2021-2023 THAILAND INDUSTRY OUTLOOK

The Thailand Industry Outlook report evaluates the attractiveness of selected Thai industries to support credit evaluation for the bank’s clients over the next 3 years (2021-2023). The report considers a range of factors that will affect each industry over this timeframe. These include the broad competitive environment (e.g. trends in trade and the global economy, structural changes occurring at global level, and economic outlook for Thailand), as well as sector-specific variables (e.g. industry structure, Thai industrial competitiveness, and ongoing regulatory changes). We look at the players’ ability to cope with uncertainties, generate revenues, and service debt.

Macroeconomic environments

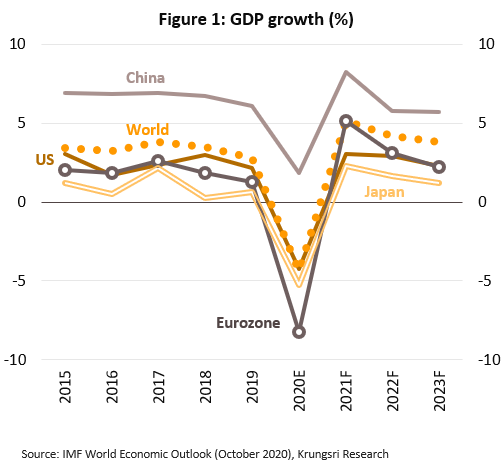

Global economy in 2021-2023: Different pandemic recovery and growth trajectories for major economies

- Over the next three years, the global economy is projected to grow by an annual average of 4.4%. It will recover from the recession in 2020, the worst setback to growth in several decades. Economic activities would continue to rebound gradually, led by manufacturing and exports. With the rollout of vaccination programs this year, lockdowns would be relaxed in many countries possibly by 2Q21, and governments would continue to offer wide-ranging fiscal and monetary support for their respective economies. Growth will also be supported by the development of several COVID-19 vaccines, which are expected to enter mass production in the first half of 2021, followed by mass immunization programs that will accelerate in the latter half of the year. Meanwhile, the election of Mr. Biden as the next American president suggests the US is unlikely to introduce more trade barriers, and with this, at least one obstruction to a recovery in global trade has been removed, and the world economy should return to growth mode.

- Over the next 3 years, the US economy is projected to return to average growth of 2.8% per year, following an estimated 4.3% contraction in 2020. This will be helped by a recovery in domestic demand fed by stronger consumption and investment, which have in turn benefited from government response to the COVID-19 pandemic and efforts to alleviate the impacts on businesses and workers. The US labor market is recovering from earlier lows, with unemployment rate improving to 6.9% in October from 14.7% in April, and unemployment claims falling to 7.3 million at end-October from 25 million at the start of May. This has helped to boost consumer spending; in April, spending was only 82% of pre-pandemic level, but by October this had recovered to 98%. Beyond this, Biden is likely to push through a major fiscal support package to stimulate the economy further and overhaul the US’ trade policy to provide a further fillip to businesses and exports. Meanwhile, the Federal Reserve is indicating it will maintain an accommodative monetary policy through to 2023 and is fully committed to intervening in corporate debt markets. As a result, financial conditions have recently returned to pre-COVID-19 levels considerably faster than the recovery from previous economic crises.

- In the Eurozone, recovery is expected to accelerate with growth reaching 3.5% per year, though this follows a much deeper recession that knocked 8.3% off the bloc’s GDP in 2020. The rebound will be powered by growth in manufacturing and stronger exports to the bloc’s main trade partners, especially the US which is now expected to follow a less confrontational trade policy for its traditional allies. Domestic demand will also benefit from stimulus measures worth EUR1.82trn, comprising: (i) long-term spending by the EU over 2021-2027 worth EUR1.07trn; (ii) EUR750bn from the EU Recovery Fund; and (iii) the temporary Support to mitigate Unemployment Risks in an Emergency (SURE) program, which injected another EUR87.4bn into the region. For its part, the European Central Bank (ECB) is also looking to further relax monetary policy by introducing negative policy rates and/or expanding the Pandemic Emergency (asset) Purchase Programme (PEPP) which has access to EUR1.35trn funds currently.

