Following the sharp contraction in the market induced by the pandemic, credit card companies should see a return to growth in 2021-2023 when spending is projected to rise along with a general recovery in the economy. However, the events of 2020 have hurt consumers’ credit-worthiness and this will weigh on business growth. Meanwhile, operators’ costs will rise because of the debt holiday and the need to increasingly book higher provisions against elevated default risks. Looking forward, the ability of card issuers to retain their customers (especially primary card holders) and market position will depend on how well they use their data to analyze and understand consumer behavior, and then exploit the resulting market intelligence by offering promotions that increase credit card spending, especially through online channels.

Overview

Credit card companies offer consumer credit to customers by sanctioning the release of funds via credit cards up to a pre-approved limit. Credit card holders can use the cards, instead of cash, to purchase goods or services, or make cash advances to a value up to the pre-approved limit. When they conduct these transactions, the ensuing debt is a form of unsecured or non-collateralized loan that can be paid off in installments, with interest typically calculated from the transaction date.

The credit card sector plays an important role in supporting private-sector consumption in Thailand. By value, credit card debt is behind only home loans, car loans and personal loans. In 2019, credit card debt represented 5.8% of total outstanding consumer loans in Thailand (Figure 1).

Each time a consumer purchases goods or services with a credit card, it will trigger several related-party transactions, from approving the release of credit to effecting the payment. Approving the release of credit typically happens instantaneously (t+0), and this makes the experience both convenient and seamless for consumers. Clearing and settlement between seller and the credit card company usually takes 1-2 days (t+n) and credit card holders will often have a 45-day period before interest is applied to this new debt (Figure 2).

The related parties connected through the transaction will include the credit card holder, the issuing bank or business, the bank or business that receives the payment, the merchant to which the payment is made, and the payment network. Details of each of this link in the chain are given below.

- Card holders: Credit card holders may either pay off the entire balance on their card on or before the due date, or they may choose to pay off the outstanding balance in installments. For consumers, the benefits of using a credit card are: (i) it is convenient and reduces the need to carry excess cash; (ii) it provides access to credit, thus reducing the impact of fluctuations in personal income and allowing consumers to spread out payments for purchases over a given period; and (iii) credit card issuers may offer additional incentives to encourage holders to use their cards to make purchases. The latter might include ‘cashback’ offers, points for purchases which can be exchanged for discounts/products, being billed for purchases in installments, benefits for making automatic monthly payments, and providing travel insurance.

- Issuers: It is the issuer which, having already vetted card holders and set credit limits, authorizes or denies a payment request. Currently, there is several types of cards available, including: (i) general credit cards, which are part of general payment networks such as Visa, MasterCard, American Express, China Union Pay (CUP) and Japan Credit Bureau (JCB); (ii) co-branded cards, which involve banks or credit card companies issuing cards jointly with another company (Thai or foreign) so that card holders get additional benefits when using the card to make purchases from the co-brand company; (iii) affinity cards, which are issued jointly with non-profit making organizations, e.g. the cards issued by Krungthai for the Thai Flyer Association and the Thai Red Cross Society; and (iv) corporate cards, which are issued by organizations to pay for business expenses such as travel. They may also offer special discounts to organizations that partner with merchants. Examples include Krungsri Corporate Credit Card and KBank Corporate Executive Card.

- Acquirers: Banks or other organizations that process transactions receive payment requests from businesses when there is a credit card transaction with a customer. When the payment is made, a charge will be imposed for the provision of this service, with the fee specified in the service contract. The fees levied by banks and processors for handling transactions vary, though providers may set a minimum charge for merchants. Banks and payment processors try to build networks of member merchants, with consideration given to the volume of transactions being made by a store or business and growth prospects. They will cooperate with retailers to offer different means of processing transactions, including: (i) electronic data capture (EDC), (ii) mobile point of sale (m-POS), (iii) one-time passwords (OTP), and (iv) automatic deduction from accounts.

- Merchants: Accepting credit card payments offers several advantages for merchants, whether this conducted through POS terminals or the internet. Credit card payments make shopping more convenient for customers, especially when purchasing high-value goods, because customers do not have to carry large amounts of cash. It is also easier for businesses to manage electronic payments than cash payments, and card payments means retailers do not need to worry about keeping a supply of coins and small change. However, some smaller businesses may prefer not to accept credit card payments because they incur processing fees and those merchants will not receive the full proceed of the goods or services sold. Such merchants may specify a minimum amount for payments made by credit cards (e.g. THB500) or charge the fee to the customer by including an additional charge over the transaction.

- Payment networks: When a merchant processes a credit card transaction, the relevant payment network will receive the request from the Thai business carrying out the transaction. These networks are based outside Thailand and are global in scope, receiving requests from around the world to make deductions in one account and balancing credit to another within the network. After the transaction information is received and evaluated, accounts will be debited and settled, and monies transferred to the relevant merchant in Thailand.

The major players are Visa, MasterCard, American Express, China Union Pay (CUP) and Japan Credit Bureau (JCB). But the fact that the most important players are outside Thailand means fees for Thai transactions might be higher than they should be. Although currently, local payment networks (called ‘local switching’) are capable of handling debit card transactions[1].

