Executive Summary

The construction contracting sector is projected to expand at a modest average rate of 2.0–2.5% annually during 2025–2027. Growth is expected to slow to 1.0–2.0% in 2025 due to economic and political uncertainties weighing on business activity in the latter half of the year. A gradual recovery is anticipated, with growth rising to 2.0–2.5% in 2026 and 3.0–3.5% in 2027. The primary growth driver will be public construction investment, forecasted to increase by 3.0–3.5% annually, particularly from infrastructure projects linked to the Eastern Economic Corridor (EEC), which aims to attract investment in targeted industries. In contrast, private construction investment is expected to contract in 2025, stabilize in 2026, and recover only modestly in 2027. Despite progress in transport network expansion across strategic areas, overall purchasing power remains constrained by prolonged economic uncertainty, U.S. tariff policy shifts, and high household debt. Consequently, financial institutions are maintaining strict housing loan approvals, delaying certain new private-sector projects.

Krungsri Research view

During 2025–2027, revenues of contractors focused on large-scale government projects are expected to expand in line with public construction investment, though growth will be gradual. In contrast, revenues of contractors focusing on private-sector projects are likely to remain flat, with only a slow recovery.

-

Large construction contractors are expected to see revenue growth in line with government infrastructure investment plans, particularly in 2026–2027. This group is well-positioned to bid for projects and has strong capabilities in managing large-scale construction works. Growth will be supported by ongoing public investment projects such as mass transit systems, double-track railways, motorways, and major transportation networks (megaprojects) linked to the EEC, as well as other basic infrastructure projects nationwide. In addition, large-scale private sector projects—including residential developments, high-rise buildings, and large commercial complexes—will continue to contribute, helping increase the backlog. However, private-sector investment growth remains constrained by economic uncertainties.

-

SMEs will likely see their revenue remain flat or grow only modestly. Medium-sized contractors may still have opportunities to secure subcontracting work from larger firms. However, key downside risks to their performance include rising operating costs and labor shortages, which could lead to liquidity challenges for some SME contractors.

