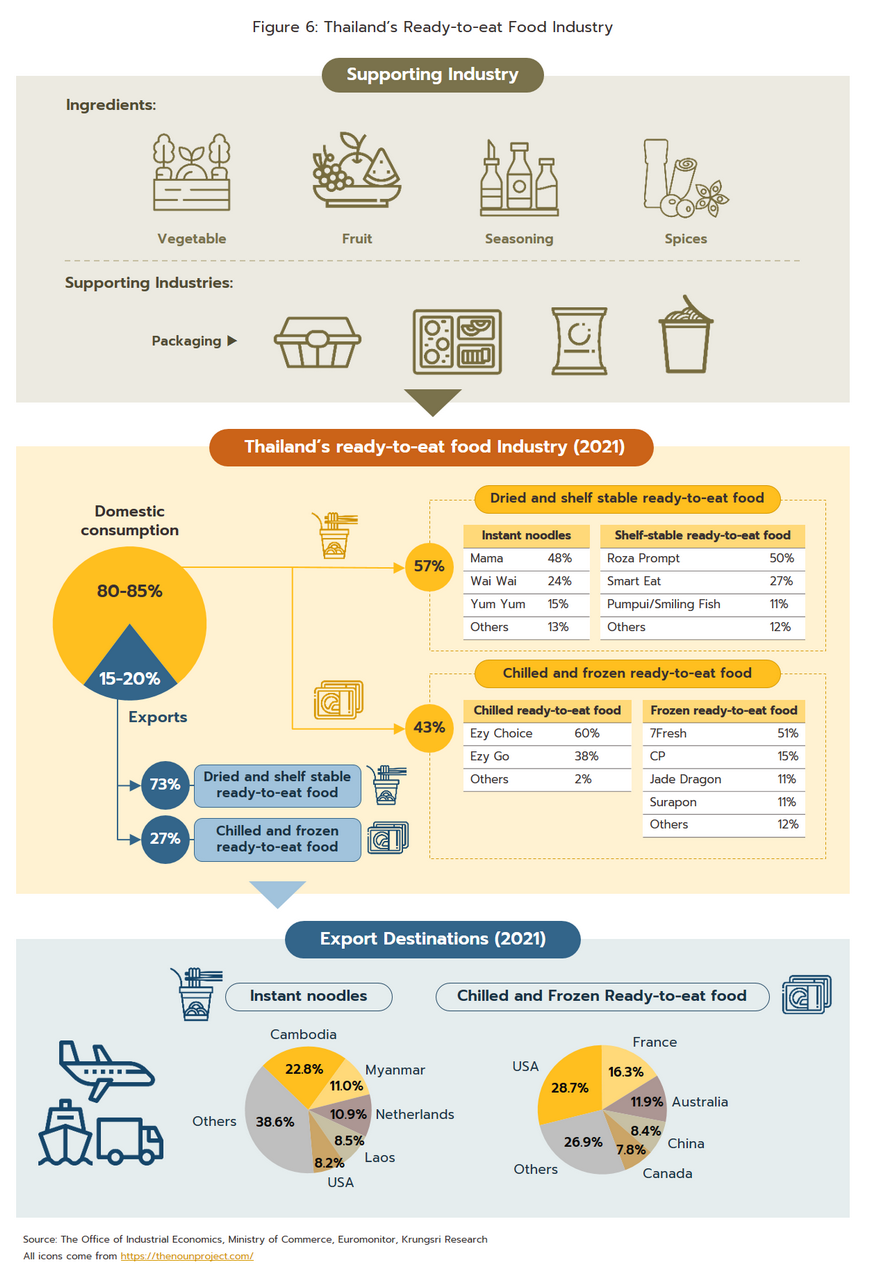

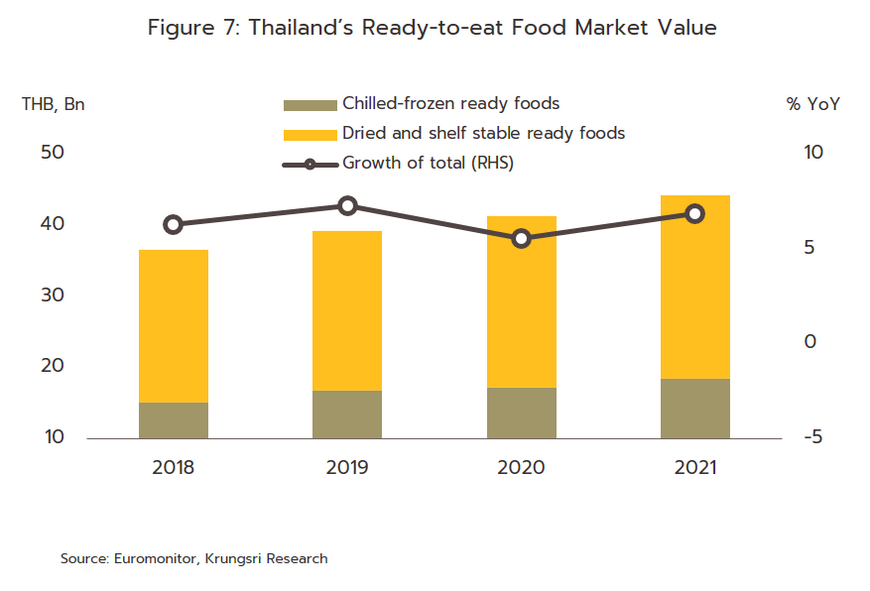

Thai producers of ready-to-eat food are largely focused on the domestic market, and over 2016-2021, this absorbed 80-85% of the industry’s output. In 2021, the Thai market had a total value of THB 44 billion, split between THB 26 billion for dried and shelf-stable ready-to-eat foods and THB 18 billion for chilled and frozen ready-to-eat foods. The 15-20% of output that is bound for overseas markets generated USD 354.1 million (or THB 11 billion) in 2021. The main export markets for Thai instant noodles and chilled and frozen goods are the ASEAN region (36.2% of exports by value), followed by the United States (13.8%) and the Netherlands (8.4%) (Figure 3).

Instant noodles comprise the main product category within the dried and shelf-stable ready-to-eat segment. Here, Thai players benefit from the size of the domestic market, which has helped to generate significant economies of scale for manufacturers, and this then helps to reduce production costs. However, the market is approaching saturation and competition is intensifying, and as it becomes more difficult to maintain growth, players are increasingly looking to expand into export markets, especially in the ASEAN region, the Netherlands and the US. By contrast, the chilled and frozen ready-to-eat segment is largely still concentrated within the domestic market. These foods benefit from the fact that they are easy to consume, are sold at price points that are similar to those of freshly prepared foods, and are extremely easy to purchase since they are distributed through convenience stores that have very extensive national networks. At present, exports are not a major contributor to earnings but these have the potential to grow, given the widespread preference for Thai food and these products’ attractive prices. Details of these two main segments are given below.

-

Instant Noodles

-

As of 2021, the market for instant noodles was worth around THB 20 billion. Within Thailand, sales are dominated by three brands that compete strongly for their combined 86.7% market share. These three are: Thai President Foods (producers of Mama), which has a 47.6% market share; Thai Preserved Food Factory (operators of the Waiwai brand), which has a 23.7% market share; and Wan Thai Foods Industry (selling under the Yum Yum brand), which has a 15.4% market share. Because these players manufacture in such significant quantities, they also enjoy economies of scale as well as having advantages in terms of access to raw materials and capital, their brand recognition, and their well-developed distribution networks. Also active in the market is Nissin foods (Thailand) [operators of the Nissin brand], a Japanese brand that has a 0.7% market share and Nong Shim, an importer of instant noodles from South Korea that are sold under the Nong Shim brand (0.6% market share). The remaining 12% of the market is shared between a number of less important brands.

-

Consumer demand for instant noodles has increased steadily due to their low costs and the ability of these products to meet buyers’ basic needs when spending power is low and access to fresh foods is limited. Instant noodles also benefit from being a favored product across most consumer groups, regardless of age or sex, and players are constantly expanding their markets by adding new and unusual flavors.

-

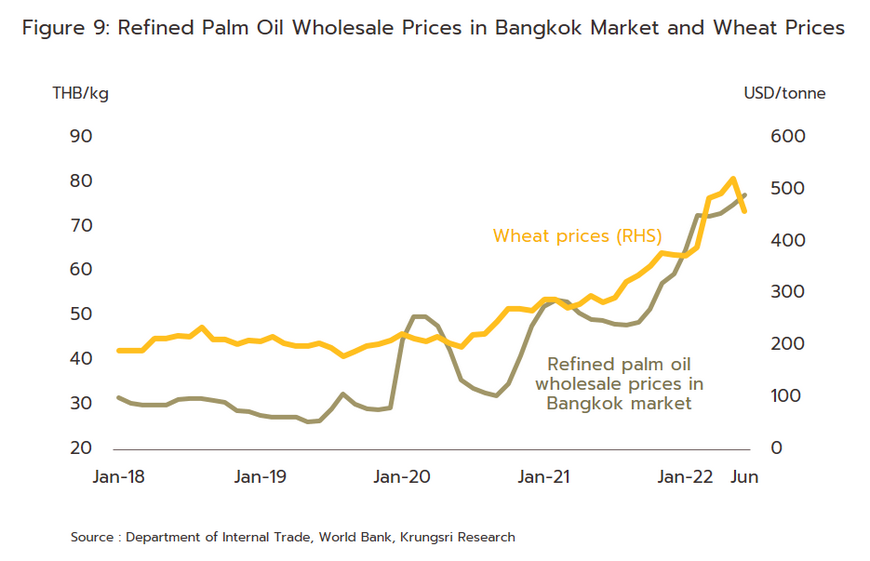

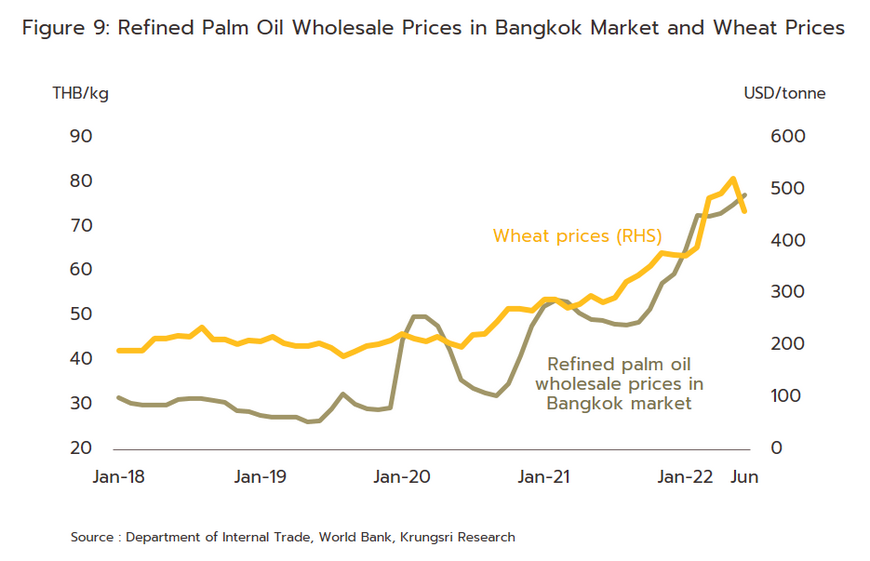

Costs of instant noodle production typically move with the price of wheat flour (70% of production costs) and palm oil (20% of costs), with the remaining 10% going to the manufacture of flavorings and other ingredients. Because wheat cannot be grown locally and must be imported, this exposes players to risks arising from variations in exchange rates, while the sale price of instant noodles is controlled by the authorities, limiting the room that players have to raise prices.