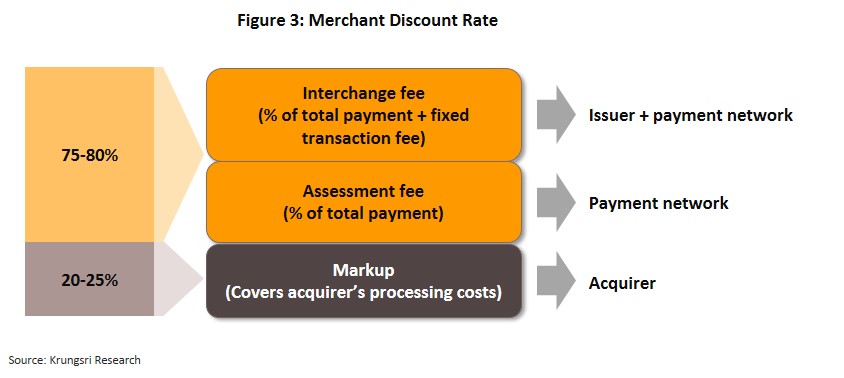

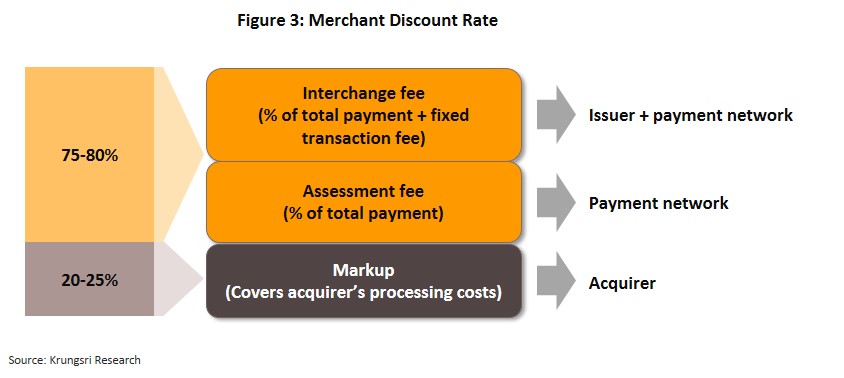

Usually a fee (or merchant discount rate) of 1.5-2.4% of the value of the transaction is imposed on Thai merchants for processing credit card payments; the exact amount will depend on the type of credit card used. This fee has several sub-components. (i) The interchange fee goes to the bank or organization that issued the card and covers the costs incurred for marketing, extending credit to card holders, processing payments by card holders, and covering and pursuing bad debts. (ii) The assessment fee is paid to the payment network, which acts as a middleman. (iii) The markup fee goes to the acquirer for its role and the costs incurred in managing and receiving the transfer of monies from the merchant that has taken the payment. On average, interchange and assessment fees will comprise 75-80% of the total fee paid by a merchant, with the markup fee accounting for the remaining 20-25% (Figure 3).

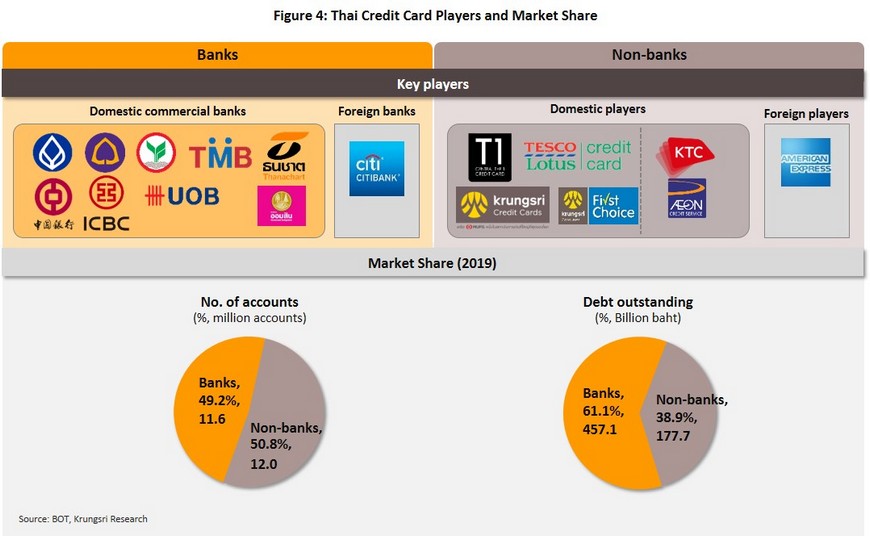

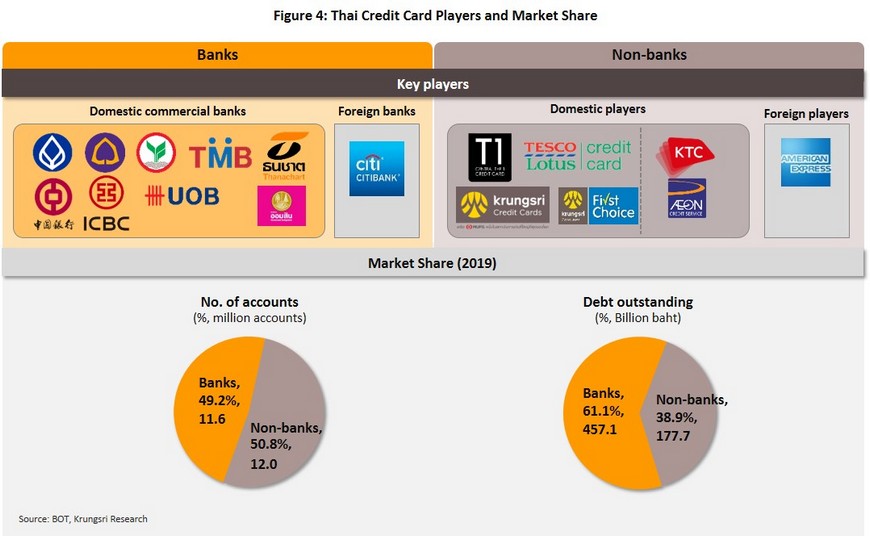

Credit card issuers currently operating in Thailand can be split into two groups. (i) The first group comprises eight Thai commercial banks (Bangkok Bank, Kasikorn Bank, TMB, Siam Commercial Bank, Thanachart Bank, UOB (Thailand), ICBC (Thailand), and The Bank of China (Thailand)); one foreign commercial bank (Citibank[2]); and one specialized Thai financial institution (Government Savings Bank). (ii) The second group consists of non-banks offering credit card services, of which there are seven: two subsidiaries of Krungsri Bank, Krungsri Ayudhaya Card and Ayudhaya Capital Services; co-brands with Krungsri Bank, operating as General Card Services, to offer the Central The 1 Credit Card, and with Tesco to offer Tesco Card services; the KTC credit card, part of Krungthai bank, Aeon credit card, part of AEON Thana Sinsap (Thailand); and American Express, a foreign non-bank (Figure 4).