Overview

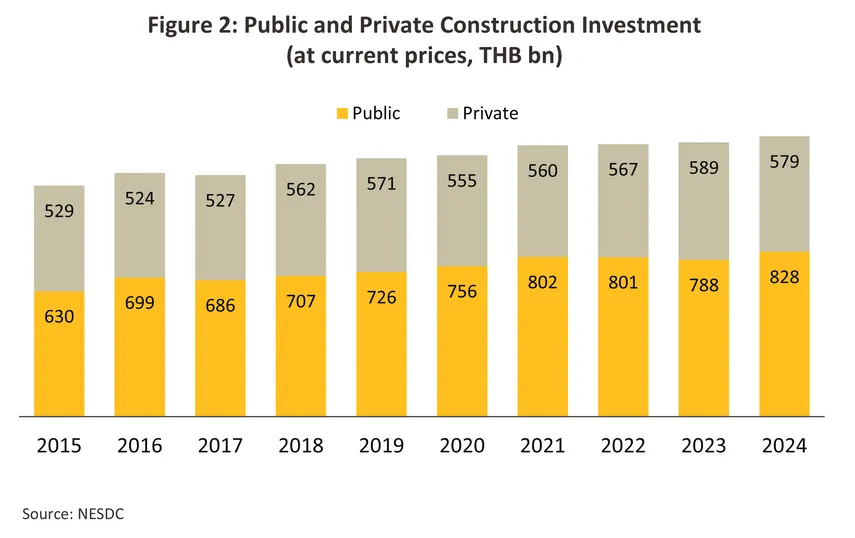

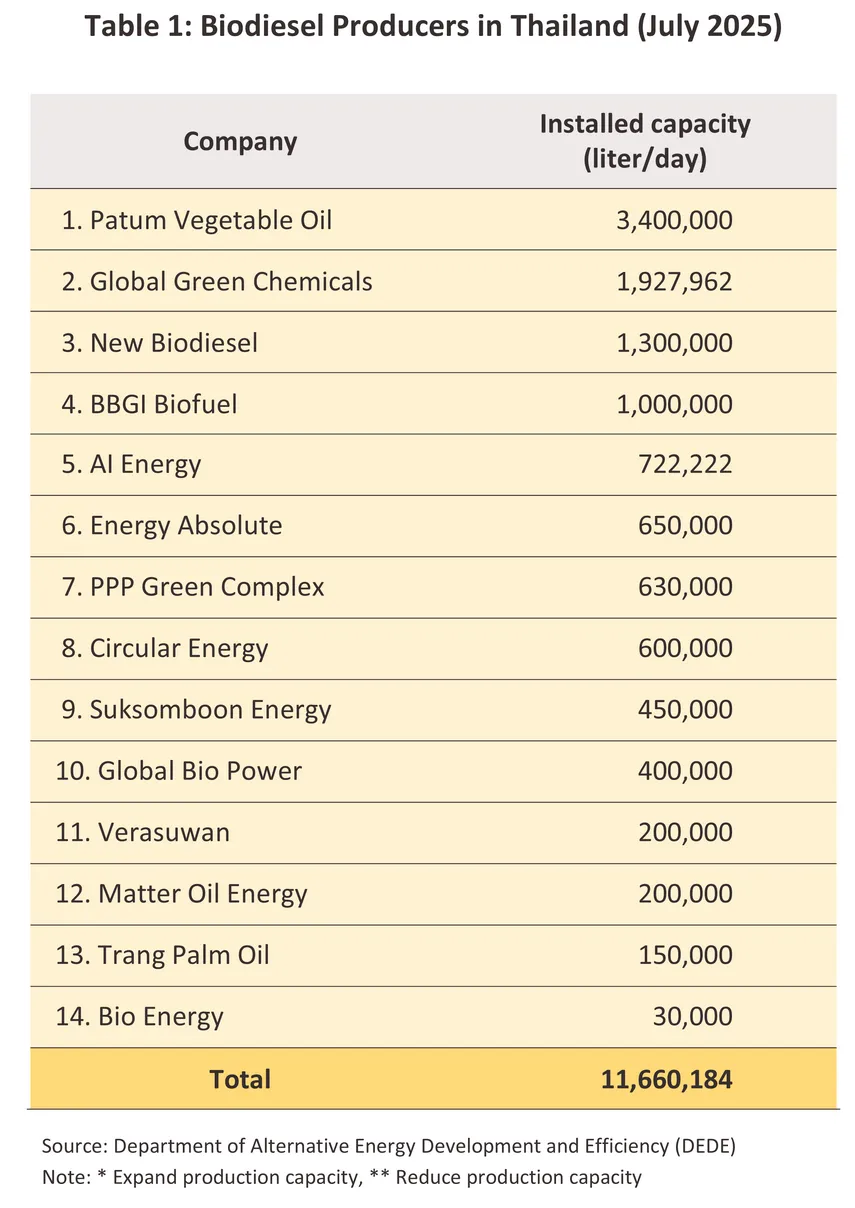

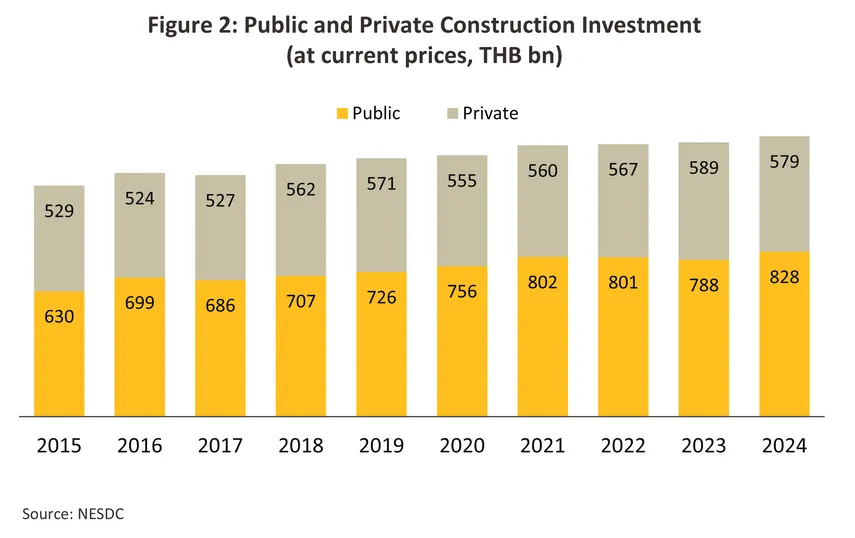

Over the years 2015 to 2024, the construction industry averaged an 8.0% share of gross domestic product (Figure 1), most of which was attributable to activity in the domestic market. The industry can be divided into the two major segments of public and private construction, for which 2024 spending was split in the ratio 59:41 (Figure 2). The impact of the COVID-19 crisis, particularly during 2020-2021, contributed to a slowdown in overall construction investment growth, as private sector investment decreased compared to 2019. Meanwhile, public sector construction investment continued to grow (Table 1), partly due to the government's ongoing efforts to accelerate infrastructure investment to drive economic growth and attract foreign investment, despite delays in many projects due to labor shortages, particularly during the pandemic when social distancing measures were in place.