-

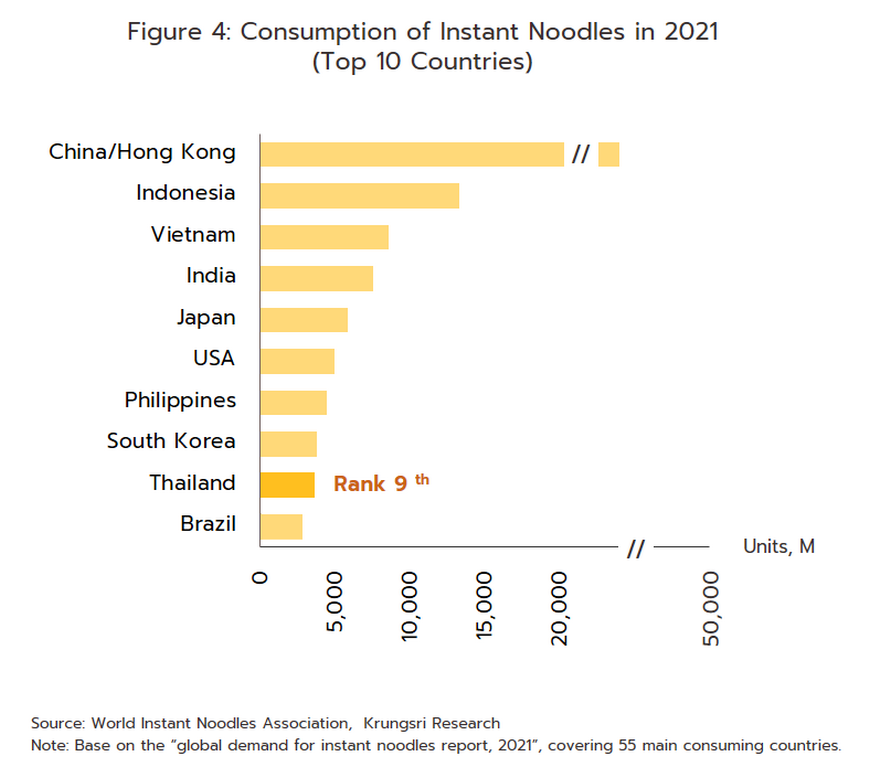

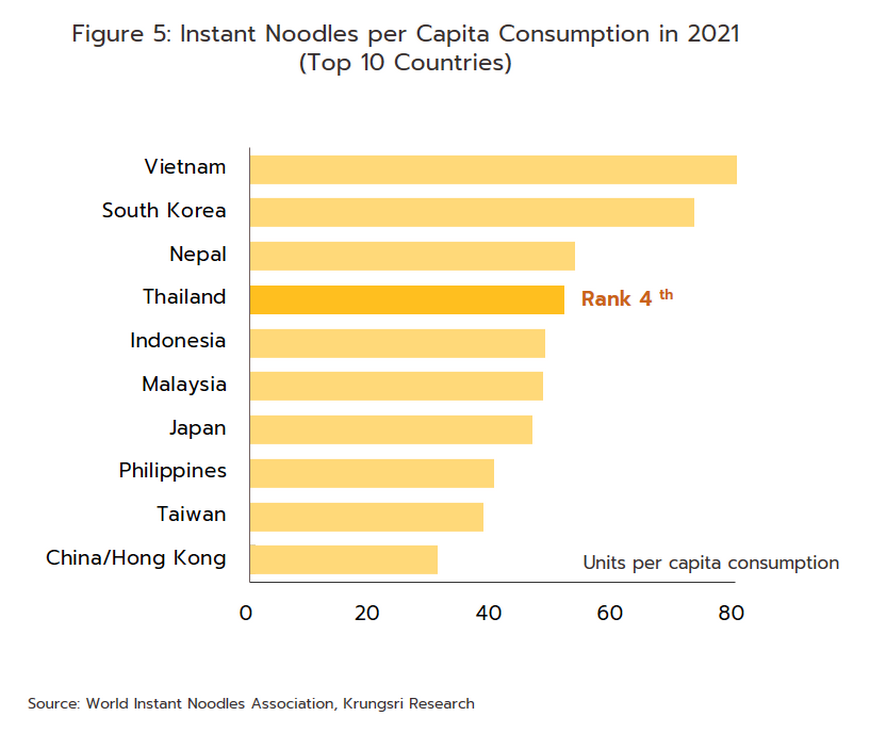

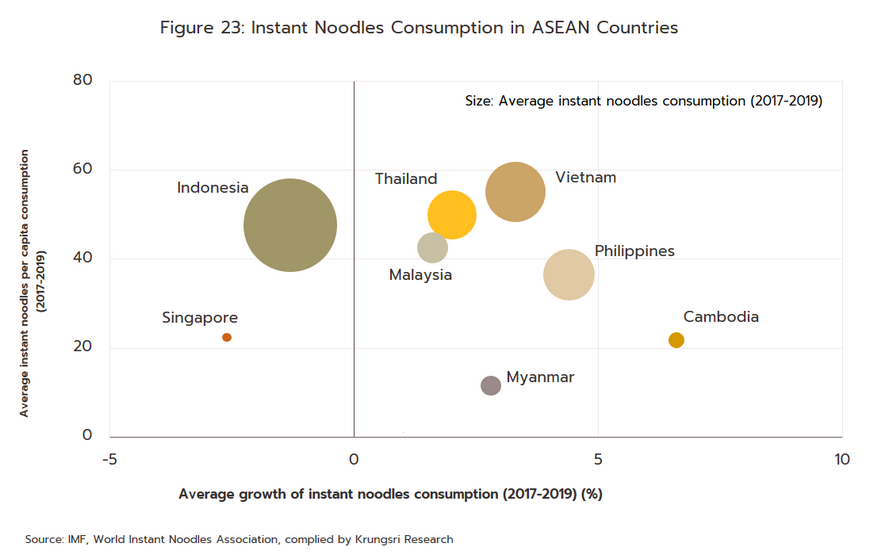

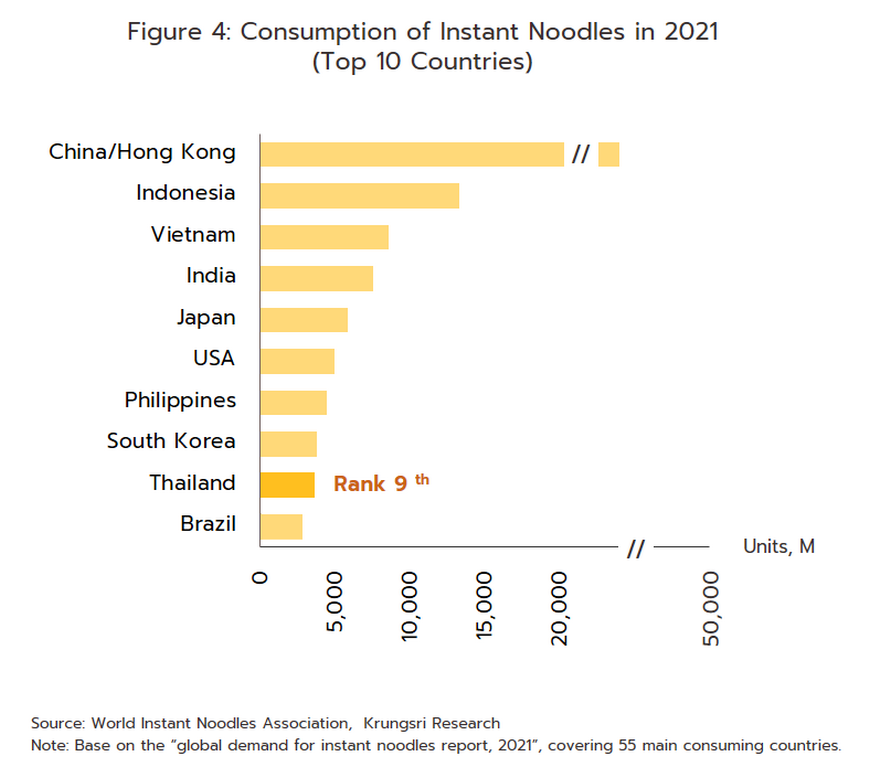

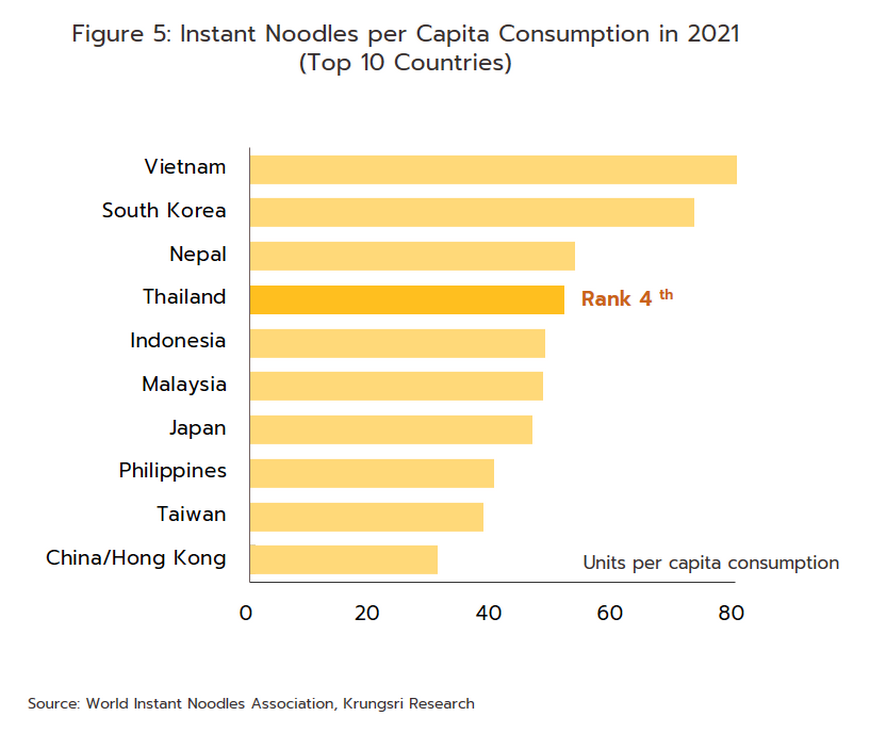

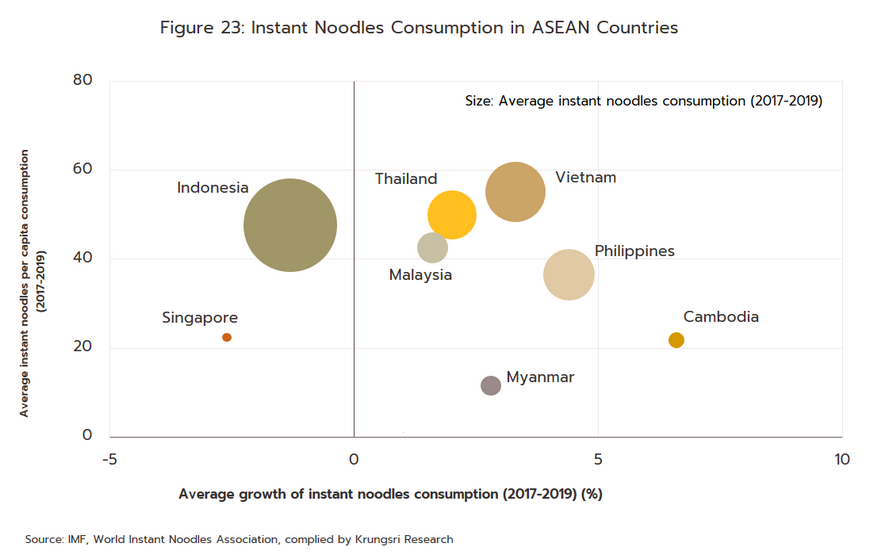

Over the period 2016-2021, an average of 80-85% of Thai instant noodle production was distributed to the domestic market, which in 2021, consumed 3.63 billion packets of instant noodles, sufficient to rank the Thai market 9th in the world. However, in terms of per capita consumption, at 51.9 packets per person per year, Thai consumption is the 4th highest in the world, coming after only Vietnam (87.1 packets/person/year), South Korea (73.3 packets/person/year), and Nepal (53.6 packets/person/year). This compares to average global consumption of 15.4 packets per person per year (source: World Instant Noodles Association: WINA, May 2022), indicating that the domestic market is close to saturation. At the same time, competition is building from the large range of alternative ready-to-eat products as well as from imported instants noodles, especially those from South Korea and Japan, which are gradually establishing a greater presence in the market. Manufacturers of instant noodles are thus having to develop new products and adopt new strategies as they fight more intensely for market share, including ramping up investment in marketing and spending more heavily on television advertising and product promotions. Export markets soak up the remaining 15-20% of output, helped by the implementation of the AFTA free-trade agreement in the ASEAN zone. Because the latter is a large market with relatively low levels of instant noodle consumption, this now presents players with the opportunity for significant expansion, especially into markets in Cambodia, Myanmar, and Lao PDR. These countries account for over 42.3% of the value of Thai instant noodle exports, and consumers in these countries are generally positively inclined towards Thai products, being familiar with Thai flavors and having faith in the quality of Thai goods.

-

Chilled and frozen ready-to-eat food

-

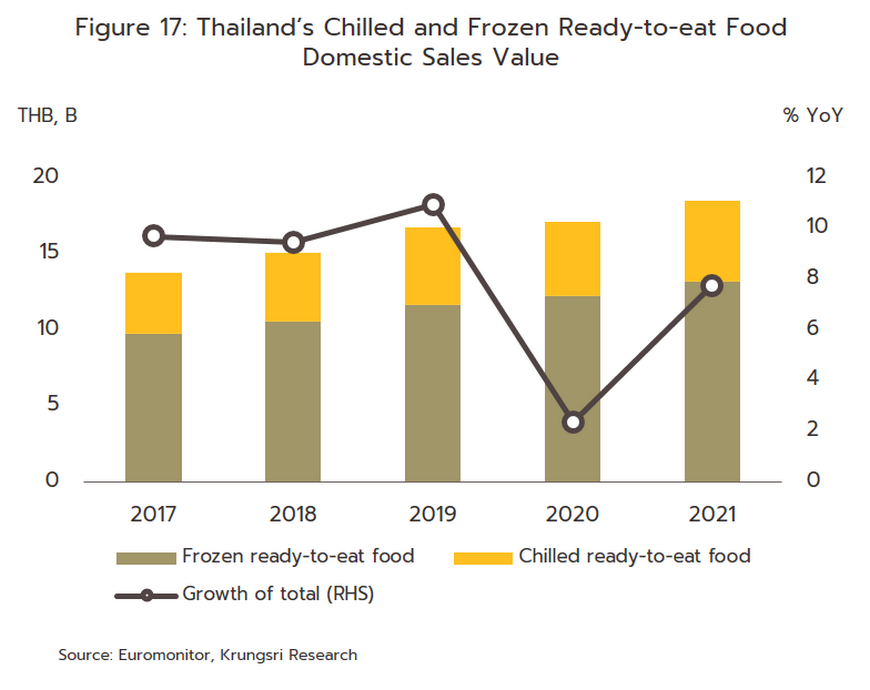

As of 2021, the Thai market for chilled and frozen ready-to-eat foods was worth approximately THB 18 billion. Thai-style dishes are the most widely consumed (45% of the market by value), followed by Chinese (29%), Italian (11%), Japanese (6%), and others (9%) (source: Euromonitor, December 2020).

-

Producing chilled and frozen meals does not require large-scale investment or the mastery of complicated technology and so entry to and exit from the marketplace is relatively straightforward. Given this, there is an abundance of players on the supply side and thanks to their low levels of product differentiation, competition is stiff. In addition, producers have to contend with strong competition from a diverse range of alternative products that include canned goods, instant noodles and freshly prepared food, most obviously fresh noodles and rice dishes.

-