Looking at market share, banks have 61.1% slice of the total outstanding debt (2019), making them the market leaders. But in terms of the number of cards issued, they only have 50.8% share, and non-banks have a slight edge over commercial banks. This difference is because some non-banks market their services to low-income earners, and hence, need to widen their customer base to reduce risks and to gain economies of scale (by reducing marginal costs). Non-banks may also be more relaxed or more generous than commercial banks in assessing credit-worthiness and when considering applications and credit scores, which means it may be easier to get credit from non-banks. Hence, these card issuers have greater access to the low-income market (Figure 4).

The Bank of Thailand regulates the credit card market and has laid out similar regulations for banks and non-banks regarding the issuing of credit cards. In terms of income or wealth, card holders should have a monthly income of not less than THB15,000 or deposits in a bank account averaging not less than THB15,000 per month over at least a 6-month period. Credit limits are set according to the following regulations: For individuals who have applied for a credit card secured against deposits held at a commercial bank or against a debt instrument, credit limits will be set at a level no higher than the value of the collateral against which the card debt is secured. For card holders who apply for a credit card secured against fixed deposits, money held in savings accounts, bonds, or private or mutual funds, credit limits are set at a maximum of 10% of the value of the deposits, bonds, or funds. The Bank of Thailand also specified that in order to make debt burden more manageable, with effect from September 1, 2017, credit limits are set at 1.5-, 3- and 5-times monthly income for those earning less than THB30,000, between THB30,000 and THB50,000, and over THB50,000, respectively. Monthly payments made by card holders on the outstanding balance of a credit card should be at least THB500 or not less than 10% of the outstanding debt, whichever is higher. Interest would be charged at not more than 18% per annum (effective rate); this is lower than in the previous regulations (20% per annum) (Table 1).

Situation

Growth slowed for credit card issuers in 2019, in terms of number of accounts and total card spending. And despite the government introducing measures to stimulate spending at the end of the year, the combined impact of a slowing economy and severe drought during the year eroded spending power. Thus, for full-year 2019, total value of credit card transactions grew by 7.9%, compared to 8.3% in 2018 (Figures 5 & 6). Meanwhile,

financial institutions responded to the worsening debt situation by tightening lending to households. Hence, growth in the number of new credit cards issued slowed from 8.7% in 2018 to 6.9% a year later (Figure 7).

In the first half of 2020, the COVID-19 pandemic and impact severely hurt private-sector consumption and consumer confidence. Consequently, credit card spending fell sharply. Data for June 2020 show credit card spending plummeted 17.6% YoY (Figure 5), while outstanding balances shrank by 6.3% YoY (Figure 6). This severe disruption was largely caused by the temporary lockdown across the country to halt the spread of COVID-19. But this had severe consequences for most of the economy, especially airlines, hotels, restaurants, offline shopping, and logistics and transportation industries. Demand for goods and services related to tourism almost disappeared both domestically and internationally. Credit card spending in these industries fell sharply. But they continued to grow for purchases of consumer necessities, and spending on health, insurance and online deliveries.

The number of new cards issued in 1H20 grew only 3.6% YoY compared to 6.9% for all of 2019. Consumer spending power was suddenly reduced as the lockdown hurt household income and employment. This was particularly significant in sectors most seriously impacted by the lockdown. And with this, the ability to service debts also weakened, pushing lenders to be more careful about issuing new credit. Card issuers responded to the worsening business environment by focusing on market segment where income exceeds THB30,000/month and/or customers that are relatively spared by the pandemic, including individuals working in medicine and e-commerce, and civil servants.

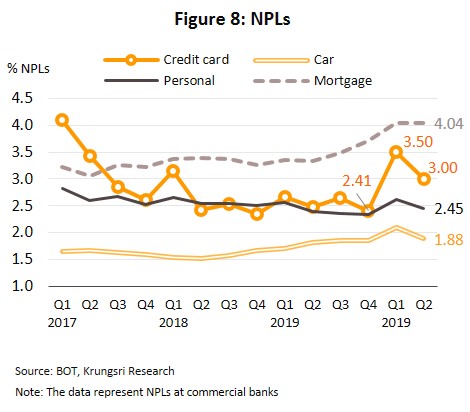

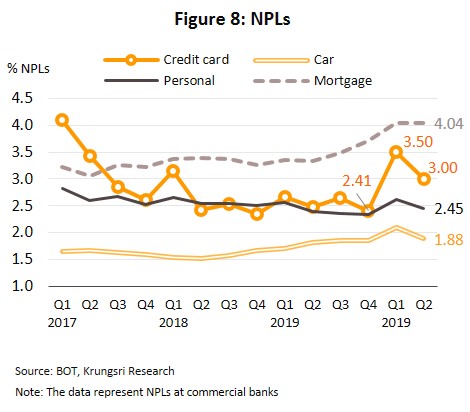

Looking at NPL, in 2019, credit card NPL remained low at 2.4% of all outstanding debt. This was due to two factors. (i) Rules specifying new credit limits for low-income earners were introduced in 2017. They helped to reduce debt burden among at-risk consumer groups. But this has been especially important for non-banks because their credit cards are mostly targeted at the lower-income group. (ii) Financial institutions have had to prepare for new reporting standards (IFRS 9), which helped to push players to accelerate their debt restructuring programs, to write off bad debt, and be stricter in offering new credit.