-

Public construction: The major share of public construction is accounted for by the build-out of infrastructure. This ran to around 81% of the segment’s total value in 2024, with the remainder going to the building of offices for government agencies (17%) and housing for state employees (2%). Large construction contractors typically enjoy advantages when contracting for government work, especially for infrastructure megaprojects, due to their experience, knowledge and expertise, financial security, and ability to develop and exploit specialist techniques and technologies. SMEs thus tend to sub-contract for larger corporations when working on publicly-funded projects.

-

Private construction: Construction work is mostly on residential accommodation, which most recently contributed 50% of all revenue to the segment. The remainder is split between industrial and commercial buildings, a category that includes facilities such as shopping centers, hotels and hospitals. Private sector construction tends to be affected by investor confidence, the overall state of the economy, the degree of political stability in the country, the extent of infrastructure spending, and any government measures that are in place to stimulate investment.

Thai construction companies, especially large corporations, have also been expanding their customer base into overseas markets, in particular the neighboring countries of Cambodia, Lao PDR, and Myanmar. Players are attracted by the high level of investment in infrastructure and utilities in these countries, for example, road and rail networks, power plants, as well as construction, renovation, and decoration of buildings and housing, along with industrial estates and factories to support investment promotion policies.

At present, there are some 117,000 construction companies registered in Thailand (source: Department of Business Development, 2024), but of these, only 727 (or 0.6% of total construction contractors) qualify as large-scale operations. Nevertheless, by income, large players account for 49% of the market, and just the three largest players listed on the stock exchange, which are Italian Thai Development, Ch. Karnchang and Sino-Thai Engineering and Construction (STECON Group), and hold a 56% share of the revenue of the total revenue of all listed construction companies. (Figure 3, data as of 2024) and 18.6% of all large-scale contractors.

Factors affecting the overall movement of the construction industry will need to consider both the market and business costs, as follows:

1) The market: The possibility of generating income depends largely on the state of the economy, the political environment, plans for and progress with public and private investment, and the regulations governing investment in particular countries, which may either support or hinder the industry.

2) Costs: This refers principally to changes in the costs of construction materials and of labor, and the effects of this on profits. Currently, Thai players are struggling with a shortage of labor in terms of both quantity and skill. Consequently, most labor productivity has been lower than wages. For construction companies, costs are split approximately 45-50% (depending on the type of construction), 30% and 25% between construction materials (construction steel, concrete, cement, and other materials), labor, and other costs respectively1/ (Figure 4).

Situation

Overall spending on construction rose 2.2% in 2024 to a total of THB 1,407.5 billion, an improvement on the previous year’s 0.6% growth that had then brought total investment to THB 1,376.6 billion (Figure 5). Following delays to budget disbursements that dragged on spending through the first half of 2024, the sector was lifted by the uptick in public sector work seen in the latter half of the year. However, sluggishness in the market for residential accommodation meant that private-sector investment in construction remained depressed. For 1H25, overall construction investment recorded solid growth of 12.3% YoY, underpinned by robust public sector project—especially the accelerated expansion of infrastructure projects. In contrast, private sector construction continued to contract from last year.

Public Sector Construction

-

In the first half of 2025, construction investment amounted to 436.8 billion baht, marking a 24.5% YoY increase (Figure 6). The growth was largely propelled by the ongoing implementation of infrastructure projects, supported by the accelerated disbursement of construction budgets that had been postponed for several months in 2024.

-

The surge was primarily driven by ongoing infrastructure developments, with investment in this category reaching 359.1 billion baht—an impressive 31.0% growth from the previous year, which had seen a significant downturn of -23.6% YoY. The majority of this investment focused on transportation network projects.

The segment benefited from ongoing work on large-scale projects, especially metro lines in Bangkok, including: (i) the Tao Poon-Rat Burana (Kanchanaphisek Ring Road) Purple Line, which as of the end of August 2025 was 61.80% complete (civil work); and (ii) the Bang Khun Non-Thailand Culture Centre Orange Line, this overall progress is 14.94% (as of August 2025). In addition, work on megaprojects in the EEC also lifted the segment. (i) Phase 3 of the development of Map Ta Phut Port continued, with infrastructure disbursements, such as revetment, breakwaters, and dredging, progressing to 93.02% finished (correct as of August 2025). (ii) The first section of phase 3 of the work on Laem Chabang Port also continues. This involves marine construction and is 67.48% (as of May 2025). The second section, covering construction of buildings, port facilities, roads, and utilities, has reached 0.47% progress as of May 2025. The F terminal is scheduled to begin operations by the end of 2027.