The market is dominated by a few large players that are able to draw on their advantages with regard to access to raw materials and distribution channels. CP All occupies a monopoly position in the market for chilled ready-to-eat foods, and operating under the brands Ezy Go and Ezy Choice, the company holds a 98.0% market share by value (as of 2021), partly thanks to the company’s ability to distribute through the large number of convenience stores that are operated by companies in the same commercial group. Sales of frozen ready-to-eat foods are also controlled by CP All, which sells under the brand Seven Fresh and has a 50.9% market share, and Charoen Pokphand Foods. The latter has a 15.0% market share under its CP brand and another 11.0% under the Jade Dragon brand, though both CP All and Charoen Pokphand Foods are part of the same commercial group, and so these have a combined 76.9% market share. Against this, other players have only a relatively slight presence in the market. These include Surapon Foods (Surapon brand, which as an 11.0% market share), S&P Syndicate (Quick Meal, 5.2% market share), and Thai Agri Foods (Little Chef, 2.6%).

-

Production costs move with changes in the cost of core inputs, which encompass agricultural goods (50-60% of costs), packaging (15-20%), transport (20-25%), and other items, including seasonings and marketing costs (10-15%). However, Thai producers are in the fortunate position of having ready access to a wide range of domestic agricultural supplies, so players are able to control manufacturing costs by adjusting their production according to seasonal variations in the goods that are available on the market.

-

Through the period 2016-2021, an average of around 80-90% of Thai-made chilled and frozen ready-to-eat food was consumed by the domestic market. Demand within Thailand is supported by continuing growth in urbanization rates, which brings with it changes to consumer behavior that favor food that is easy and convenient to buy and consume. In addition, sales of chilled and frozen food are helped by the fact that these products are distributed through convenience store networks that have a very extensive national reach and that are typically open 24 hours per day. The remaining 10-20% of output is bound for export markets, where Thai products have an advantage thanks to manufacturers’ access to a broad supply of raw materials and overseas consumers’ acceptance of Thai food with regard to both its flavor and quality. This is particularly so for frozen foods, since the freezing process keeps food fresh and flavors intact for up to 18 months, an important consideration given the long transit times to some destinations.

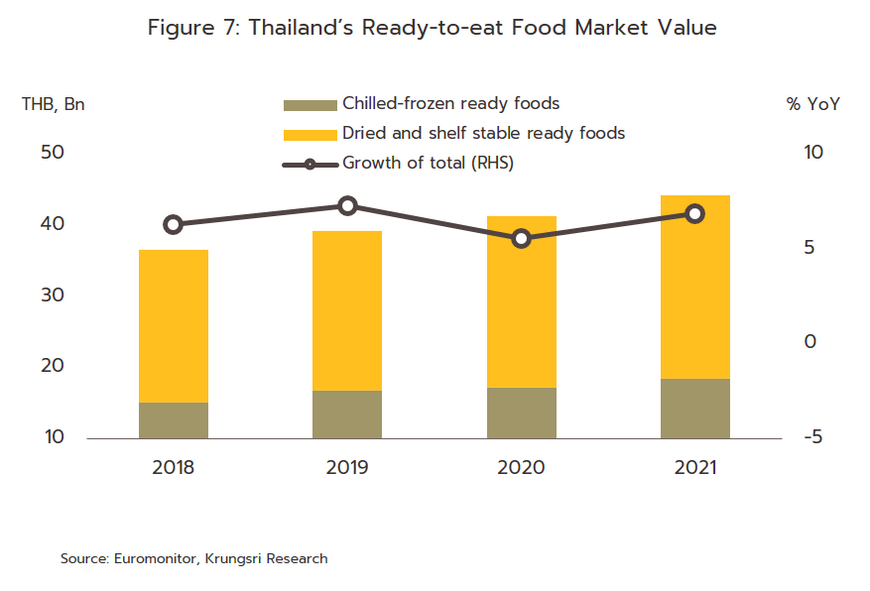

SITUATION

The Thai ready-to-eat food industry enjoyed average annual growth of 6.4% over the years 2016-2021, helped by increasing urbanization in Thailand, which in turn drove changes in lifestyle that supported greater demand for products emphasizing ease and convenience. Over the same period, exports also saw steady growth. Details of these developments are given below.