- In Japan, recovery will be relatively anemic with growth at 1.7% annually, following a 5.3% GDP contraction during the 2020 recession. Growth will be supported by several factors. (i) Exports would expand in line with the recovery in the world economy and global trade. (ii) Household consumption would improve supported by a strong labor market (unemployment rate was just 3% in September), though rising household savings point to a fragile recovery. (iii) Business confidence is strengthening, particularly in the travel and tourism industries (e.g. restaurants) which are the prime beneficiaries of the government’s ‘Go To Travel’ stimulus package. (iv) Investment in digital services will expand over the long-term in response to anticipated labor shortage; this is one of the government’s key initiatives. Along with this, public-sector investment has also been boosted by the postponed 2020 Olympics. (v) Other stimulus measures, including those aimed at alleviating the effects of the pandemic, are supported by a JPY549bn supplementary budget. And like other central banks, the Bank of Japan will likely maintain an accommodative monetary policy in the foreseeable future.

- China is outperforming other major economies and can look forward to average growth of 6.6% per year over the next three years, accelerating from an estimated 1.9% growth in 2020. The country is now reaping the benefits of its rapid and comprehensive measures to control the COVID-19 outbreak. It is recovering faster than most other countries, to the point where even industries that had been severely impacted by the pandemic, such as restaurants and domestic airlines, have returned to pre-pandemic heights. In the coming period, household consumption is expected to be an important driver of the Chinese economy. In fact, this is part of China’s 14th Five Year Plan (2021-2025), which also lays the framework for the structural reform of the economy. This will be achieved through the development of technology and innovation, increasing the efficiency with which factors of production are allocated, protecting the environment, and shifting the center of gravity within the economy from a dependence on export markets to domestic consumption. Also, China’s favor in the scramble to recover is the healthy state of its labor market, coupled with being a frontrunner in the race to develop a COVID-19 vaccine. Its success has enabled the country to roll-out a mass immunization program ahead of other countries. The net effect of all these factors will be a sustainable recovery through the next few years. Although investment is weakening, it is also becoming more balanced with investment in manufacturing rising in line with stronger exports and higher profits, and over a broader timeframe, the government’s long-term plans to raise manufacturing standards and push ahead with technological innovation. This is happening alongside slowing investment in real estate (reflected in falling land prices) and a slack in government spending on infrastructure which has been an important stimulus for the economy but is now becoming less necessary.

Anticipated structural changes in the world economy and the impact on businesses and industries

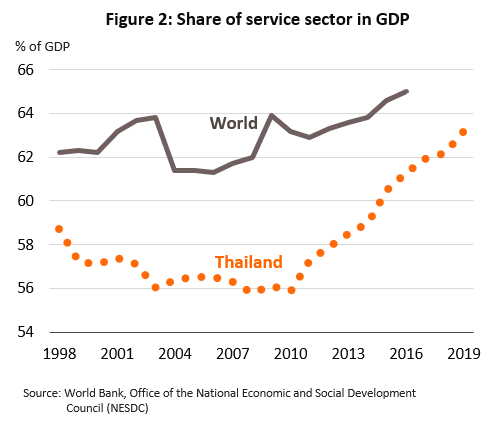

- The global economy is undergoing structural shifts as it transitions from a dependency on manufacturing to becoming increasingly centered on services. So between 2008 and 2017, the share of world GDP attributed to services rose from 62.0% to 65.1%. Although, in advanced economies such as the US, the UK and France, services generate about 75% of GDP, led by ‘modern services’ such as IT, software design and finance. In Thailand, the service sector’s share of GDP has grown from 55.8% in 2008 to 63.2% in 2019. But in the Thai economy, traditional services such as tourism, trade, and hotels & restaurants dominate, and only 14% of national GDP comes from modern services which are largely confined to finance and telecommunications. However, in the next period, this will change. Technological progress will raise importance of modern services within the economy because these will add value to goods and services. For example, design and consultancy services to best utilize technology such as artificial intelligence and big data to boost sales and design new products that better meet consumer needs. Thus, if Thailand wishes to keep up with prevailing trends that are transforming businesses worldwide and secure sustainable, long-term development, it will be essential for the country to meet and overcome the challenges involved in transforming the economy into one that is based on the provision of these modern services.