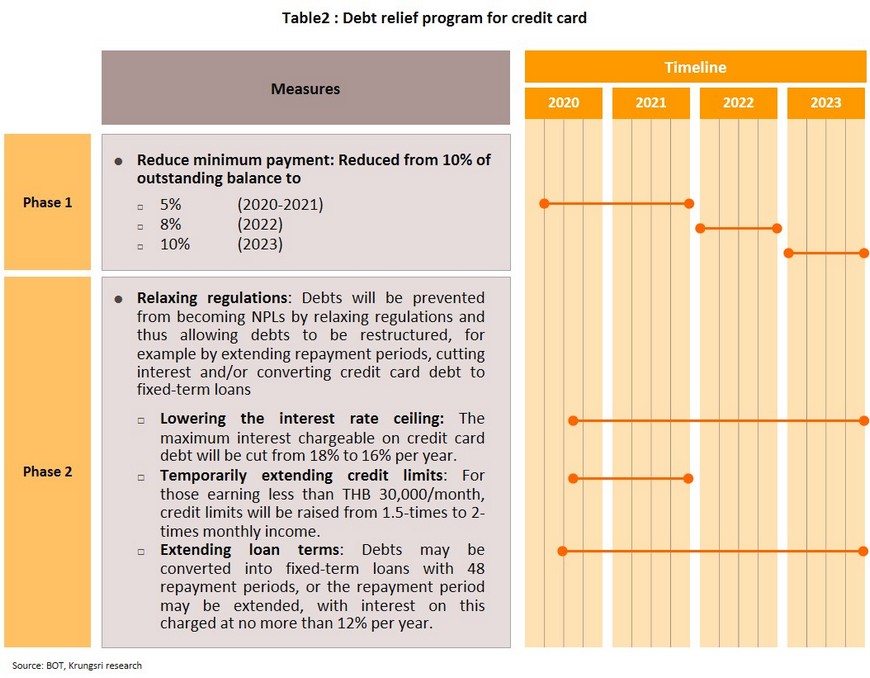

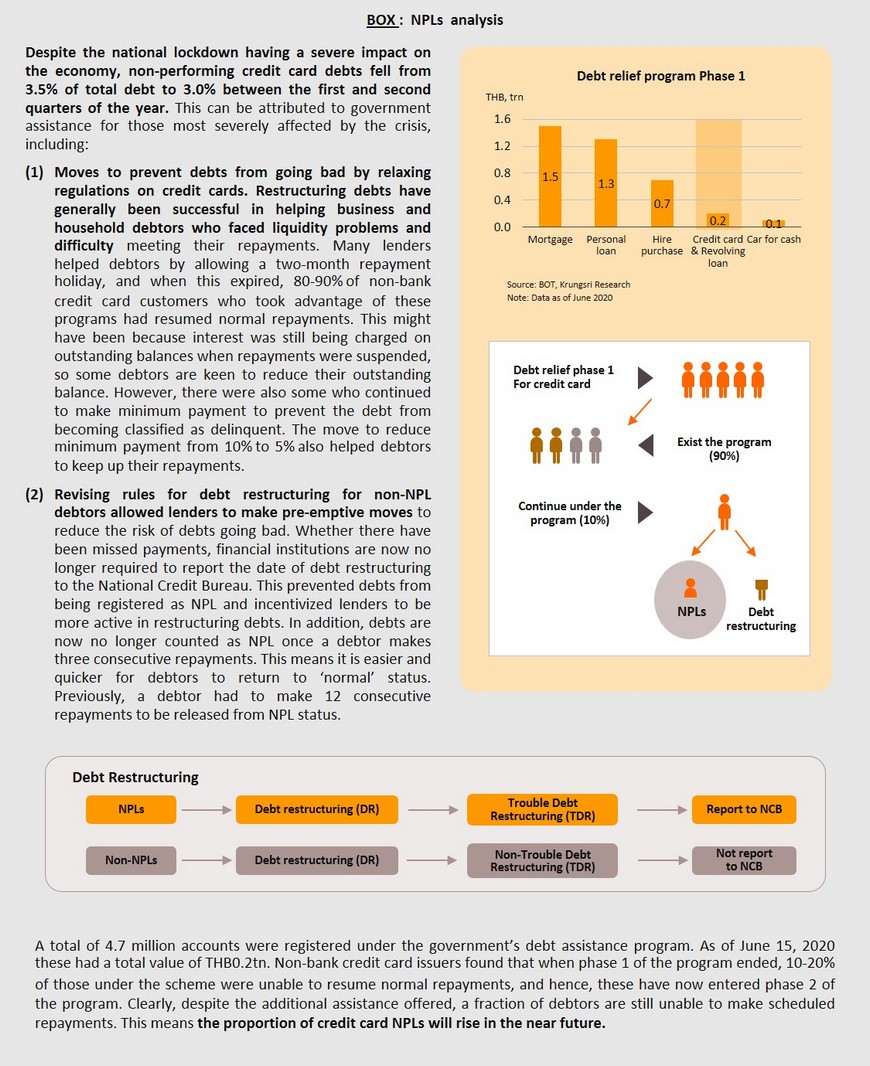

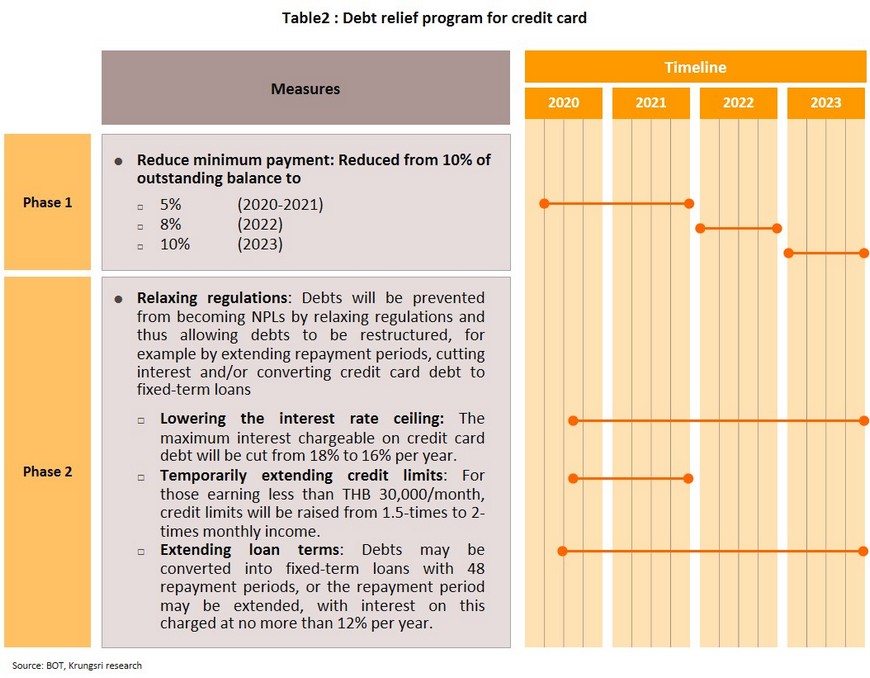

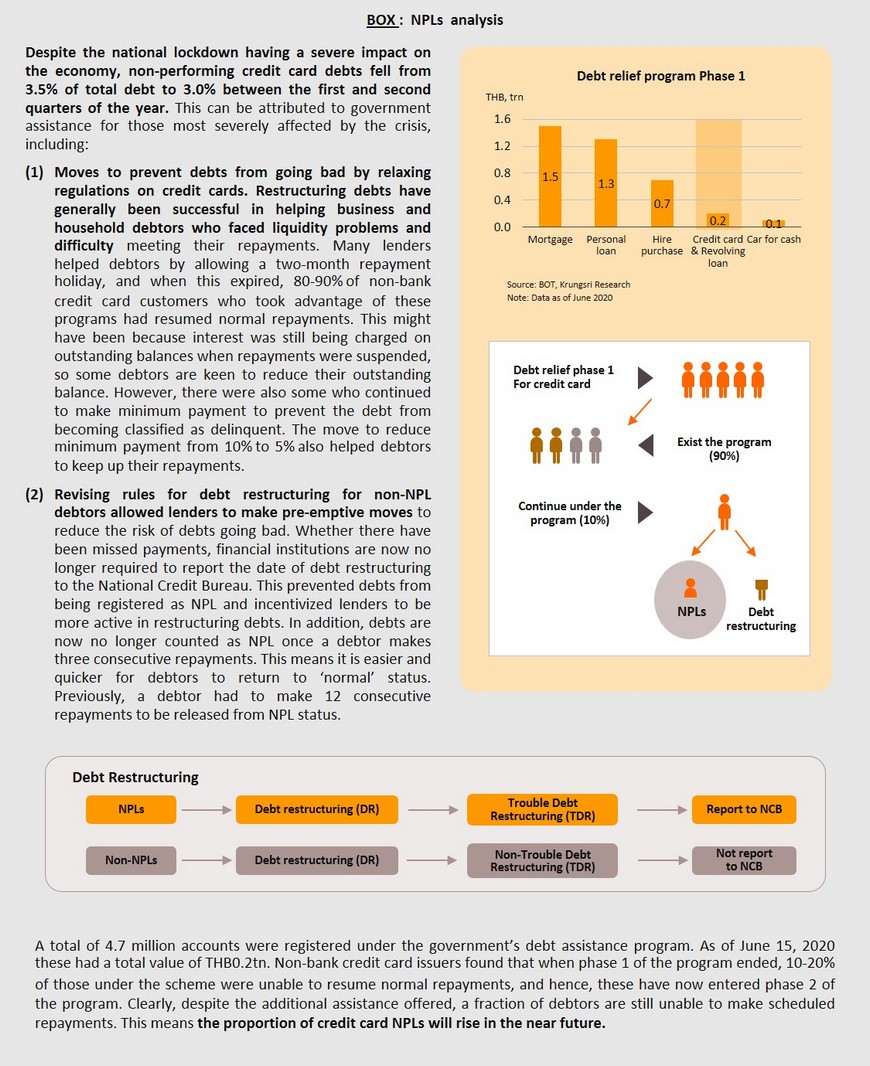

Then came the COVID-19 pandemic which caused a sudden drop in income for some card holders, which severely reduced their ability to service their debt (especially those most affected by the lockdown and those whose income depended on tourism). Because of this, in 1Q20, NPLs jumped to 3.50% of outstanding balance. In response, the Bank of Thailand moved to help debtors by issuing new regulations to govern repayment schedules. Phase 1 reduced minimum repayment of outstanding balance from 10% to just 5% for the period 2020-2021. This will rise to 8% in 2022 and return to 10% by 2023. However, to prevent debts from turning into NPL, some lenders have offered more extensive assistance. For example, Krungsri has offered its credit card holders a two-month debt holiday (April-May 2020), followed by minimum payment of only 3% and the option to pay off outstanding balances in up to 48 installments.

Under phase 2 of the program, certain regulations governing the issuing of credit cards will be relaxed. It is hoped that this will help with the restructuring of debts and slow the growth of NPL. Under Phase 2, (i) the maximum interest chargeable on credit card debt will be reduced from 18% to 16% per annum, (ii) those earning less than THB30,000 per month will see their maximum credit limit raised from 1.5-times to 2x their monthly income, and (iii) it will be possible to convert credit card debt to a fixed-term loan repayable in 48 installments, extend the repayment period, and pay not more than 12% per annum interest rate on the outstanding balance.

In addition, in February 2020, the Bank of Thailand also relaxed its rules on debt restructuring. The most important changes were: (i) amending the categorization of debtors, so that if non-NPL debtors who have had their debts restructured are able to meet their new obligation, they will not be considered recipients of troubled debt restructuring and it will not be necessary to report the date of their debt restructuring to the National Credit Bureau (NCB); (ii) allowing lenders to categorize NPLs as performing debts if restructured NPL payment schedules are met for 3 consecutive months/repayment periods; and (iii) permitting financial institutions to calculate expected credit losses based on only outstanding balances.