-

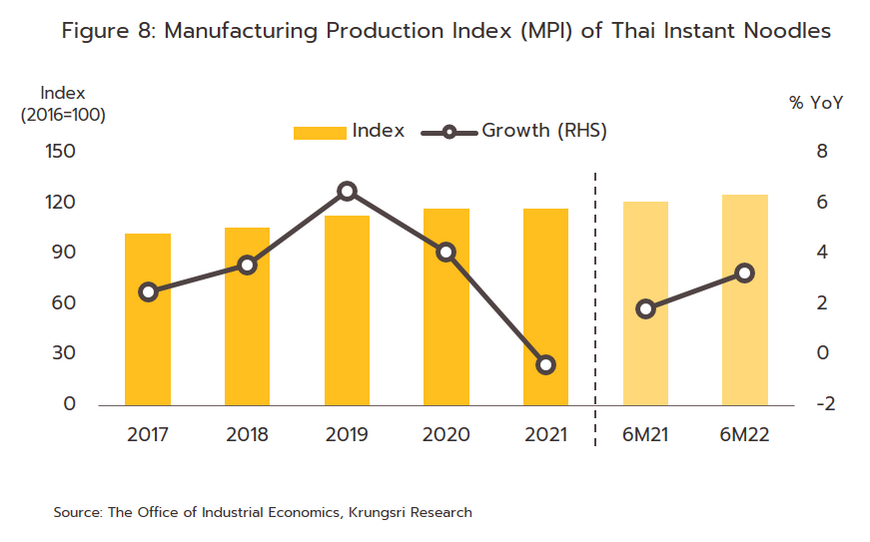

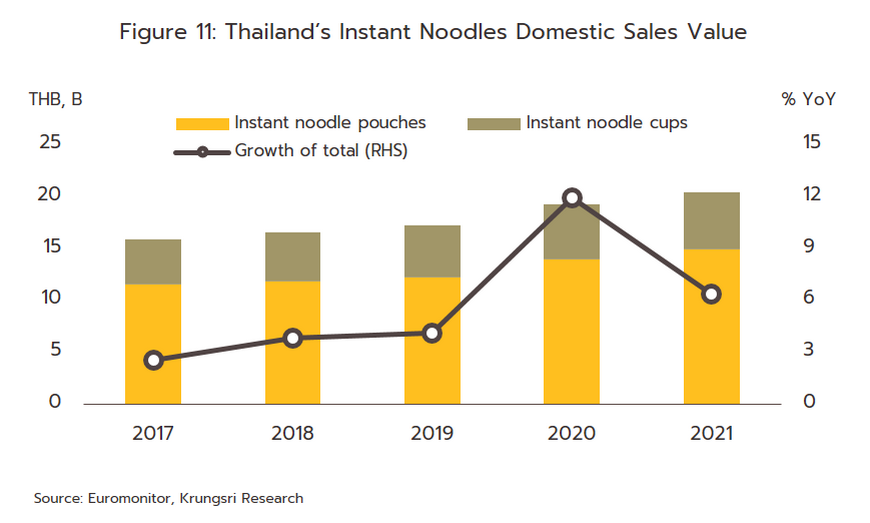

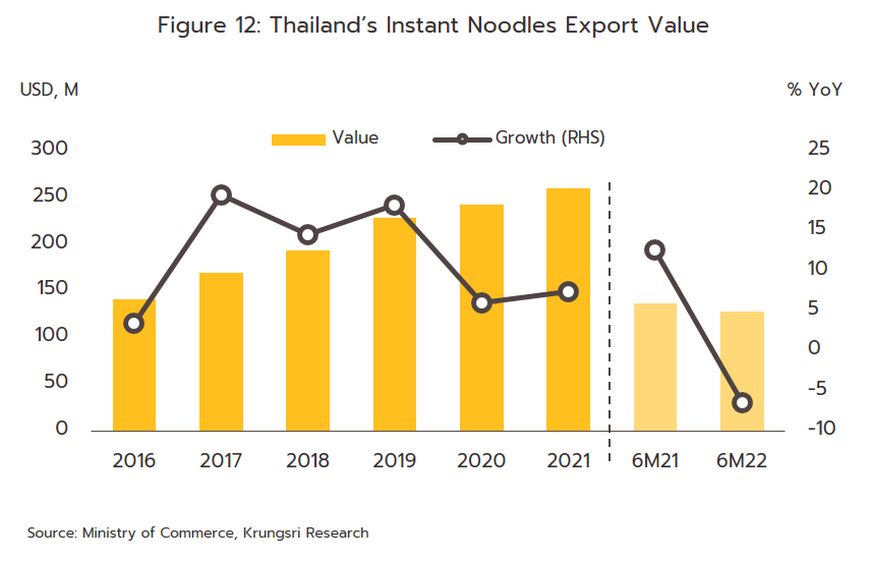

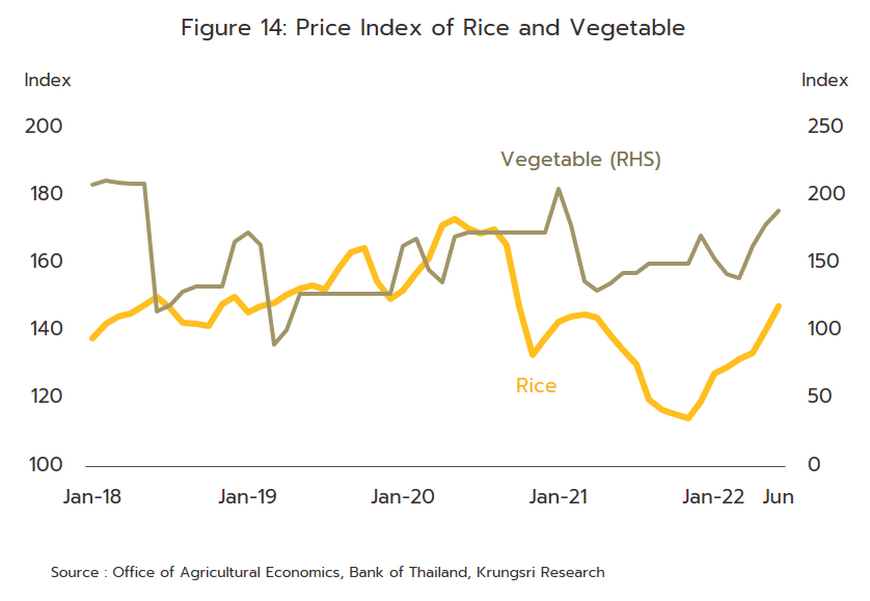

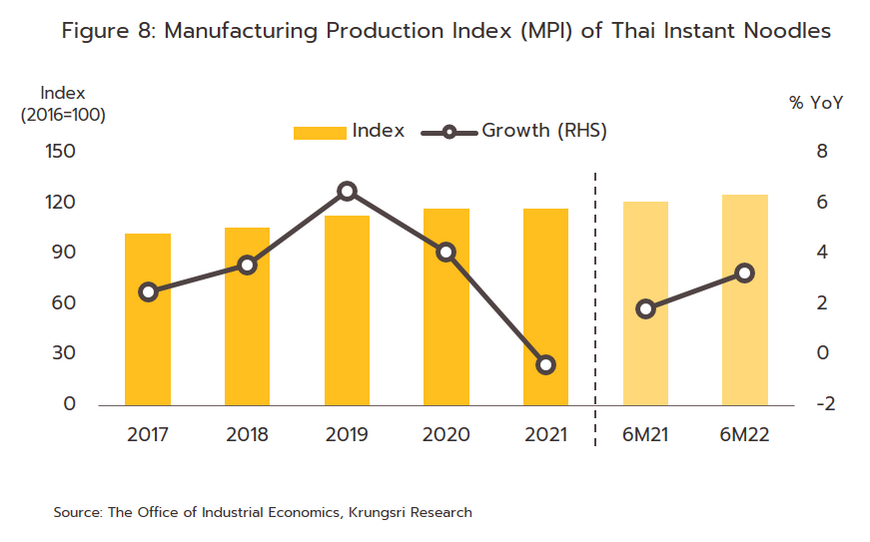

Instant noodles: Over 2016-2020, output rose steadily, as reflected in the 3.9% average annual climb in the industry’s manufacturing production index (MPI). These increases were underpinned by strength in the domestic market (where the bulk of sales are made), which expanded by an average of 5.1% annually in terms of value, though through the same period, exports jumped 11.4% per year. However, at the same time, costs for palm oil and wheat (for use as wheat flour) climbed by averages of 6.7% and 8.9% annually, putting downward pressure on profits.

-

In 2021, output slipped slightly, with the segment’s MPI edging down -0.4%. Stocks had built up over 2019-2020 as consumers stockpiled food at the start of the pandemic, and so this provided the space for players to meet demand by running these down. Alongside this, costs for palm oil and wheat, the industry’s most important inputs, surged by respectively 44.1% and 36.1%. Because consumer spending power has been under threat, manufacturers looked to preserve market share by leaving prices unchanged, but the outcome of this was that net profit margins came under pressure.

-

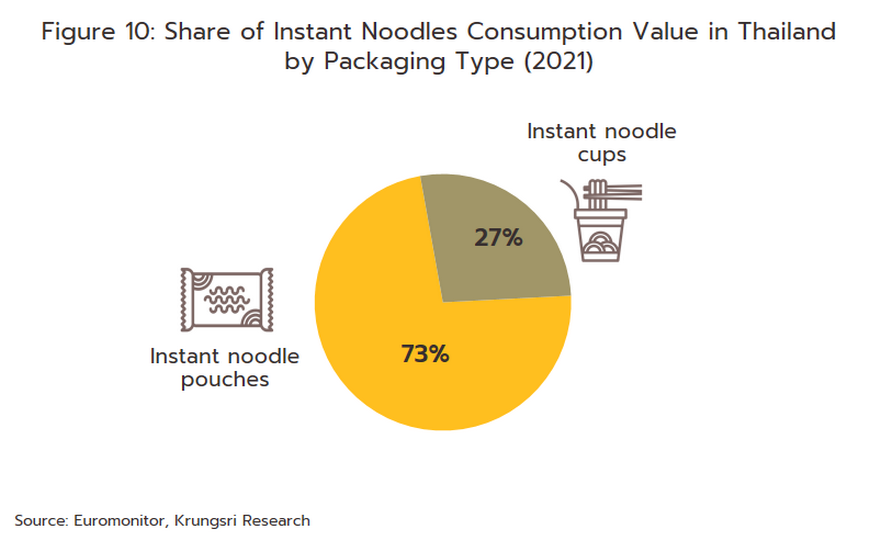

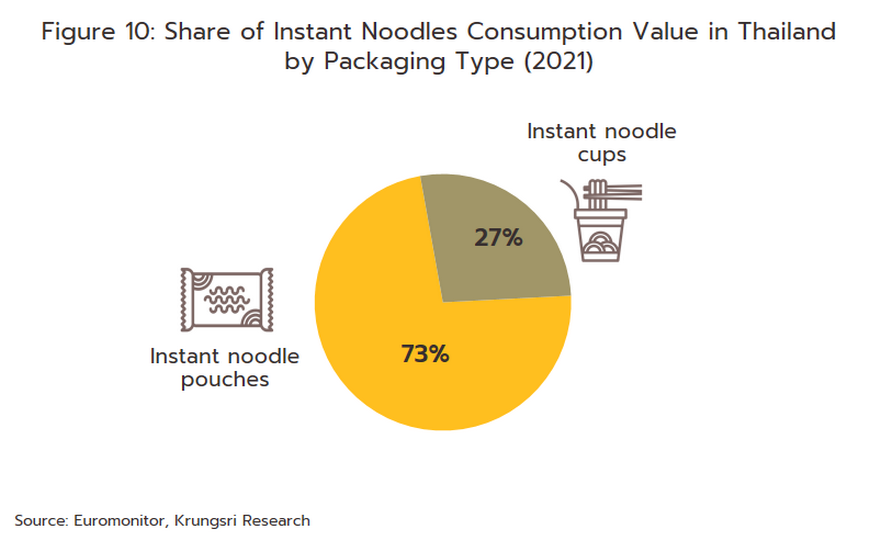

Domestic demand expanded by 6.4% to a value of THB 20 billion in 2021, with increases seen for both packet/pouch noodles (+6.8%) and cup/bowl noodles (+5.1%). Because it is a low-cost food, sales of instant noodles were boosted by the poor economic outlook and weak spending power that encouraged consumers to exercise more care over their expenditure. In addition, the imposition of pandemic control measures restricted the opening hours of restaurants and canteens and limited access to eat-in dining, and this then diverted demand to instant noodles.