- At the same time, the global trading environment is more tense and trade barriers are becoming increasingly common. Indeed, the World Trade Organization (WTO) reported that in just one year (October 2018-October 2019), WTO member states have employed 102 measures to control trade worth USD750bn. This is the most barriers reported in 7 years and a 27% increase on the year earlier. To control imports, imposing import tariffs was the most common move followed by import bans, stricter import procedures, and imposing other fees. Exports were most often controlled by imposing export charges, specifying pre-conditions for export and requiring the issue of export licenses, and capping export volumes. The products most affected by these restrictions are minerals, fuel products, machinery, electrical equipment and parts, and precious metals.

The tendency to erect trade barriers is both a threat and an opportunity for Thailand, especially given escalating tensions between the US and China since 2018. Both these countries are important export destinations for Thailand. The US-China trade war has exerted downward pressure on Thai exports, but at the same time, Thailand is presented with an opportunity to benefit from trade diversion to develop its own export sector by replacing exports in the bi-lateral US-China trade vacuum. Thus, in the first 10 months of 2020 (January-October), the value of Thai exports bound for the US rose to 14.8% of total exports from 12.7% in 2019, while exports to China climbed to 12.8% from 11.8%. In addition, Thailand may also benefit from investment diversion as US and Chinese investors seek to circumvent trade barriers by offshoring production facilities. In fact, in 2018 and 2019, applications for investment incentives to the Board of Investment from US and Chinese companies comprised 57% and 52% of total submissions (by value), respectively. However,

this path is not without obstacles and Thailand needs to develop comparative advantages to become a more attractive investment destination than its neighbors, such as Malaysia, Indonesia and Vietnam which unlike Thailand, already have free-trade agreements with Europe as part of their strategies to attract more foreign direct investment.

- Modern technology is rapidly reconfiguring the industrial sector and is creating a major structural transformation. In addition to rising competition, global megatrends will change productivity levels, pushing industry into the Fourth Industrial Revolution. But beyond this, the COVID-19 crisis has revealed weaknesses in prevailing business models, and companies are now rushing to strengthen supply chains and make them more resilient. The major technologies that will determine how industry is transformed over the next 3 years will include the following.

- 5G technology: 5G broadband can offer over 100 times the bandwidth of 4G networks, and 5G systems will support the revolution in manufacturing processes by controlling machinery-functional systems. They can collect and analyze big data resources to automatically adjust raw material and finished goods inventory. Examples of assembly lines that are built around 5G technology include Ericsson’s and Vodafone’s electric microcar production lines in Germany and Bosch’s electrical appliances production facilities in Britain.

- The Internet of Things (IoT): IoT devices are already playing a greater role collecting data from sensors embedded in a wide variety of commonly-found devices, including surgically-implanted heart monitors, smart fridges that monitor expiry dates of food, biochip transponders that check the state of livestock, and sensors in greenhouses to maintain optimum growth conditions. These devices will accelerate competition between suppliers to develop devices that gather and transmit data, and the use of these devices will change fundamental supply chains for manufacturers of parts and equipment in almost all industries, especially medical devices, electrical appliances, and auto assembly.

- Drone: The development of drones (pilotless, remote-controlled flying vehicles) has been closely connected to the development of related technologies including sensors, satellite systems, the IoT and AI. This has allowed drones to be used as labor- or time-saving devices in applications such as surveying land, preliminary visual inspection of an area, and spraying pesticide and applying fertilizer.

- Edge computing: This has evolved as a way of getting around the limitations of cloud computing-based big data analytics, and involves creating real-time links between data on changing consumer demand with production lines or other business operations, allowing systems to respond to customer data without having to pass through a cloud-based data center. Such systems, which emphasize speed, are most often used in applications where organizations need to respond swiftly to changing consumer behavior, in both the industrial and services sectors (e.g., healthcare providers, recreation services, and logistics).

- Artificial intelligence (AI): Industrial applications for AI are increasing. And when used alongside other new technologies, including cloud computing and the IoT, it is increasingly facilitating big data analytics, such as supporting recording and diagnostic systems in hospitals and healthcare facilities, assisting in call-center services, and employed in manufacturing and services industries that are affected by labor shortage. In addition, the deployment of ‘cobots’, where human staff work with robots and automated systems, is also increasing. For example, robots and drones working with farmers in field-based applications. Research by PwC reveals the majority (60-70%) of leading global corporations have developed AI applications for use in their assembly lines. Siemens now uses AI for its engineering quality control tests and to schedule maintenance of machinery. PwC predicts that by 2030, AI will be generating USD15.7trn worth of added-value in the global industrial sector. A survey of the investment plans of leading global companies carried out by Emerton Data (a data science consultancy) reveal 85% of respondents plan to use AI in their production processes.