-

Other types of construction also showed signs of recovery, with investment rising 1.0% YoY to 77.6 billion baht, rebounding from a -1.2% contraction in 1H2024. This improvement was largely supported by gains in non-residential buildings (+3.1% YoY). However, construction of residential buildings for government employees declined by -15.2% YoY.

Private Sector Construction

-

In 2024, construction investment stood at 579.0 billion baht, representing a -1.7% decline (Figure 7). The contraction was primarily attributable to a slowdown in residential projects, whereas commercial building and factory construction continued to register growth.

-

Spending on the residential sector totaled 288.8 billion baht, marking a -5.8% contraction, compared to a 3.1% expansion in 2023. This was broadly in line with the -6.8% contraction in the number of residential units newly registered in the year nationwide, though considering just the Bangkok Metropolitan Region and the four major provinces of Chiang Mai, Chonburi, Khon Kaen, and Nakhon Ratchasima, the decline was limited to -4.2% (Figure 8). Weakness in the market stemmed from: (i) overall softness in consumer spending power, the rise in the cost of living, and high levels of household debt; (ii) the increasing caution among lenders over releasing new loans, coupled with the recent run-up in interest rates; and (iii) labor shortages that have particularly affected SME contractors.

-

Work on commercial properties (shopping malls and other retail space), office units, transportation centers, and factories and other industrial units generated income worth THB 290.3 billion, a rise of 2.7%. Growth was driven by the strength of demand for commercial properties in the central business district, and for industrial and office space in industrial estates, especially in strategic locations such as the EEC, where pro-business policies are increasing investment inflows into industries targeted by the government.

-

For 1H2025, construction investment totaled THB 282.3 billion, down -2.5% YoY (Figure 7), reflecting a continued decline in residential construction, while commercial building activity also showed early signs of contraction.

-

Residential construction remained sluggish, with investment in the sector contracting by -4.7% YoY, in line with a -15.6% YoY drop in newly completed and registered housing units nationwide, with a sharper drop of -26.2% YoY in BMR, as well as in four key regional provinces (Figure 8)

-

Non-residential construction recorded an investment value of THB 66.2 billion, contracting slightly by -1.0% YoY. The exception was factory construction, which continued to expand. Considering the value of nationwide industrial factory ownership transfers during the first half of 2025, it totaled 8.6 billion baht, an increase of 102.2% YoY, with a notable surge of 299.1% YoY in the Eastern region—home to the strategic industries in the Eastern Economic Corridor (EEC). This surge was particularly pronounced in the Eastern region, a strategic hub for targeted industries under the EEC.