-

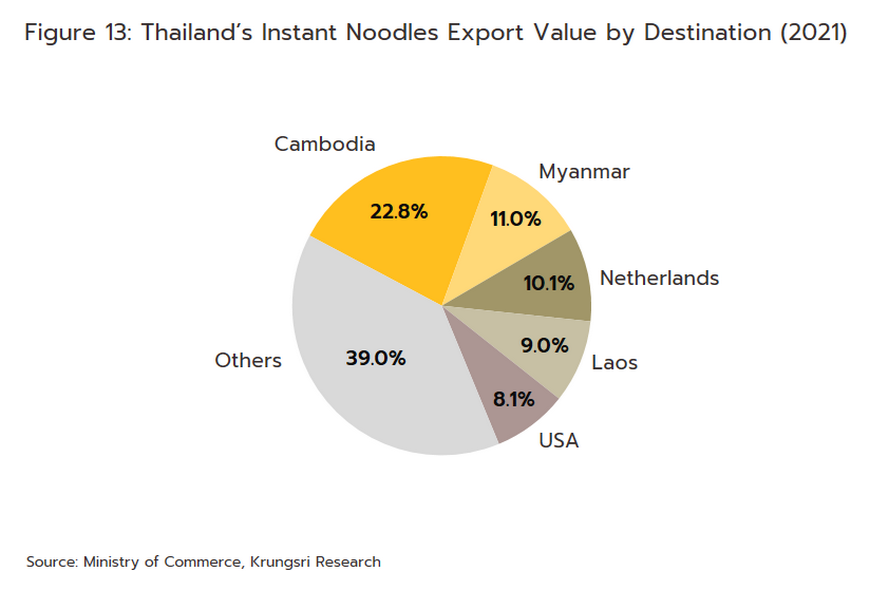

In 2021, exports rose 7.3% to a value of USD 259.2 million, helped by two main trends. (i) Controls were relaxed on cross-border trade with Cambodia, Myanmar, and Lao PDR (these three share a combined 42% of exports), with the number of active border crossings increasing from 35 in 2020 to 48 in 2021. Alongside this, Covid-19 checks on goods moved across the border were also eased, and these two factors combined to increase the value of sales into markets in Cambodia, Myanmar, and Lao PDR by 5.5%, 6.2% and 4.5%, respectively. (ii) Exports to China jumped 64.7% thanks to the increasing popularity of Thai instant noodles among Chinese consumers, most notably for spicy shrimp curry, green curry, and pink noodle flavors (source: Department for International Trade Promotion). Exports to China also benefited from the opening of the Lao-China high-speed rail link on 3 December, 2021, which now makes transporting goods to China considerably easier. As such, the contribution of the Chinese market to the total value of exports of instant noodles increased from 1.2% in 2020 to 1.8% a year later.

- Output returned to growth in 1H22 and this was reflected in the 3.3% YoY increase in the segment’s MPI. Manufacturers sped up production lines to meet an anticipated increase in demand ahead of a 10-20% hike in retail prices in April and May. This was the first increase in the price of instant noodles in 15 years but it had become necessary due to: (i) the 59.0% YoY jump in the cost of wheat that the war in Ukraine precipitated (in 2020, Russia and Ukraine accounted for respectively 19% and 9% of the value of global wheat exports); and (ii) the 41.5% YoY increase in the cost of palm oil that was precipitated by the decision by Indonesia (the source of over 60% of global exports by value) to address domestic shortages of palm oil by banning exports between 28 April - 22 May 2022. The cost of the major inputs into instant noodle production are expected to stay elevated through 2022 and this may trigger a further rise in retail prices (the sales price of instant noodles is controlled by the Department of Internal Trade, which has the authority to sanction price rises in light of increased costs). This would then trigger another round of stock building by wholesalers and retailers, and so production and domestic distribution should both grow by 2-3% over 2022.

- In the first half of the year, exports contracted -6.5% YoY to USD 82.2 million, a sharp turnaround from growth of 12.5% in 1H21. However, a year ago, the Covid-19 pandemic was at its height and countries were accelerating their imports as they looked to stockpile food. In addition, at the time, uncertainty over the status of border crossings with Myanmar meant that businesses there were rushing to increase imports ahead of the possible closure of these. Thus, sales to Myanmar jumped 22.9% YoY in 1H21, before slumping 12.0% YoY in 1H22. Nevertheless, through the remainder of the year, the need to restock should help to boost exports, and for the year as a whole, export sales are predicted to decline by between just -1 to -2%.