- Blockchain: The use of distributed ledger technologies in place of centralized systems allows for the sharing of information among users on a network, but because data is password-protected, data-security is maintained. This would facilitate peer-to-peer business transactions, especially those involving digital currencies or assets, as well as the secure storage of large, sensitive datasets, such as medical genome maps, biometric data, or tracking and tracing sources of agricultural products to create systematic information, which will lower costs across the supply chain.

- Quantum computing: The development of computers that exploit the peculiarities of the quantum world, in place of the binary digital computers used currently, will increase both the speed and potential of AI. Quantum computing is now entering the stage where commercial applications are feasible. The market for smart devices that are built on quantum technology is forecast to be worth USD8bn by 2022 (Business insights & lifestyle guides, hivelife.com), mostly involving smart equipment such as driverless vehicles and robotics.

- 3D printing: The use of 3D printing allows for the rapid, low-cost design and production of goods controlled by digital technology. This can be used to better meet rising demand from middle-income consumers for customized products. This will play an increasing role in transforming industrial supply chains and allowing for the reuse and recycling of materials through ‘recycle bots’ in industries including fashion, parts for use in auto assembly and aeronautics, electronic equipment, tools, equipment and spares, and even printing tissue cultures.

- Cultured meat/plant-based meat: It is now possible to manufacture meat products from cow, chicken, pig and tuna stem cells. Meanwhile, meat-like products produced from plant-based ingredients are increasingly similar to meat in terms of taste and texture. These products have advantages over traditional meats, including smaller environmental impact, quality, absence of hormone and antibiotic residues, a healthier nutrient profile, less negative health impact than consuming conventional meats, and is a sustainable food supply in the event of food shortages resulting from outbreak of diseases in livestock or natural disasters. The products can also help to meet changing consumer patterns arising from an aging society and rising interest in personal health and wellness.

- Global value chains are being transformed by the after-effects of the COVID-19 pandemic. The pandemic had brought industrial supply chains almost to a halt in the first few months, but this has since incentivized corporations to identify some of the complexity in their supply chains and reduce the distance that separates them from their suppliers. This is being achieved by spreading production over several countries in the same region, and locate them near sources of supply. This process is leading to the creation of shorter, more diversified and more regionalized supply chains. In light of this, Krungsri Research projects that in five years, parts of Thai industry will be more deeply embedded in global value chains. Industries that will benefit from greater linkages to supply chains would be in downstream positions where Thailand has competitive advantages, including the production of food & beverage production, and computer & electronic products. However, upstream industries, especially agriculture and mineral extraction, risk seeing a weaker participation in global value chains.

Thai economy in 2021-2023: Recovery will be buoyed by the export sector and government stimulus measures

The Thai economy is projected to expand by an average of 3.4% annually over the next 3 years. Factors supporting economic growth in the coming period will include the following. (i) The latest wave of COVID-19 cases in the country is expected to be contained by 2Q21 given quick measures, experience from handling the first wave, and the availability of vaccines. This means the government should be able to relax pandemic control measures then, allowing the economy to return to near-normal and boosting sentiment in private-sector businesses. (ii) Business operations and consumer behavior have adapted rapidly to changing circumstances, with a surge in numbers working from home and online shopping. (iii) The export sector will rebound premised on a cyclical recovery in the economy and improving global trade, helped by easing of lockdown measures and rollout of extensive stimulus packages in major economies that lean heavily on both fiscal and monetary levers. (iv) Thailand is beginning to relax travel restrictions, and now permits entry for selected persons, including film crew, trade show participants, high-income earners, and those with ‘Special Tourist Visas’ (STVs). International travel should also pick-up gradually, possibly from the second half of 2021. The mass COVID-19 vaccination programs worldwide will encourage international tourism and tourist arrivals in Thailand should recover. (v) Government efforts to kickstart the economy will help to sustain greater levels of spending. They include measures to stimulate consumption and reduce cost of living, accelerated disbursement of the annual budget, an emergency decree allowing the government to borrow THB1trn to counter the impacts of the coronavirus disease, and using state enterprise funds to invest in infrastructure projects. Other measures include offering soft loans and financial assistance to businesses affected by the pandemic, through the Bank of Thailand (BOT) and the Thai Credit Guarantee Corporation’s Portfolio Guarantee Scheme.