-

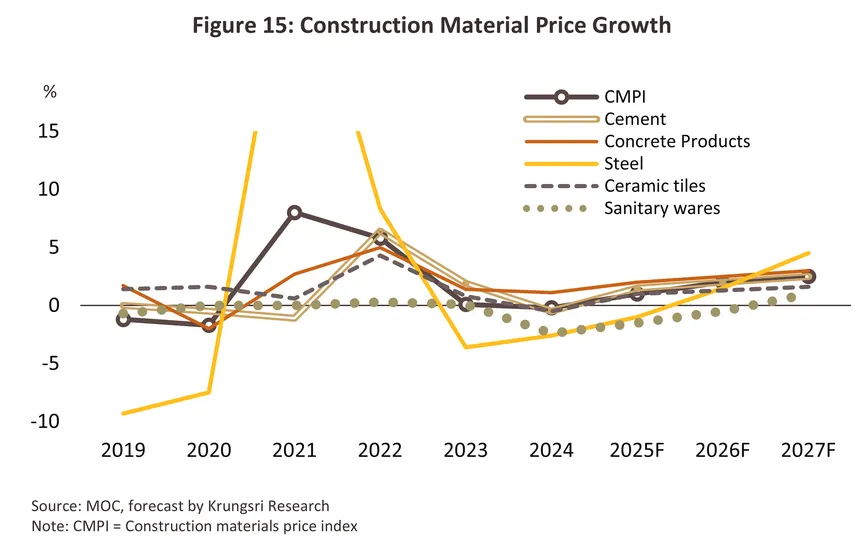

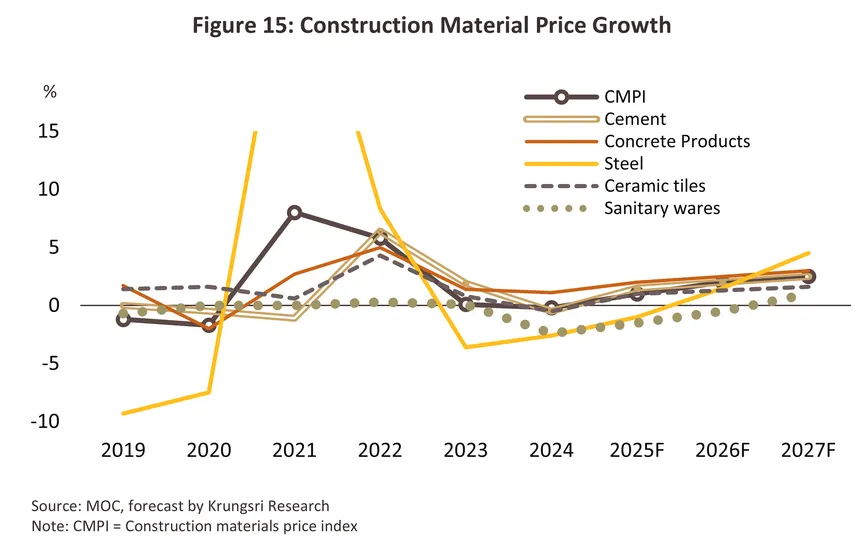

The Construction Materials Price Index contracted -0.2% in 2024, reversing 2023’s 0.1% growth. Average prices for construction steel products (28% of all spending on construction materials) fell by -2.6% (Figure 9). Prices for channel and for round and deformed bar all came under pressure from the ongoing real estate crisis in China and the need for Chinese foundries to dispose of excess stock, which has then ended up flooding markets in Southeast Asia (Figure 10). Weakness in the housing market worsened problems with the oversupply of cement (11% of all expenditure), and this then added to pressure on prices, which fell by -0.5% as a result. Nevertheless, prices for concrete products edged up 1.1% on a combination of a rise in diesel prices and stronger demand for use in public sector infrastructure projects through the second half of the year. In 9M2025, the Index strengthened by another 0.4% YoY on rising demand for construction materials for use in government-backed transportation projects. In particular, prices for ‘other’ products (e.g., asphalt) jumped 3.8% YoY. However, the price index for steel and steel products continued to decline (-2.6% YoY), reflecting the impact of persistently high global supply.

Outlook

The construction industry is projected to see only modest growth of 2.0–2.5% annually over 2025–2027 (Figure 11). In 2025, expansion will be limited to just 1.0–2.0%, especially in the second half of the year when growth will be constrained by domestic political uncertainty and weaker economic conditions resulting from U.S. tariff policies. Recovery is expected to gradually pick up to 2.0-2.5% in 2026 and 3.0–3.5% in 2027, driven mainly by large-scale government projects, particularly those linked to the EEC and extensions to road and rail networks. Private construction investment is expected to remain flat or recover only gradually, both in residential and commercial real estate, in line with the broader economic slowdown. Industrial real estate, including industrial estates and warehouses, is likely to continue expanding in response to investment trends, particularly in target industries within strategic locations. Overall, the recovery in construction investment is expected to remain concentrated in high-potential locations, including Bangkok and its surrounding provinces, major tourist hubs, key provincial cities, transport network corridors, and designated industrial development zones, particularly the Eastern Economic Corridor (EEC). In contrast, secondary urban areas may still need to wait for opportunities driven by improvements in transportation infrastructure that connect them to regional centers.

-

Public construction investment is projected to grow at an average annual rate of 3.0–3.5%. Growth is expected at only 2.0–2.5% in 2025, before accelerating to 3.0–3.5% in 2026 and 3.5–4.0% in 2027. The key driver will be large-scale infrastructure projects, which are expected to progress further under the 2026 budget. In August 2025, the Cabinet approved a budget allocation of THB 185.3 billion for the Ministry of Transport (Source: Thansettakij, Aug 13, 2025), covering ongoing projects to develop new highways, rural roads, motorways, transportation and logistics systems, as well as rail infrastructure. These initiatives aim to ensure the timely completion of 77 projects, valued at a total of THB 337.8 billion, under the Ministry of Transport’s Action Plan on Thailand Logistics Development (2023–2027).

-

EEC: Work on projects connected to the EEC and included in the 2023-2027 action plan on EEC infrastructure and utilities will expand to encompass additional initiatives, including the development of U-Tapao Airport and the Eastern Aerotropolis, together with the new Si Racha-Rayong twin-track railway. During the past period, most projects related to the EEC have remained behind schedule.