-

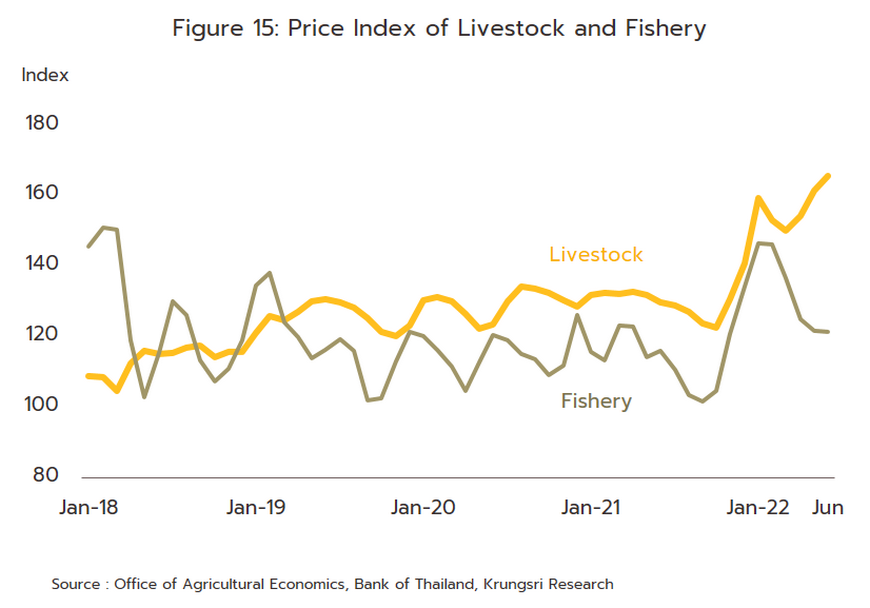

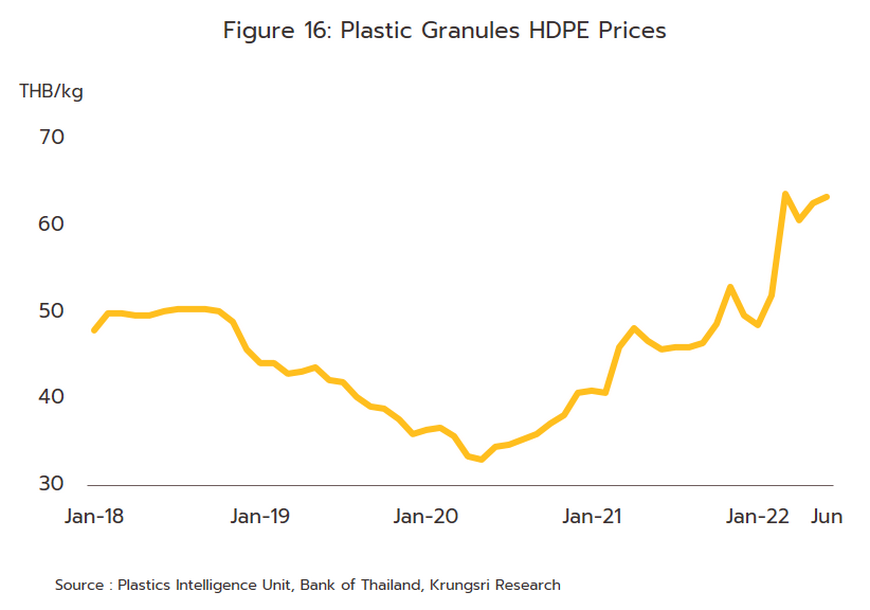

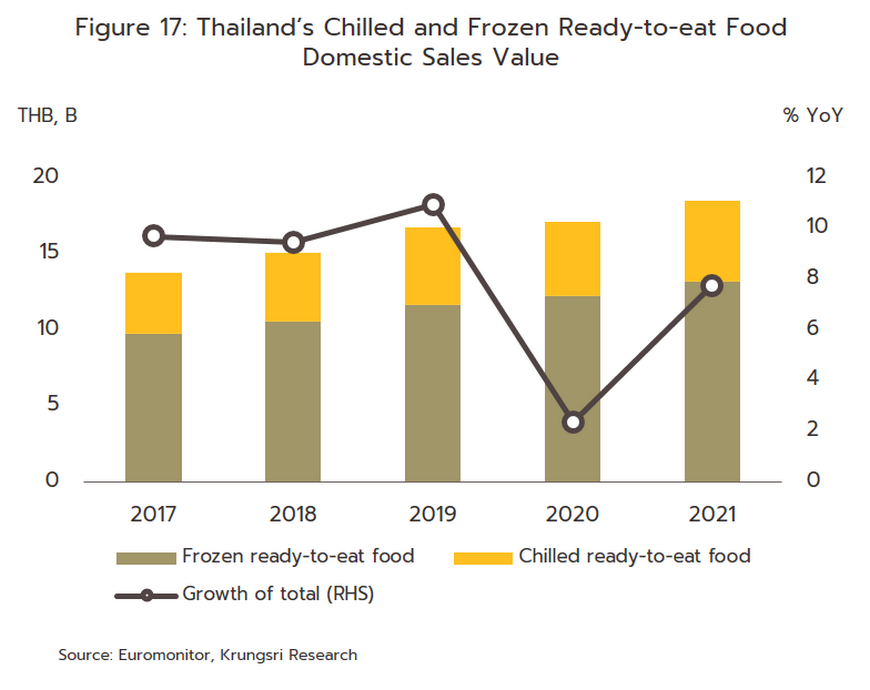

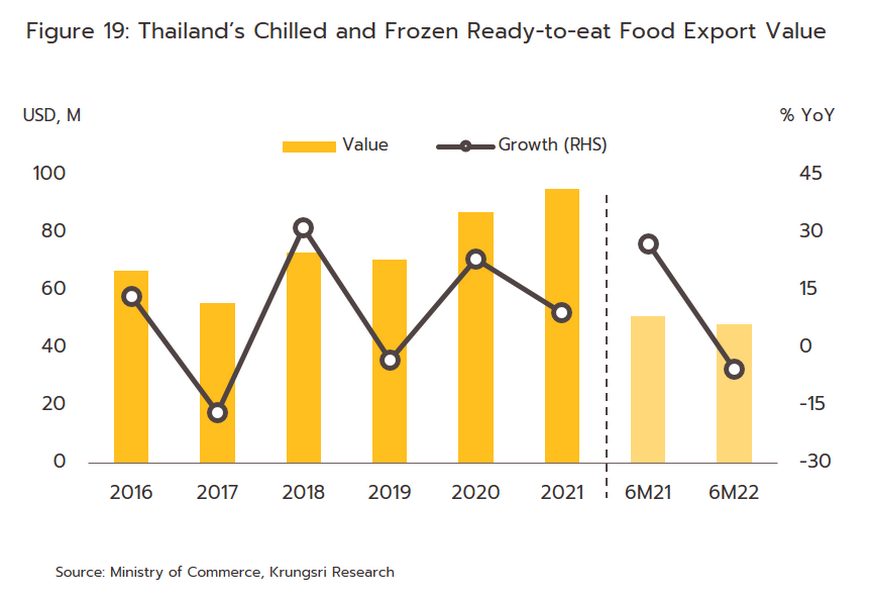

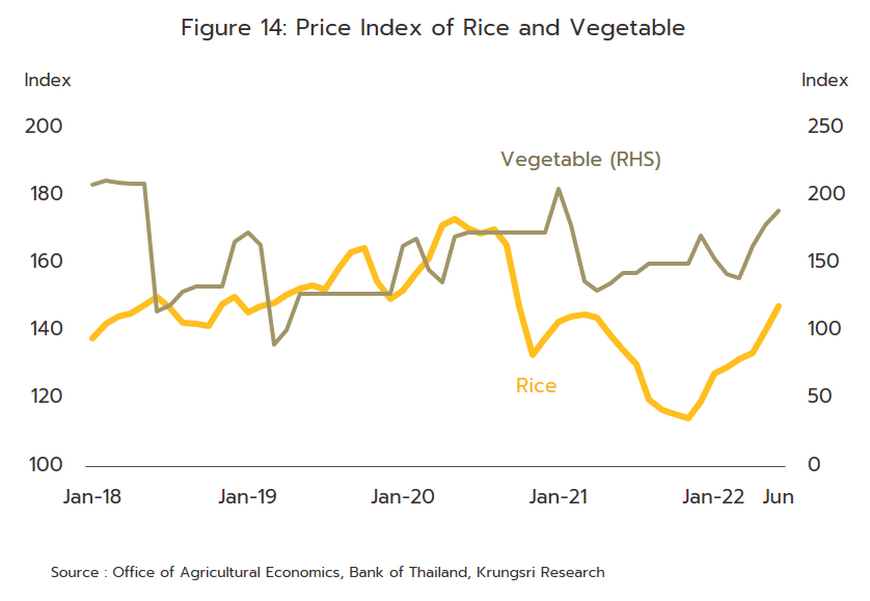

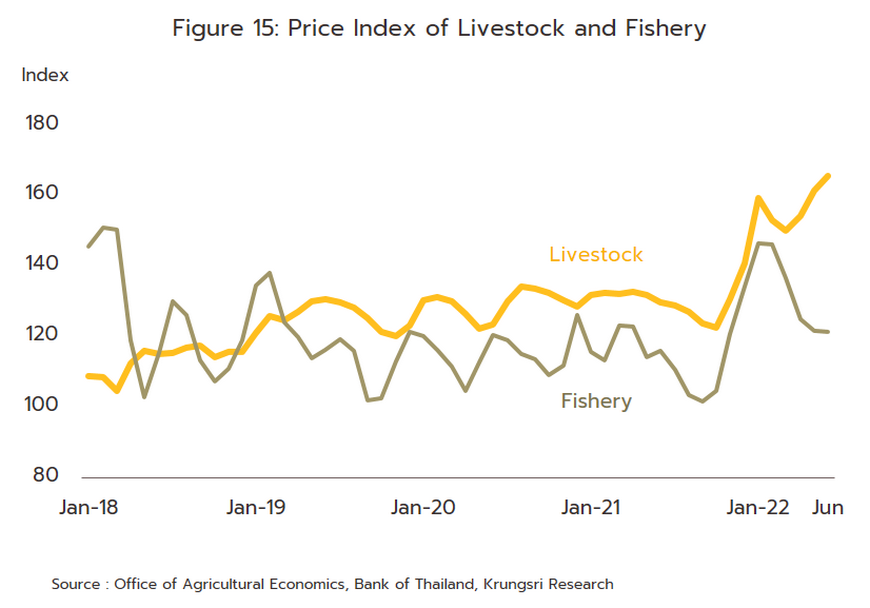

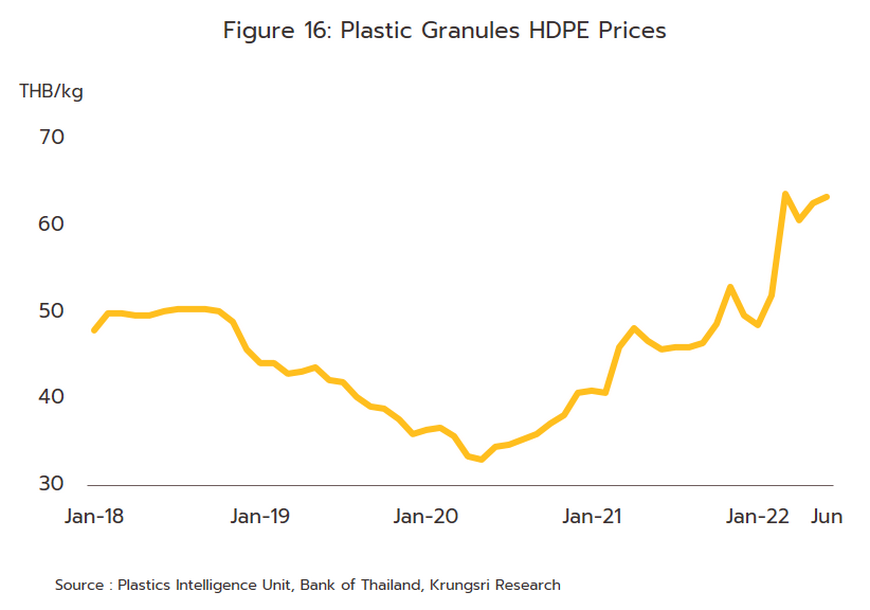

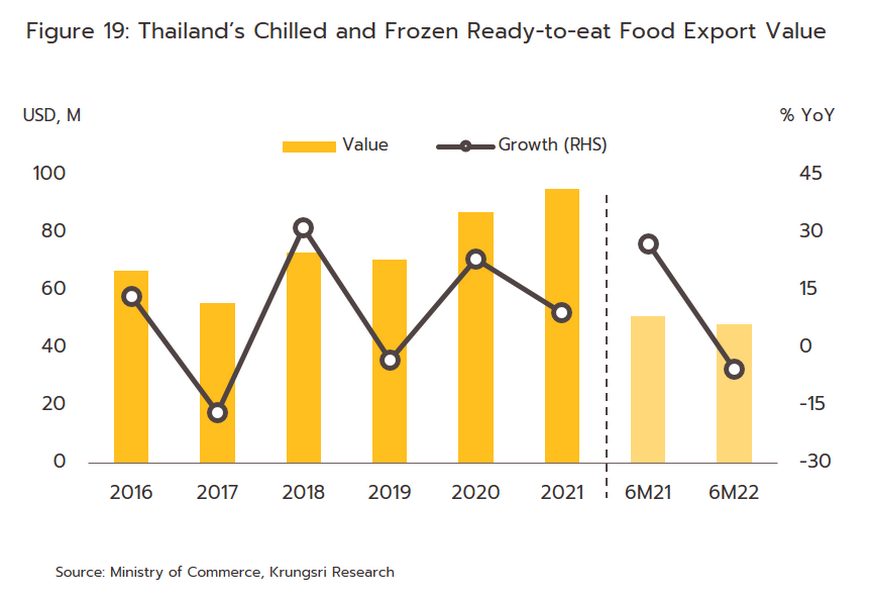

Chilled and frozen ready-to-eat food: Over 2016-2021, output by this segment rose, driven largely by growth in the domestic market (the main source of income) that averaged 8.5% per year, though exports also increased at an average rate of 9.6% annually. At the same time, the cost of inputs remained relatively stable, with average annual increases of 0.4% in the price of the HDPE pellets that are used to manufacture packaging, 0.4% for livestock, and 3.6% for vegetables, and decreasing by -0.8% for rice and -3.8% for fisheries products. Cost control was therefore not an issue for producers through this period.

-

In 2021, output continued to grow to meet rising demand on domestic and international markets, although economic recovery in the major economies helped to lift the price of crude and this then pushed the cost of HDPE-based packaging up by 30.7%. Nevertheless, the cost of other inputs either fell (rice was down 18.0% and vegetables fell 7.4%) or remained flat (livestock edged up in price by just 0.7% and the cost of fisheries products was unchanged).