Accelerating public-sector investment in infrastructure will underpin recovery of the overall business and industrial sectors

Government investment in infrastructure projects, especially in megaprojects, will be a major driver of growth in business and industry over the next several years. The latest Transportation and Communications Action Plan, published in 2018, forms part of the 20-year Strategic Plan for Communications and Transport (2017-2036) and calls for a total of THB1.77trn investment in infrastructure projects. The planned development of rail networks will involve a large number of projects that will start in 2021. The most significant will be the Den Chai-Chiang Khong and Ban Phai-Nakhon Phanom dual-track railways, the Thai-China high-speed rail, and the MRT Orange Line extension. Linking different parts of the country to the wider region will make the transport network significantly more comprehensive. The Eastern Economic Corridor also plays a strategic role in attracting and supporting many other large-scale investment projects, and these are now beginning to move into the construction phase, including the Suvarnabhumi-U Tapao high-speed rail, phase 3 of the development of Map Ta Phut and Laem Chabang ports, and the upgrade of U Tapao Airport, which will have a combined value of over THB60bn in 2021 (from a total combined value throughout the projects of THB680bn). The government has also agreed to upgrade and extend other projects, including developing Laem Chabang Port to connect the EEC to the south of Thailand and the country’s neighbors, thus helping to establish the country as an ASEAN transportation hub. This will lead to investment to develop and construct new transportation networks, for example, a dry port which should be completed by 2023-2024. Pushing through policies to accelerate the extension of this multimodal transport network, which will deepen regional communication and connections, will also help to pull in additional investment from manufacturing industries, especially those that are dependent on high-technology (e.g., auto parts and assembly, digital electronics, and healthcare), and from other parts of the economy such as real estate, retail and construction.

Business Environment

Structural problems are capping the competitiveness of Thai industry

The WEF’s 2019 Global Competitiveness Index reveals Thailand’s score for overall competitiveness improved to 68.1 from 67.5 in 2018, but the improvement lags behind that of other countries. Thailand’s rating out of 141 nations slipped from 38th to 40th. Thailand’s overall competitiveness improved because of macroeconomic stability, the economy is balanced, the financial sector is strong, and the population has almost universal access to high-quality healthcare. But Thailand needs to develop its regulatory environment, reduce bureaucracy, encourage the development of lifelong learning skills so the workforce can continuously up- and reskill, and encourage competition through diversification of production and distribution, and reduce risk of markets becoming monopolies.

Other areas where Thailand needs to reform urgently include developing a comprehensive infrastructure and network of rail and seaport services, assuring labor rights, building skills in innovation and technology (including developing, and then finding applications for innovations, and raising awareness of the importance of cybersecurity), and increasing the level of research & development. With regard to the latter, Thailand scored only 33.6 out of 100, trailing behind regional competitors such as China (79.5), India (57.1) and Malaysia (44.0), partly because expenditure on research & development accounts for only 0.8% of Thai GDP. Thailand also faces ongoing labor shortage. Although the country imports robotics systems for industrial applications to cut costs and raise standards, Thailand remains a ‘technology user’. Hence, it falls behind countries such as Japan, the US and China, which are a ‘technology investor’ and continuously invest in the development of robotics and other technologies to use themselves. Because of this, Thailand is only able to deploy robotic systems in certain industries, such as auto assembly, electronics, machinery and metals, plastics and food processing. Hence, the Thai export sector is still largely dependent on finding markets for products that are assembled with low levels of technology. Unfortunately, effecting the kind of structural reforms necessary to overcome these obstacles and to fully-transform Thai industry along the lines of the 4th Industrial Revolution will be a long process. The factors outlined above will weigh on the export sector, reduce competitiveness and escalate the risk of the country losing market share.