These measures have helped credit card issuers to restructure the debts of smaller borrowers and to reduce risk of these turning non-performing. As such, NPL ratio has fallen from 3.5% of outstanding balance in the first quarter of 2020 to 3.0% in the second quarter.

Marketing campaigns and promotions by credit card issuers to encourage spending used to target travel and tourism purchases, such as buying package tours, airline tickets, and paying for hotels. But since the COVID-19 pandemic, spending on travel has collapsed. Instead, issuers have switched to promoting spending on essentials such as insurance, medical services and spending in convenience stores and supermarkets. They also encourage consumers to spend in department stores and shopping centers which they partner with, for example by offering 3-6 months of interest-free installment plans for purchases or allowing consumers to collect points that can be exchanged for gifts through the use of e-coupons.

Business trends over the next 3 years (2021-2023)

Tailwinds that will support growth in the industry include the following.

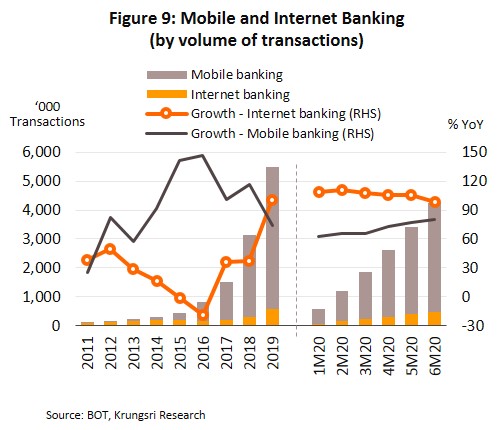

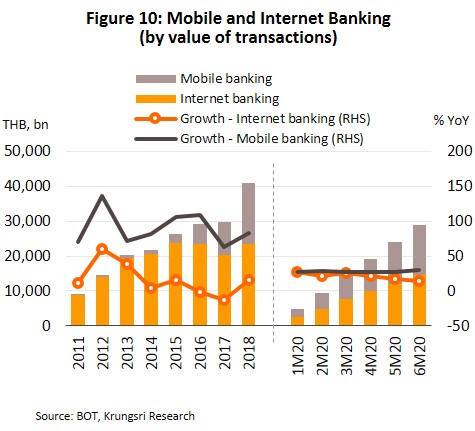

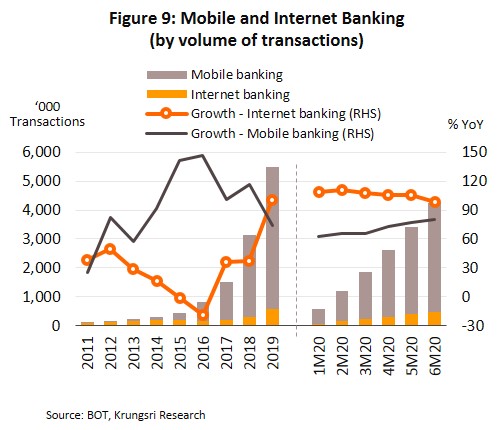

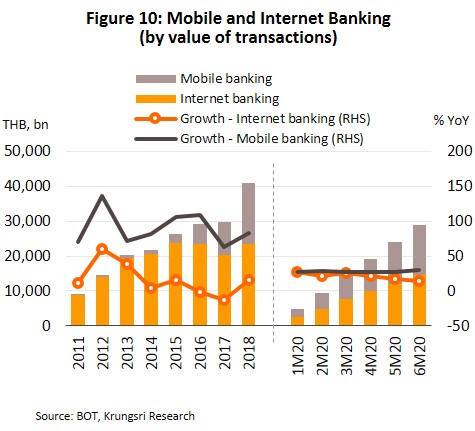

- Electronic payments are still gaining popularity, as reflected in both the number of online transactions and value of credit card purchases. In 2019, the number of payments made through internet and mobile banking platforms jumped by 99.9% and 73.5%, respectively (Figure 9), while total transaction values increased by 15.7% and 83.5% (Figure 10). In the first half of 2020, the global pandemic and national lockdown kept individuals confined largely to their homes and social distancing measures were enforced. This prompted consumers to depend more on online shopping. This led to wider acceptance of electronic payment systems. As such, the number of internet and mobile banking transactions continued to rise, by 98.3% YoY and 80.5% YoY, respectively, in 1H20. However, growth of transaction values has slowed significantly, rising by only 14.5% YoY for internet banking and 29.8% YoY for mobile banking (Figure 10). However, this was in line with a much bleaker economic situation.

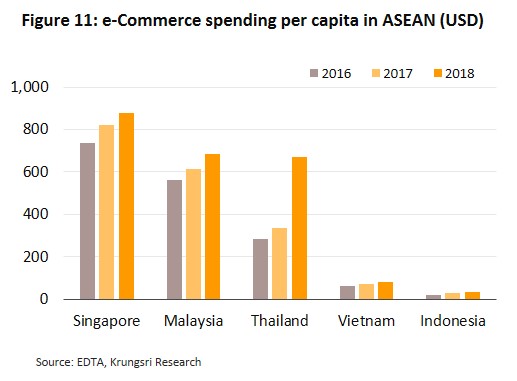

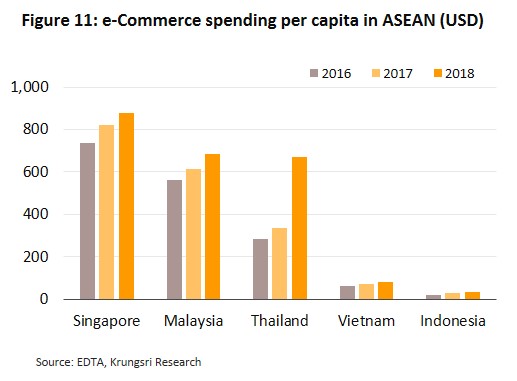

- The e-commerce sector is expanding rapidly. This will support greater use of electronic payment systems by consumers. The value of e-commerce transactions per capita in Thailand jumped from USD285.1 per person in 2016 to USD669 in 2018, placing the country on par with Malaysia where online spending is USD683.0 per citizen (Figure 11). Future growth in demand for electronic payment services in Thailand will also be supported by: (i) the relatively mature e-commerce market in the country, with a large number of established Thai and foreign e-commerce platforms in the market. These are supported by efficient and comprehensive logistic platforms and delivery services. The operators also regularly run promotions to further stimulate the market; (ii) a consumer base that is now generally familiar with using digital devices to access e-commerce platforms. This was strengthened by the global pandemic, which had encouragement consumers to depend more on online shopping; and (iii) the transition to 5G technology in Thailand, which will encourage renewed innovation and faster and more convenient online shopping.