-

Major projects in other regions primarily consist of construction investments aimed at enhancing Thailand’s transportation and logistics capacity, particularly to strengthen cross-border trade connectivity with neighboring countries. Key initiatives include the double-track railway (Phases 1 and 2), high-speed rail, nationwide highway networks, and airport capacity development to improve multimodal connectivity.In 2025, there are 223 transportation projects planned, comprising 116 new projects and 107 ongoing ones. For 2026, an additional 64 new projects are included in the investment plan (Source: Manager Online, Jan 9, 2025). In addition, the government’s economic stimulus plan, with a total budget of THB 157 billion, encompasses 34 infrastructure projects (water management and transportation) valued at THB 85.0 billion. These infrastructure projects were approved by the Economic Stimulus Policy Committee on June 24 and July 24, 2025. Out of all approved projects, a total of 482 projects have been endorsed, with a combined budget of THB 133.5 billion (Figure 12)

-

Private construction investment is projected to grow at an average rate of -0.5% to 0.5% per year over 2025–2027. In 2025, investment is expected to slightly contract by -0.5% to -2.0% due to economic uncertainty and weaker purchasing power, which dampens consumer and investor confidence in the residential, commercial, and industrial property markets. Investment is expected to stabilize in 2026 and gradually recover at a modest pace of 2.0–2.5% in 2027.

- Residential sector: The number of new housing units coming to market within the Bangkok Metropolitan Region (BMR) is expected to decline by -35.0% in 2025, before returning to an annual growth of 0.5–1.5% (approximately 30,000–40,000 units per year) in 2026–2027 (Figure 13) (Source: Krungsri Research, Aug 2025). Recovery will be supported by the government’s expansion of transportation networks, including mass transit extensions and new motorways that enhance connectivity between suburban areas and city centers. Nonetheless, the recovery will remain concentrated in certain strategically significant areas, particularly city centers, selected transit corridors, as well as tourism and industrial hubs—benefiting primarily large contractors. However, overall growth is expected to remain subdued, especially in 2025, due to several headwinds.

- Slow recovery of purchasing power: Economic uncertainty, including the impact of U.S. tariff policies on Thai exports, coupled with high household debt, suppresses regional consumer spending and leads financial institutions to maintain tight credit approvals for housing loans.

- Residential high-rise market confidence: Concerns over building safety following the March 2025 earthquake have delayed some condominium projects.

- Labor shortages: Both in quantity and skill, particularly among small contractors relying on migrant labor, including Cambodian workers affected by Thai-Cambodian border issues.

- Construction cost volatility: Fluctuations in material prices and transportation costs add financial pressure.

- High inventory levels: Excess housing supply limits the ability to adjust prices according to rising costs, potentially causing developers to postpone some projects, which may reduce profitability, especially for small-sized contractors.

-

-

Factories and industrial estates: This segment will benefit from an uptick in work on public-sector infrastructure projects, especially in the EEC. Players currently plan to invest in new industrial estates and then sell this space or use it to develop new factory units. This will then help to absorb increased investment in the target S-curve industries. A report by the Industrial Estate Authority of Thailand (IEAT) shows that during the first half of Fiscal Year 2025, the IEAT had 23,662 rai of industrial land available for sale, along with 4,959 rai proposed for the establishment of new industrial estates, and an additional 27 projects expected to be established or expanded in the future (Source: M Report, Apr 18, 2025). However, global and domestic economic uncertainty, coupled with concerns over the country’s political stability, may delay investment decisions in the business sector, particularly during 2025–2026.

-

Commercial property: This broad category may be split into two sub-categories. (i) Retail space construction is expected to expand at a modest pace in line with developers’ investment plans (Figure 14), aimed at accommodating the recovery in private consumption and tourism. Krungsri Research projects that new retail supply will enter the market at an average of 1.0–1.5% per year during 2026–2027. (ii) Office building construction is anticipated to gradually increase, supported by the recovery of business sector investment. Krungsri Research estimates that new office supply in the Bangkok Metropolitan Region (BMR) will grow at an average of 1.0–2.0% per year, or approximately 550,000 square meters, during 2025–2027 (Figure 14).

-

Prices for construction materials will tend to inch up slightly over 2025-2027 (Figure 15). Greater spending on infrastructure by the public sector in line with government plans and growing investment in private sector commercial developments will add to demand for structural materials such as cement and construction steel, and this will likely translate into higher prices. However, domestic semi-finished and finished steel prices may continue to decline, as imported steel from China could potentially flood the market. Following The U.S. tariff increase (under Section 232) on most countries2/, including China, China is seeking alternative markets for steel exports, with ASEAN emerging as one of the key target markets.