Regulatory reforms and the impact on industry

Stability

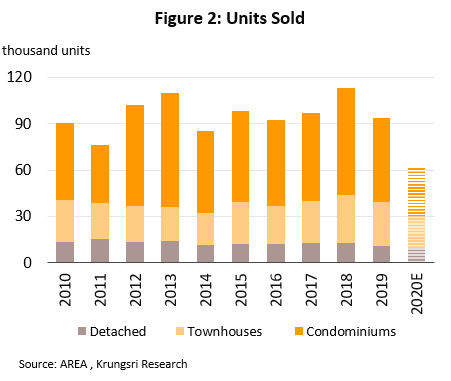

- There have been measures and changes in the real estate market (enforced since 2020) to reduce speculative pressure, improve efficiency of land allocation, and reduce uncertainty over the future value of mortgage collaterals.

- Greater regulation of mortgage loans with the introduction of new loan-to-value (LTV) rules. (i) For first homes valued at less than THB10mn, banks can offer 100% LTV ratio, with possibility to increase to 110% with a ‘top-up’. (ii) For first homes valued at over THB10mn, borrowers must make minimum 10% down payment. (iii) For second and subsequent homes, if there is a loan still outstanding on the first property or if the property is valued at over THB10mn, the maximum mortgage (loan for the property plus any ‘top-up’) will be relative to the collateral value, as specified in the regulations. These rules came into force in April 2019, with changes to the rules affecting first homes effective January 2020.

- The Land and Building Tax Act was effective in January 2020. This could increase real estate developers’ tax burden if they have a large backlog of unsold stock, especially unsold condominiums held for longer than 3 years because they will now attract a land tax.

- Government has reformed financial regulations to protect consumers, reduce the impact of the COVID-19 crisis, and to prepare the industry for greater competition.

- Increasing consumer protection. This is achieved by: (i) changing how interest is calculated and rules for fee collection when loans are paid-off early; (ii) changing interest charge for defaults by SME and individual borrowers, and splitting them into a series of payments (with effect from January 8, 2020); and (iii) extending regulation to cover services provided by specialized financial institutions (SFIs), asset management companies (AMCs), and nano-finance operations (with effect from September 4, 2020).

- Policies to reduce the impact of the COVID-19 crisis. These include aid to SME and individual debtors, a debt consolidation program for individual borrowers, a preventative debt restructuring program (January 1, 2020-December 31, 2021), and reducing statutory contributions by Thai banks to the Financial Institutions Development Fund (FIDF) from 0.46% to 0.23% of deposits for two years, starting April 2020.

- Authorities are also preparing the financial system for anticipated changes. They introduced new regulations to govern personal digital loans and the use of alternative data to support applications for the same (from September 15, 2020), drafting the Payment Systems Roadmap (2019-2021) which pushes for the use of digital systems as the primary payment channel, and enforcing new rules on peer-to-peer lending platforms (from July 2020).

Health

- The imposition of a sugar tax on non-alcoholic drinks with rates calibrated to sugar content should help to increase consumer awareness about the health impact of excessive sugar consumption. The tax rates are being ratcheted up in 4 stages: September 16, 2017-September 30, 2019, October 1, 2019-September 30, 2021, October 1, 2021-September 30, 2023, and October 1, 2023 onwards. In response to the steadily rising excise duties, prices may rise, demand may weaken, and manufacturers may start to produce low-sugar or health drinks.

Energy and the environment

- Reform of the energy sector is directed by the revised 2018 Power Development Plan for 2020-2037. The plan places a strong emphasis on alternative energy and supports the development of generating facilities powered by biomass, bio-gas and waste. The plan also opens the market for energy to competition in the supply of rooftop solar energy, help balance supply from alternative sources, and promotes investment in energy storage. Given this, investments in these energy sources will increase from 2021 onwards.

- Reform of energy sector regulations

- The LNG market has been liberalized. In the past, only a small number of operators were allowed to enter the market. Now, private-sector players are permitted to supply and transport LNG. As such, domestic prices for natural gas may fall.

- The crude reserves that refiners and traders are required to maintain have been lowered to 4% of total volume distributed, from the earlier requirement of 6% reserve ratio. This policy will run from May 1, 2020-June 30, 2021. After that, it will rise to 5%. This will reduce stockholding costs for operators.