-

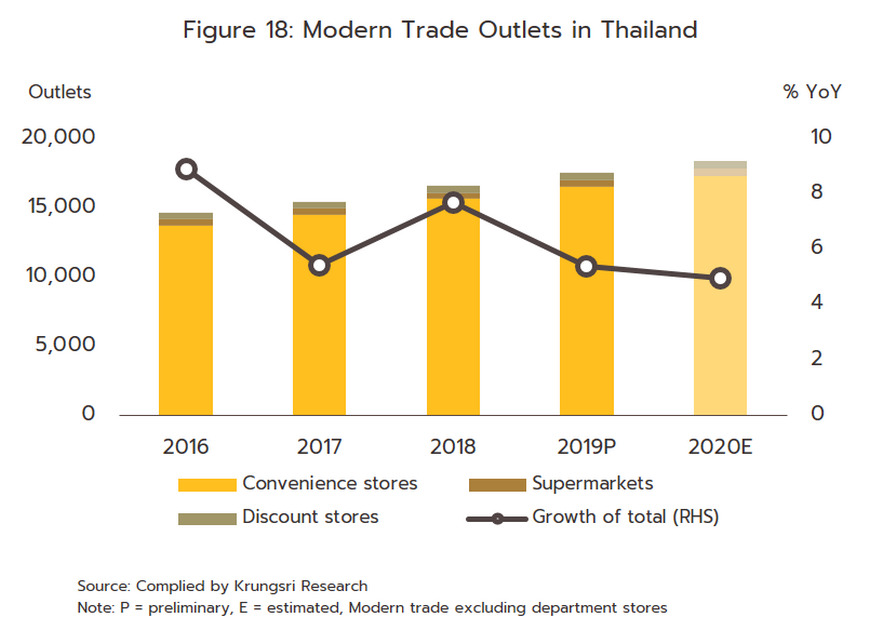

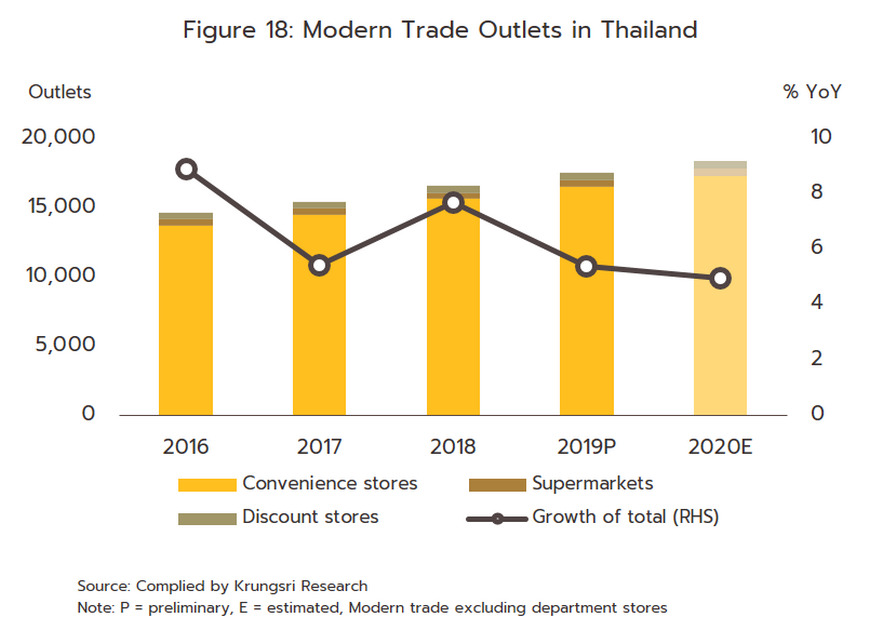

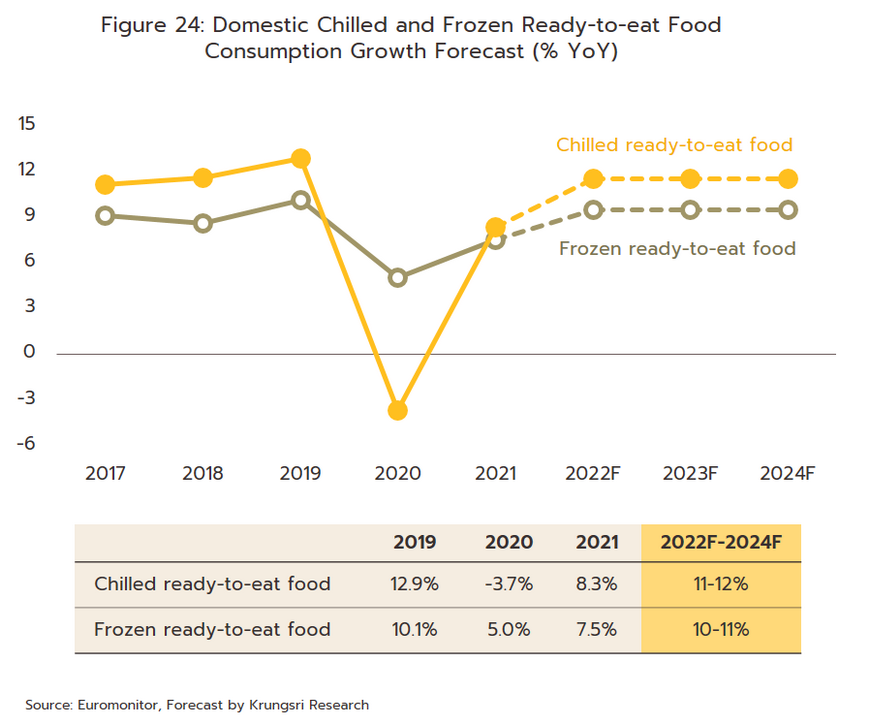

The Thai market for chilled and frozen ready-to-eat food expanded by 7.8% to a value of THB 19 billion in 2021, split between THB 5.3 billion from chilled foods (up 8.3%) and THB 13 billion from frozen foods (up 7.5%). Growth was driven by a number of factors, including: (i) an increased tendency among consumers to stay at home, which was amplified by Covid-19 control measures that restricted the opening hours of restaurants and limited access to eat-in dining; (ii) continuing expansion in the number of modern trade outlets, especially of convenience stores, supermarkets, and discount stores (sales through these three types of retail outlets represent a full 92% of all sales of chilled and frozen food in Thailand); (iii) ongoing urbanization, which is encouraging a greater number of Thais to adopt lifestyles that favor speed and convenience; (iv) moves by producers to develop new flavors and to expand the range of dishes on offer; and (v) the relatively low prices of most frozen and chilled foods, which benefit from economies of scale that help minimize cost of production, along with ongoing promotional campaigns launched by modern traders. Accordingly, chilled and frozen food products are priced at a level that makes them competitive with freshly prepared meals.

-

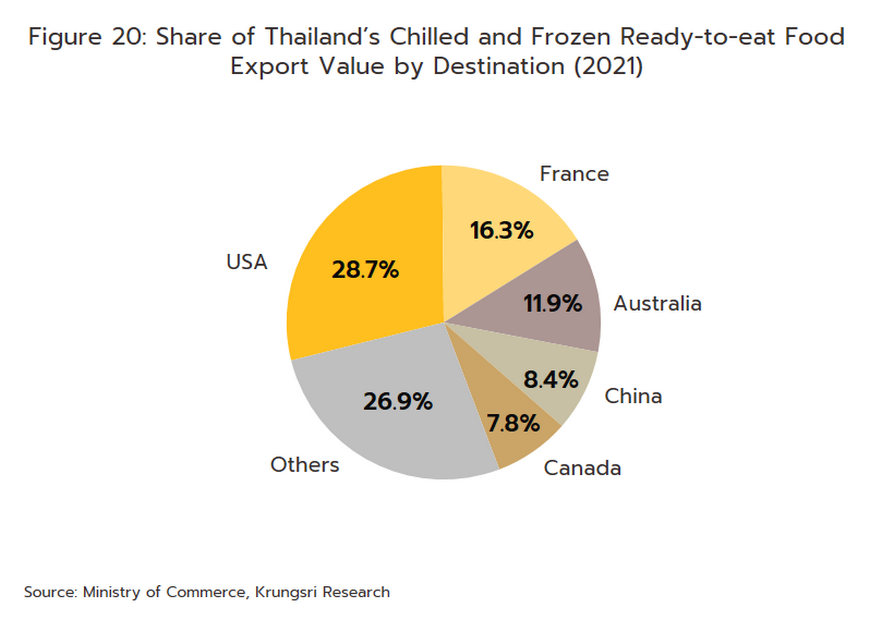

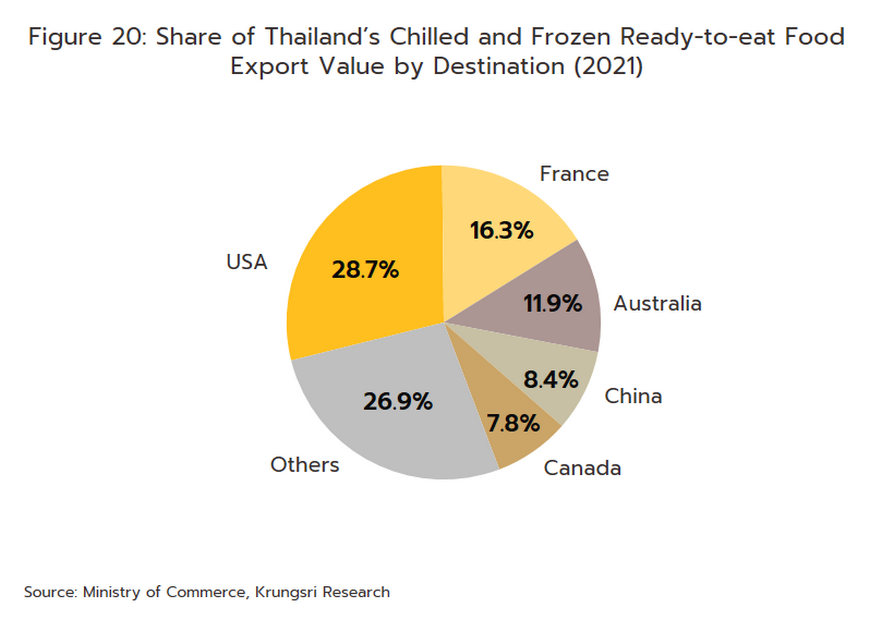

In the year, exports also brought in USD 95.5 million, up 9.2%. Sales were boosted by the relaxation of Covid-19 controls in many export markets and the economic recovery that this then permitted, though Thai ready-to-eat chilled and frozen food is also gaining in popularity due to the widespread perception of it as healthy and because consumers see it as representing an interesting new Asian cultural style. This then fed into a 13.3% increase in exports to the US and a 21.2% jump in exports to EU, these two now accounting for a combined 56.1% of the value of exports from this segment. In addition, Thai players are working to penetrate the Chinese market, which grew 6.8% in 2021 following explosive growth of 655.1% in 2020 that was driven by the growing popularity among Chinese consumers, and especially younger adults, of chilled and frozen food. The proportion of Chinese sales to total exports thus increased by 8.4% in 2021 and 8.6% in 2020, up from just 1.0% in 2019.

-

Production of chilled and frozen ready-to-eat food continued to grow through 1H22, largely thanks to ongoing strength in the domestic market. However, packaging costs also maintained their upward trend, with the cost of HDPE pellets up another 30.8% YoY, as did the cost of most food inputs. Thus, the index of livestock prices was up 19.3% YoY, that of fisheries products was up 13.2% YoY, and that for vegetables increased 3.8% YoY, rises that were only slightly offset by the -4.7% decrease in the index of rice prices. The prolongation of the Ukraine-Russia war has lifted the cost of oil and of energy and stoked worries over food security that are encouraging the widespread stockpiling of food, and this is expected to add significantly to overall 2022 production costs (i.e., for both agricultural inputs and for packaging.) In response, players may increase the prices of some product lines. For the year as a whole, output should rise by 9-10% on increases in domestic demand for chilled and frozen ready-to-eat food of respectively 11-12% and 10-11%.

-

Exports weakened over 1H22, slipping -5.4% YoY to USD 48.3 million. Following the buildup of stocks during lockdowns in February and March 2021, some importers in the US and Europe engaged in a process of destocking before restocking through the rest of the year, affecting sales at the start of 2022. However, for the year overall, the value of exports should increase, though the impact of surging inflation and slowing economies on consumer spending power in the US and Europe will keep growth to just 1-2%.

OUTLOOK

Overall, the ready-to-eat food industry should see continuing growth through the years from 2022 to 2024. The fragile recovery means that consumers will tend to be more careful about their spending and as they try to keep their expenses under control, sales of low-cost instant noodles will rise. Sales of chilled and frozen ready-to-eat foods to both domestic and export markets are forecast to see stronger growth, helped by expansion in the modern trade sector at home and increasing consumer preference for Thai food abroad. The outlook for individual market segments is outlined below.