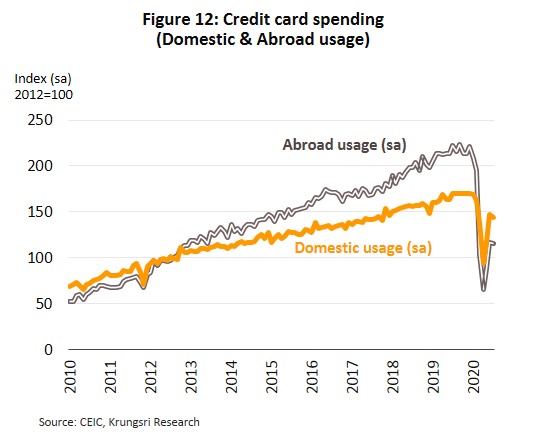

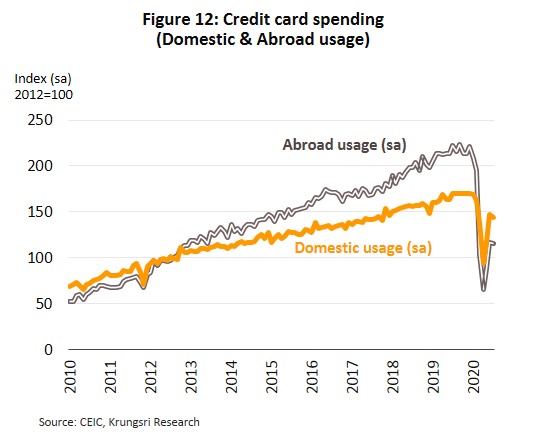

- The reopening of the country and phased exit from lockdown since June 2020 have eased the return to more normal levels of consumption. This has increased the use of credit cards. The government has also introduced measures to promote domestic tourism which have boosted credit card spending, although usage remain below pre-pandemic level (Figure 12). Credit card usage overseas remains weak, although this has limited impact on Thai players because foreign purchases account for only 8.1% of total credit card spending.

- The government’s support for electronic ‘Know Your Customer’ (e-KYC) technology will make applying for credit cards quicker and more convenient by allowing individuals to confirm their identity electronically using the National Digital ID (NDID) platform. This technology has been operating in a regulatory sandbox since February 6, 2020. Currently, they are testing the use of biometric data to confirm identities by banks. This is expected to be extended for use in inter-bank identity confirmation. When fully implemented, the e-KYC system will allow individuals to carry out a range of financial transactions through digital channels, making it more convenient to access banking services and reducing the need to make in-person visits to a bank branch to, for example, open an account, request for a loan or apply for a credit card.

Headwinds that could dampen growth include the following:

- The weak economy will undermine household income and credit-worthiness. Krungsri Research forecasts the Thai economy would contract by 6.3% this year, followed by anemic growth of 3.0-4.0% in 2021-2023. This will encourage lenders to exercise greater care in releasing new credit, including that made available through credit cards. Given this, credit growth is expected to slow in the coming period.

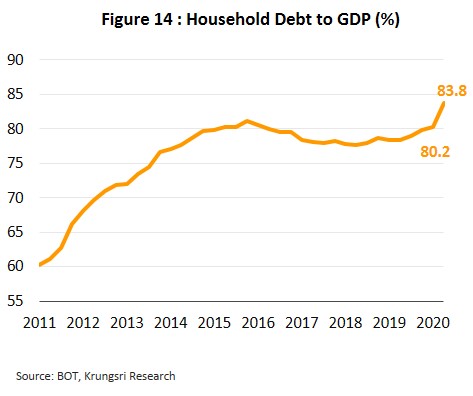

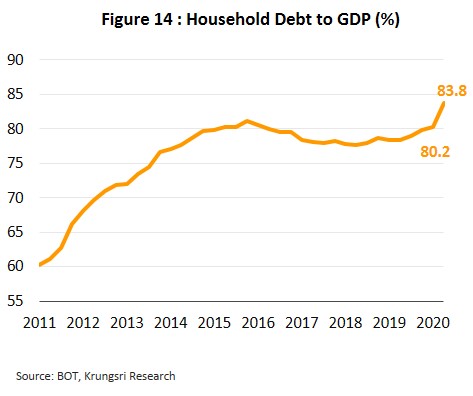

- High level of household debt would cap any increases in credit card spending. This is especially true in the wake of COVID-19, which will bump up already-high debt levels. It has increased from 79.9% of GDP at the end of 2019 to 83.8% as of 2Q20, the highest in 18 years (Figure 14). This has made many households’ financial situation much more fragile, and has exposed them to greater risk is there is a downturn in the economy. There is now an elevated possibility of a future debt crisis driven by defaulting household borrowers.

- The proportion of NPLs in the credit card sector is expected to rise in the future. Financial institutions will need to strengthen provisions to deal with this. Currently, the ratio of NPLs to total debt has not moved up substantially because lenders have moved quickly to shed poor-quality debts, to write off bad debts, and to work with the Bank of Thailand to help borrowers. But in the coming period, the value of NPLs will rise due to (i) NPL ratio trails the performance of the economy, and (ii) since the economy is expected to remain sluggish for an extended period, this will implications on household income. This would be a major problem for low-income households because they are especially sensitive to any worsening of the economic environment. Partly to meet elevated risks and partly due to the new TFRS9 accounting rules (which specify that provisions should be sufficient to cover foreseeable future events and their effects on consumers), the overall worsening of credit-worthiness will have the added effect of forcing lenders to increase provision charges. This means operating costs will rise.