- Extending expiry of subsidies for E20 and E85 gasohol and B10 and B20 diesel from 2022 to 2024. This will help to ease the COVID-19 impact on ethanol and palm oil producers. The pandemic has reduced in demand for transport fuel.

- Pushing back plans to address air pollution, especially PM2.5 particles. Authorities had pushed back plans to tighten regulations on exhaust emissions, and moving to Euro 5 and then Euro 6 standards. There will be introduced in 2024 and 2025, instead of 2021 and 2022, because the stricter standards will raise production costs for manufacturers as they will need to develop new engines and exhaust systems.

- Introducing new energy-efficient building regulations. The Building Energy Code (BEC) will cover the design and construction of new buildings in 9 categories: hospitals, schools and universities, offices, condominiums, conference centers, theaters and cinemas, hotels, service centers, and department stores and shopping centers. From 2021, the code will apply to new buildings with a footprint of 10,000 sq.m. or more. From 2022, this will be extended to those over 5,000 sq.m., and from 2023 to those larger than 2,000 sq.m. This will increase costs for design and construction materials for new buildings, and for retrofitting older buildings.

Trade

- Successful conclusion of negotiations for the Regional Comprehensive Economic Partnership (RCEP)*/ agreement on November 14, 2020. This will be followed by ratification by the signatories in the second half of 2021, and enforcement. The agreement is aimed at reducing duties on 99% of the goods traded between member states. This is expected to increase trade between Thailand and RCEP signatories (prior to the agreement, it comprised 55.8% of the total value of Thai exports). For Thailand, this will present a clear opportunity for manufacturers of autos and auto parts, plastic nurdles and plastic products, chemicals, rubber and rubber products, and electronics and parts for electronic appliances, as well as the fishing industry. The RCEP may also benefit Thailand by encouraging investors from non-ASEAN countries to invest in production facilities or business centers in Thailand, as well as trigger the growth of supporting industries.

- Since January 1, 2021, the UK has reduced or suspended tariffs on imports from countries with which the UK does not have a free-trade agreement and which have not been granted GSP status. (i) For goods that were subject to tariffs of up to 2.5%, imports are now tariff-free. This covers imports of gemstones and jewelry, air conditioners, and automatic data processing equipment. (ii) Goods for which tariffs were set at no more than 20% will see tariffs cut to a maximum of 2.5%, covering auto parts and equipment and glasses. (iii) Where tariffs were 20-50%, they are now reduced to no more than 5%, which will affect imports of processed fish products and vehicles weighing up to 5 tonnes. (v) Tariffs of over 50% (e.g. for tobacco products) will be cut to a maximum of 10%. These changes are naturally expected to benefit exports of Thai goods in these product categories.

- Since April 25, 2020, the US has rescinded GSP status for imports of Thai ceramics in 473 product categories, including tiles, sanitaryware, insulators, souvenirs and decorations, tableware and crockery. This will increase the cost of exports to the US, which with a 10% share (in 2019) is Thailand’s second most important export market for ceramic products. Japan accounts for 40% market share, making it Thailand’s largest market.

- Revision to the ASEAN Trade in Services Agreement (ATISA) is intended to fully liberalize trade in services from 2021. Compared to the 128 categories of services covered by the earlier ASEAN Framework Agreement on Services (AFAS), the ATISA extends trade liberalization to 155 areas. Under the agreement, signatory nations - without exception – must automatically grant foreign businesses most favored nation status. This could increase investment in Thailand’s services sector.

- The Trade Competition Commission is preparing to announce guidelines for operators of digital food delivery services. They are aimed at ensuring that delivery businesses operate fairly and there is free competition. The announcement is pending publication in the Royal Gazette, which means enforcement will start in 2021.

Other measures

- The annual THB40/room fee levied on hotels is suspended from July 1, 2020-June 30, 2022. This would reduce the financial burden on hotels because they have been badly hit by the pandemic.

- The Thai Industrial Standards Institute will include retread tires a controlled item, which will affect tires used in large vehicles, including passenger vehicles with more than 9 seats, trucks and articulated vehicles. It is hoped that this will improve the quality of retreads, making them safer and reduce accident rate. The regulations will be enforced in 2021.

- Review or repeal duplicate/outdated laws and regulations (the ‘guillotine’ process). This includes regulations governing visas and work permits for non-Thais. If successful, this will help businesses in industries troubled by labor shortage.