-

Opportunities for construction contractors in overseas markets, particularly in neighboring CLM countries, are generally limited to large contractors with sufficient capital, advanced construction technology to enhance efficiency, and strong business connections with local investors that facilitate investment expansion. However, operating in overseas markets carries with it certain risks, including those related to: (i) employment conditions that may fall short of international standards, and uncertain or unclear contracts; (ii) political instability in some countries; and (iii) increased competition from players from other countries, including domestic operators within these overseas markets. To help offset these risks and to improve their chances of securing work, Thai players will need to link up with companies embedded in construction supply chains within these markets. This could include local real estate developers, construction contractors and employment agencies.

- Headwinds limiting growth may come from the following areas.

-

Political uncertainty: It could lead to a lack of continuity in some public sector infrastructure projects, especially through delays in budget disbursement that may weigh on the overall investment climate.

-

Construction labor shortages: These remain a major structural problem for the industry, with players continuing to compete with the manufacturing and service sectors for workers (both skilled domestic staff and migrant laborers). The problem has been further aggravated by the border dispute with Cambodia, given that most Cambodian workers are employed in the construction sector. This may cause some projects to fall behind schedule, with negative impacts on contractors’ revenues, especially for SMEs.

-

The entry of foreign construction firms, particularly large Chinese contractors, into the domestic market—often through joint ventures with Thai contractors on mega-projects such as double-track and high-speed rail (Source: Thai Construction Industry Association, Mar 2025)—as well as direct investment in medium- and small-scale projects, has intensified competition for Thai construction firms. This competition affects multiple areas, including pricing, technology, and innovation, thereby increasing business pressure on smaller contractors.

However, the impact of building collapses during the earthquake at the end of March 2025 may lead to delays in certain government construction projects, as contract review systems are reassessed, and new contractors are sourced. At the same time, this event could provide opportunities for large Thai construction firms to secure projects and expand their backlog, particularly in cases where they had previously been at a pricing disadvantage compared to Chinese contractors in government tenders.

-

Rising operational costs resulting from stricter regulations—particularly measures gradually implemented following the earthquake—are prompting construction contractors to place greater emphasis on diligence and adherence to safety standards. This includes amendments to ministerial regulations on blacklist issues, grade adjustments or reductions, and the revocation of registrations for negligent contractors responsible for injuries or fatalities (Source: Cabinet Resolution, Apr 8, 2025; Thansettakij, Apr 8, 2025).

-

Housing inventory remains high (Figure 16) due to the continuous entry of new supply into the market, while consumer purchasing power and confidence remain weak amid economic uncertainty. This is particularly affected by the impact of U.S. tariff policies, which pressure the export-oriented industrial sector, combined with persistently high household debt that constrains regional purchasing power. As a result, private sector investment in new residential construction projects is expected to remain at low levels.

-

Net zero targets may represent both opportunities and challenges for businesses. Growing global interest in the ESG (environmental, social, and governance) agenda and the increasing shift to sustainability is helping to add to demand for environmentally friendly (or green) buildings3/. Key drivers supporting opportunities for the expansion of green buildings include tax breaks and other types of government support, together with the development of the low-cost environmentally friendly construction materials. Coherent Market Insight thus estimates that the value of the global market for green buildings will jump from USD 375.80 billion in 2025 to USD 780.72 billion by 2032, representing compound annual growth of 11.0%. Nevertheless, during the transition period, encouraging businesses to embrace these changes and to keep pace with global adoption of green construction will likely remain a challenge (Figure 17).