-

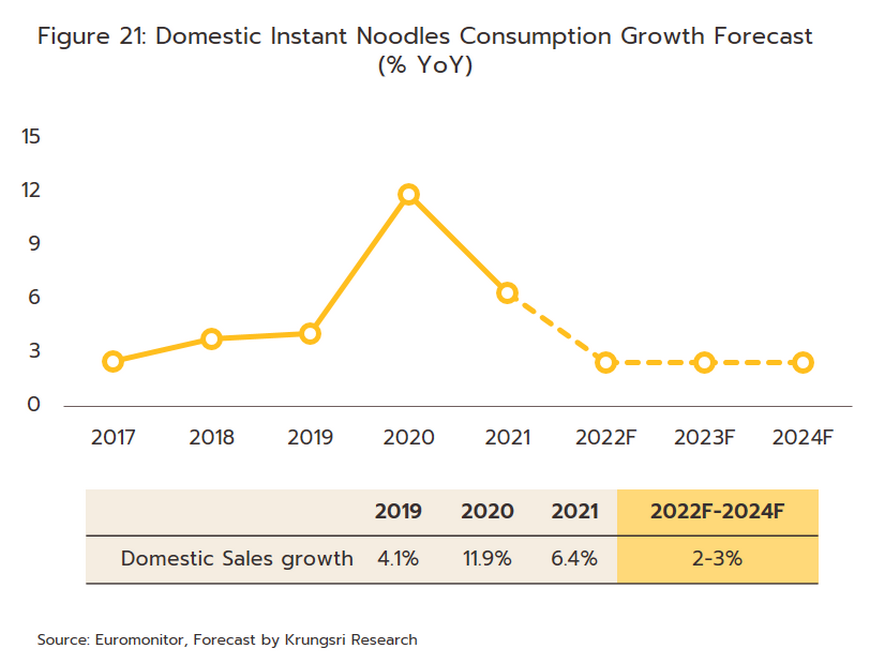

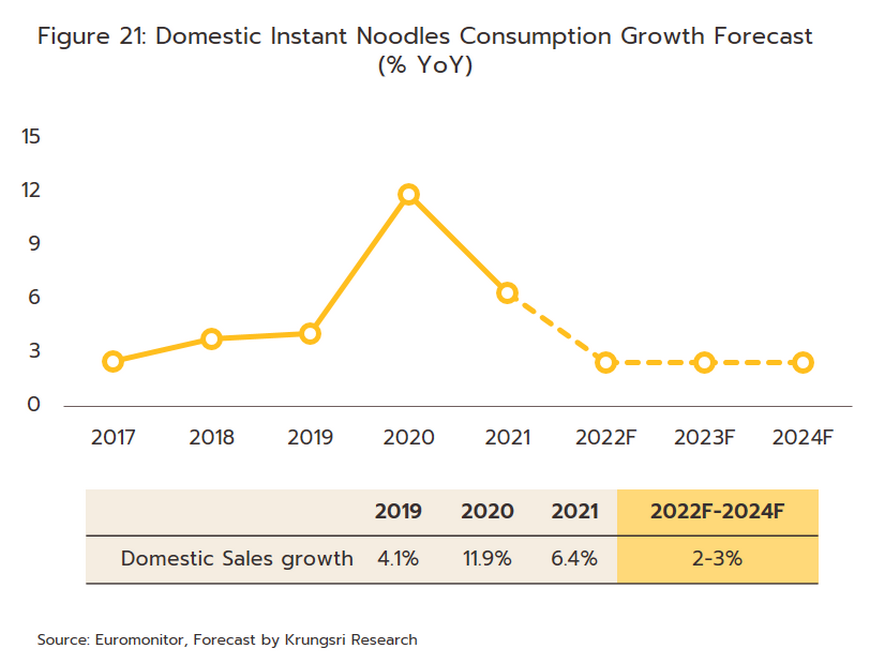

Instant noodles: Output is expected to increase by around 2-3% annually over 2022-2024 on stronger demand on domestic and overseas markets. The continuation of the Ukraine war will mean that the cost of the most important inputs will continue to rise through 2022, in particular for wheat and palm oil, but in 2023 and 2024, an expansion in supply will remove some of the pressure that is keeping these prices high. However, the government is considering the introduction of a ‘salt tax[1]’ (a charge based on the sodium content of food), and if it does, this will add to manufacturer’s costs.

-

Domestic demand is forecast to strengthen by an average of 2-3% per year. Consumers are generally being more careful about their expenditure and because instant noodles are a low-cost food, this will likely stimulate stronger sales. However, in 2021, Thai consumption of instant noodles averaged 51.9 packets per person per year against averages of 25.9 in Cambodia, 15.4 globally, and just 14.2 in Myanmar, which tends to indicate that the domestic market may be close to saturation (Figure 5). Competition is also strong from alternative products, including shelf-stable ready-to-eat foods, chilled and frozen ready-to-eat foods, and freshly prepared food, as well as from goods such as bakery products, snacks, cereals and ready-to-drink milk products, and increasing sales of these may help to raise competitive pressure within the segment. In response, manufacturers will tend to develop new products as they try to extend their appeal to consumers. This will include producing noodles with new and different tastes and textures, packaging these in new ways (e.g., in pouches, cups and bowls) and releasing higher-end products to counter the challenge posed by Japanese and Korean imports.

-

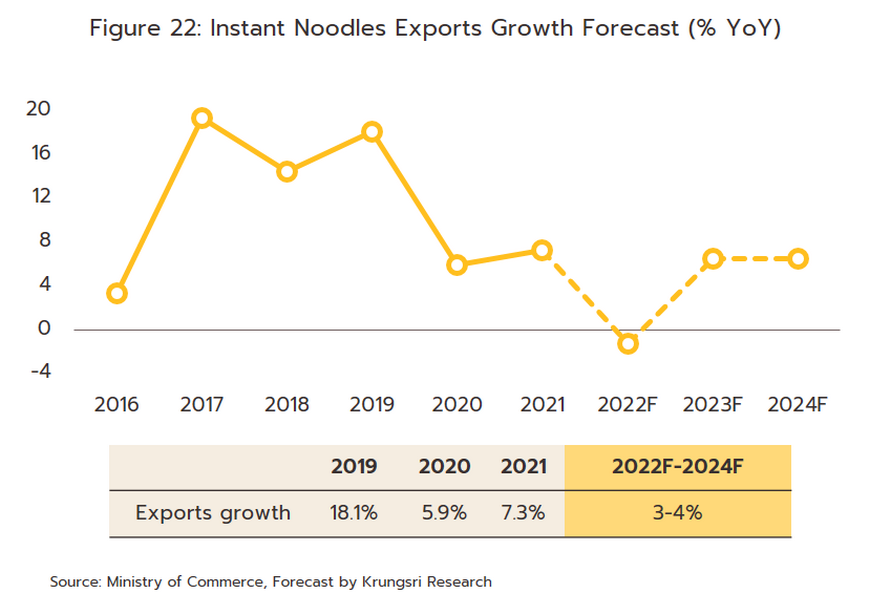

Exports will do slightly better, and the prediction is for the value of these to increase by an average of 3-4% per year. However, in 2022, a contraction of between -1 to -2% is now expected in light of the destocking that is being seen as importers rebalance their holdings following the earlier increase in imports. Over 2023 and 2024, export markets are predicted to return to annual growth of 6-7%, helped by restocking that will be triggered by a better economic outlook. Cross-border trade with Thailand’s neighbors will be particularly strong thanks to the relaxation of checks and controls on the release of international shipments and the reopening of border crossings (for 2022, the government aims to reopen another 12 sites, which would mean that 60 of 97 of Thailand’s land crossings would be open). More generally, consumption of instant noodles remains somewhat low in much of the ASEAN zone, though this is most pronounced in Myanmar and Cambodia (Figure 23). Nevertheless, it remains to be seen how political problems, potential economic troubles, and uncertainty over the rules governing cross-border trade[2] will affect exports from Thailand. These risks are most severe in Myanmar, Thailand’s second most important export market for instant noodles (in 2021, sales to Myanmar contributed 11.0% of all receipts from the export of instant noodles, second only to Cambodia, with 22.8%).

-

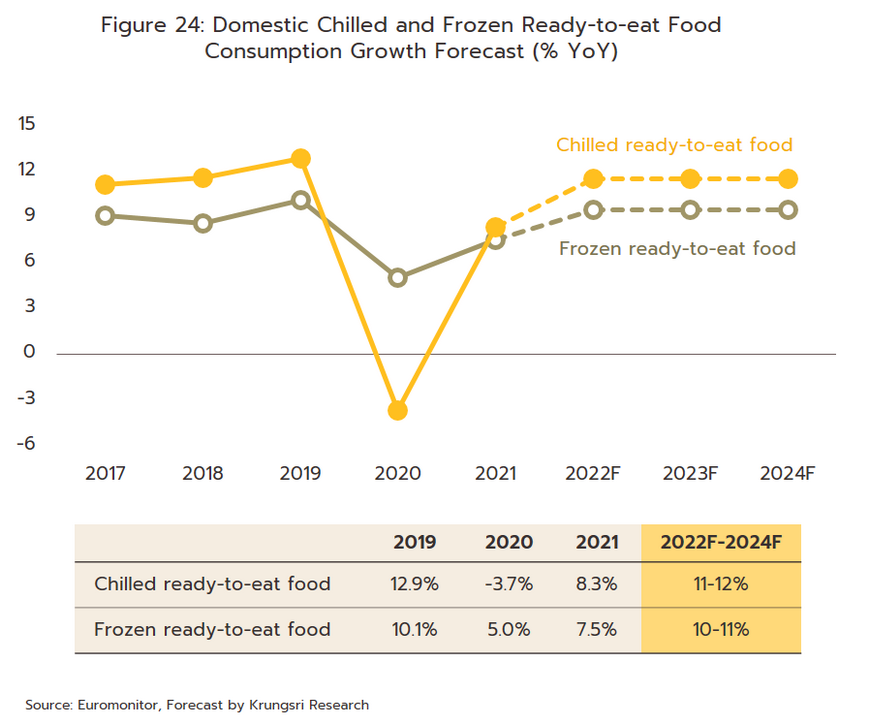

Ready-to-eat chilled and frozen food: Output is predicted to increase at the healthy rate of 9-10% per year over 2022-2024, lifted by strong demand at home and abroad. However, the Ukraine war has pushed up the global cost of energy, and with this, the costs for agricultural materials and plastics have risen, adding to production costs for packing and agricultural inputs for players in this segment. These trends will affect companies through 2022, but pressure on costs should ease in 2023 and 2024, assuming that the conflict ends or lessens in intensity.

-

Overall domestic demand is expected to grow by an average of 10-12% annually. Consumption in the chilled ready-to-eat food segment is forecast to expand by 11-12% per year, while at 10-11%, growth in the frozen ready-to-eat food segment will be slightly weaker. This outlook is supported by: (i) ongoing urbanization that is helping to shift consumer lifestyles to a greater focus on speed and convenience, including in their food choices; (ii) continuing expansion in modern trade networks, especially convenience stores (over 2016-2020, this segment saw average annual growth of 6.6%) since these run extensive networks that have deep penetration into local communities and this then makes it very easy for consumers to purchase these products; (iii) the development of a wider range of dishes by manufacturers that includes an expanding selection of Chinese, Japanese, and Italian food; (iv) the greater nutritional value of chilled and frozen ready-to-eat food compared to dried foods, which makes these especially attractive to younger consumers, who are concerned about their health but who also prefer to buy easy-to-eat foods;(v) the increasing spread of modern appliances such as refrigerators with large freezer compartments and low-cost microwaves, thus making it more convenient to buy and consume chilled and frozen foods; and (vi) strong competition that will encourage modern trade outlets to cut their prices and to offer other promotions. The industry will face challenges from the development of other types of ready-to-eat products including new shelf-stable goods, freshly cooked foods, bakery goods, snacks, and cereals, which are becoming increasingly available and so are adding to competitive pressures within the industry.

-

The value of exports is forecast to rise at an annual average rate of 3-4%. For 2022, growth will be restricted to just 1-2% by a combination of importers running down their stocks through 1H22 (now that the pandemic is abating and the need to stockpile food is fading) and economic weakness in the major export markets of the US and Europe. However, in 2023 and 2024, the situation should improve and growth is forecast to accelerate to 4-5% per year, supported by: (i) the increasing popularity of Thai food in many countries, where it is now accepted for its safety and use of modern production techniques, as well as being an attractive alternative to more traditional food choices, especially during a period when the risk of illness is increasing; (ii) improvements in food technology that allow food processors to release chilled and frozen foods that better match the flavor and quality of freshly made alternatives; and (iii) the development of a broader and more interesting range of dishes that appeals to a wider range of buyers. Despite these tailwinds, the industry will face challenges as manufacturing costs may be affected by more rigorous checks on food exports, including the necessity of meeting HACCP, GMP, and ISO 9001-2000 standards, as well as in some cases having to conform to halal traditions, and by stricter rules over labelling and requirements for supply chain tracking and traceability.

[1] The Excise Department is currently assessing the potential impacts of this tax, which is expected to be implemented in 2023 or 2024.

[2] Following the implementation on 1 May, 2021, of a ban on the import of non-alcoholic drinks through land crossings with Thailand, companies in Myanmar remain uncertain about future changes to these regulations. As a result of the ban, importers are now required to ship goods via boat, extending transit times from just 1 day (for shipments to Yangon and some other provinces) to 1 week. This has then added to transport costs and pushed up prices for Thai-made soft drinks.

.webp.aspx)