- Government measures to alleviate some of the COVID-19 impact and to help consumers effected by the lockdown will reduce turnover for players in the credit card industry. In particular, cutting maximum interest rate from 18% to 16% per year will reduce income, as would moves to prevent debts going bad, such as cutting minimum monthly credit card repayments from 10% of the outstanding balance to 5% in 2020-2021 and 8% in 2022. Although, this could push up outstanding debts (Box 1).

- Competition among players providing micro-finance services will strengthen, which will have an impact on credit card issuers. Against the backdrop of a sluggish economy, providers of financial services looking for better returns are likely to be attracted to the micro-finance market. Competition will increase from several different directions, including: (i) financial institutions, which would have greater interest in nano-finance, for example SCB’s Money Thunder offering; (ii) tech companies, such as Grab-Wallet and KBank’s joint ‘super application’ which include a comprehensive range of payment services and makes available loans to Grab drivers, and Ascend Nano which offers loans through True Move H to True customers up to THB10,000 (with added incentive of 0% interest in the first month); and (iii) from other non-banks such as J-mart, which has joined with KB-Kookmin, a South Korean lender, to start issuing credit cards in Thailand in 2021.

Krungsri Research View

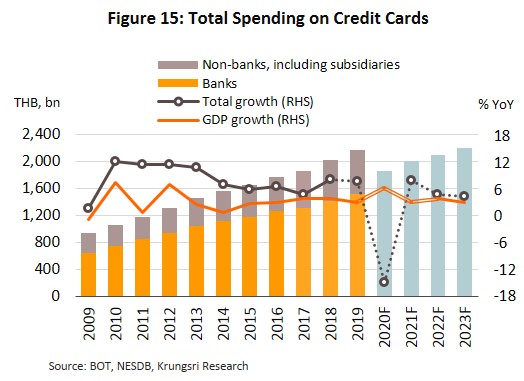

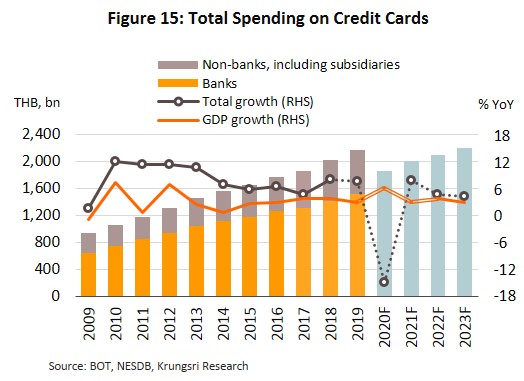

For full-year 2020, credit card spending is projected to drop by 14.8% as a result of the COVID-19 pandemic. But from 2021 to 2023, growth is projected to rebound to an average of 5.7% per year (Figure 15). This outlook is premised on changing consumer behavior towards using electronic payment methods, the growth of the e-commerce sector, and a recovery in spending (including that made with credit cards) as the country returns to more normal conditions. However, players will still have to contend with headwinds from the worsening economic situation which would reduce household income and their ability to meet repayment schedules, already-high and rising household debt levels, the government-mandated requirement to provide assistance to credit card holders, higher operating costs driven by the need to book larger provisions to address a likely rise in NPLs, and rising competition from both traditional lenders and non-bank operations.

These factors, coupled with the changing financial landscape, will encourage players to review their business strategies.

- Operators need to prepare for a general decline in the quality of debtors, which they can achieve by applying pre-emptive measures to manage NPLs. Delinquency rates could rise in the coming period but to minimize the risk of debts turning non-performing, lenders need to be proactive in restructuring debts ahead of time, extend repayment schedules, cut interest rates, and potentially write-off bad debts. In addition, if the recovery is delayed, they would need to book larger provisions against an expected rise in NPLs. These will eat into profits.

- Growing the market for online payments remains an important strategy for players as they try to expand their customer base. Most consumers are now familiar with making purchases of goods and services through an app or website, and then paying for them online. Hence, expanding the use of online payment systems by partnering with online sellers will simultaneously improve customer convenience and the use of credit cards. Such a strategy is particularly appropriate for Millennials and Gen Z consumers, who are most at ease with shopping on digital channels.

- Players will look to new, higher potential market segments to reduce their exposure to risks. This will involve marketing to customers with higher incomes or who work in industries which have been relatively spared by COVID-19. This will include those earning over THB30,000 per month and those with a secure source of income, such as employees in medical or public health industries, civil servants, or staff in e-commerce operations.

- Using alternative data to assess credit-worthiness will help lenders make more accurate decisions on whether to issue credit cards to individuals who cannot show evidence of income and who would find it difficult to obtain a credit card. These include freelancers and self-employed individuals. This will depend on issuers tying up with external organizations to gain access to information, though it might not be necessary to get evidence of, for example, an individual’s payment history for public utilities and telephone services.

- Offering rewards to customers when they use their credit cards remains an important incentive to motivate card usage, and so issuers will benefit from competing in this area. Operators should create programs that provide a wide range of rewards that is flexible and encourages the use of credit cards to make both e-commerce and offline purchases. That can include cashback offers for purchases made at stores which have partnered with the card issuer.

Given a business environment in which the quality of debtors is worsening, and which will likely see greater competition from new players, it is important for operators to extract as much value as possible from their data analysis operations to understand risks and consumer behavior. In addition, players will need to focus on staying ahead of the curve by developing innovative new services and technology, an area that in the coming period will play an increasingly central role in preserving and extending competitiveness in the credit card market.

[1]With effect from September 1, 2013

[2]Citibank took over the Always credit card company on September 23, 2018

.webp.aspx)