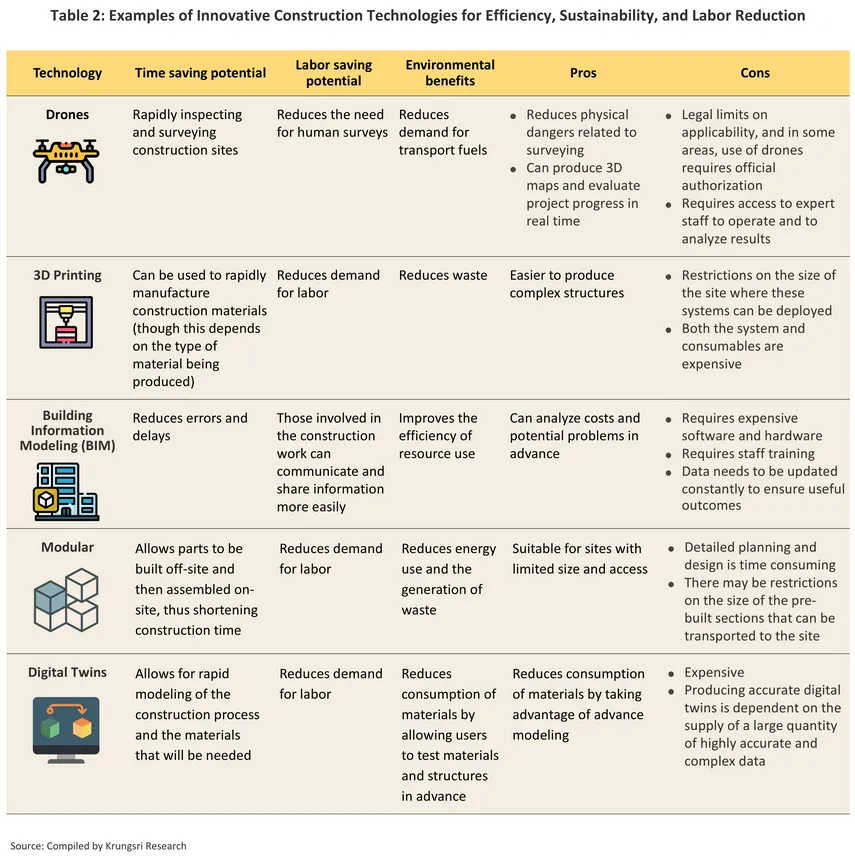

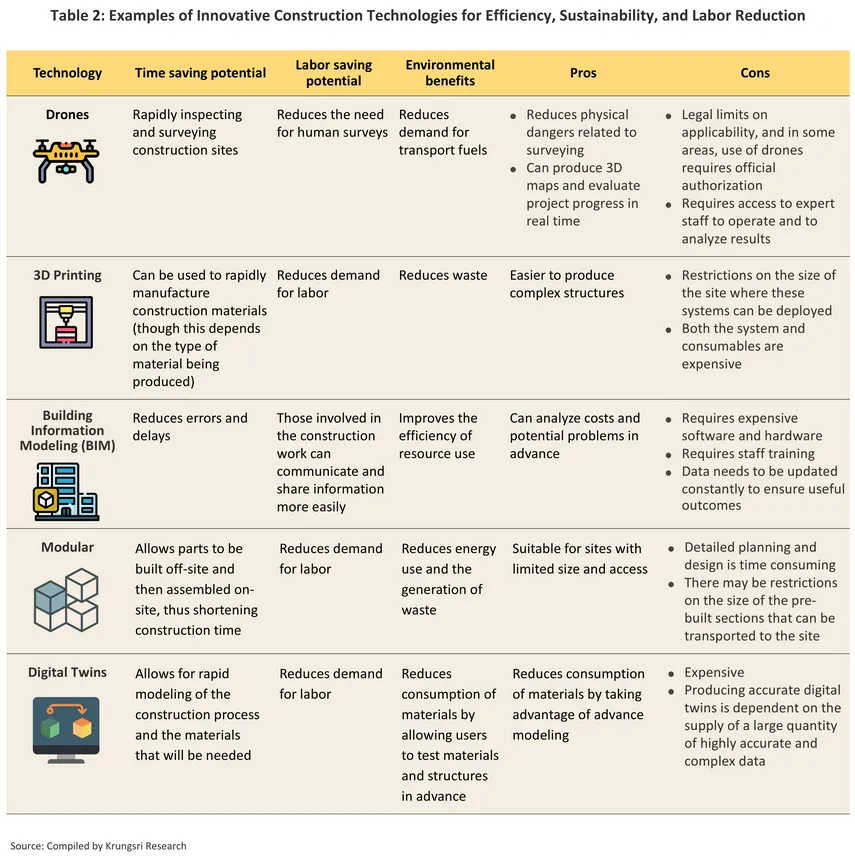

Larger players will be in a better position than SMEs to exploit these trends thanks to their improved access to capital and technology, which will then allow them to reduce wastage and improve overall operating efficiencies. This could involve the use of drones, 3D construction printing, building information modeling (BIM) systems (Table 2), and environmentally friendly building materials, though these cost on average 10-20% more than the standard alternatives (Real Estate Information Center, November 2022). More broadly, in addition to being a legal requirement, strict adherence to environmental regulations and certifications4/will also help companies strengthen their competitive edge, thereby supporting sustainable business growth in the future.

1/ Average cost breakdown from large contractors

2/ For steel and aluminum, the U.S. raised tariffs from 25% to 50% for most countries. Only a few countries are exempted or subject to preferential rates under negotiated trade agreements — for instance, the United Kingdom, where steel remains subject to a 25% tariff. (Source: BBC, Sep 17, 2025)

3/ Green buildings are constructed using natural materials that are employed efficiently and sparingly, and these buildings thus demonstrate social and environmental responsibility through the length of their lifecycle.

4/ These are valid across a building’s lifecycle (www.greennetworkthailand.com). Examples include the LEED and WELL certifications.

.webp.aspx)