Krungsri Research believes the measures described above represent both an opportunity and a challenge to the Thai economy. But the changing global economic and social context means modernizing the country’s regulatory framework is an undertaking that cannot be avoided. Indeed, if successfully pursued, this process will help to lay the foundation for a business environment that will support long-term, sustainable, commercial and industrial growth.

AGRICULTURE

Rice

Situation in 2020

- Paddy outputs dropped 25.0% YoY in 9M20 following the worst drought in 40 years. The Rice Price Index surged 8.6% YoY led by higher prices for white and glutinous rice that were driven by (i) insufficient output to meet domestic demand, especially glutinous rice, and (ii) some exporters stopped sending shipments overseas as they stockpiled food in response to the pandemic. Overall, the income index for rice farmers fell 19.0% YoY, largely due to lower yields.

- Exports crashed 31.9% YoY to 4.0 mn tonnes in 9M20, bringing in USD2.70bn proceeds (-15.3% YoY). This was partly supported by much higher prices for Thai rice (e.g. Hom Mali, Glutinous and White) relative to rice from Vietnam, India and Pakistan. China, an major market for Thailand, also cut imports to run down domestic stock.

- In 4Q20, (when 80% of paddy has been harvested), output should rebound due to (i) higher rainfall, and (ii) high prices, expansion in cultivated area, and more plantings. For full-year 2020, paddy output is projected to rise by 6.5% to 30 mn tonnes. But exports will drop 25.0% to 5.69 mn tonnes because of weaker price competitiveness. Although prices of Thai rice have dropped since, they remain higher than rice from other countries because exporters had bought stock when prices were elevated.

Outlook for 2021-2023

- Annual output is expected to rise by 1.0-3.0% to 30-32 mn tonnes of paddy or 20-21 mn tonnes of milled rice. This would be driven by more favorable weather, which will boost yields especially for in-season rice (in 2021-2022, La Niña condition should help farmers). Farmers will also likely expand planted area and/or increase number of plantings because (i) although prices are falling, they remain above production costs, and (ii) they are incentivized by government measures to expand operations, including income guarantee, crop insurance, help with planting schedules, and soft loans to slow the release of new harvest.

- Players will continue to face challenges, including domestic and international price competition and high cost of Thai rice, though the impact will vary across different segments of the industry.

- Exporters: Exports will return to growth as competitiveness improves when domestic prices fall and current stock is sold off. But exporters will need to shoulder the costs of purchases made in 2019-2020 when Thai rice was more expensive.

- Millers: Businesses face higher risks because they will have to contend with uncertain weather and large excess supply. Large/integrated operations which can control costs will have an advantage, while SMEs may face problems with liquidity or securing paddy supply.

- Silos: Revenue will remain depressed due to large excess capacity. Operators will need to cut prices and seek alternative markets.

Rubber

Situation in 2020

- In 9M20, natural rubber output slipped 2.4% YoY due to outbreak of leaf fall disease and a shortage of migrant labor. Hence, output of upstream rubber products (ribbed smoked sheet, block rubber and concentrated latex) also shrank, albeit also due to weak demand. Exports (80% of output) fell 21.4% YoY to 1.9 mn tonnes with lower volumes to most markets. The COVID-19 crisis has dampened demand from downstream industries. Thus, exports of RSS and TSR tumbled 25.9% and 37.4% YoY, respectively. However, exports of latex rose 3.3% YoY mainly due to stronger demand from surgical gloves producers in Malaysia. Export prices slid 6.5% YoY, in tandem with lower crude prices, causing export proceeds to plummet 26.4% YoY to USD2.4bn However, government support helped to keep domestic demand similar to 2019.

- Rubber tapping activity has been affected by heavy rains, which means output will continue to slide in 4Q20. Hence, 2020 output is projected to drop 1.5% to 4.7 mn tonnes. Exports will remain depressed in 4Q20, and for 2020, it will shrink 16.0-17.0% following a 10.7% drop in 2019, due to weak demand and competition from the CLMV countries. Export prices will fall by 3.0-4.0% on lower crude prices (along with lower prices for oil-based synthetic rubber, a substitute good). As such, overall export value would drop by 19.0-20.0% to USD3.3bn However, domestic demand will rise by 1.0-2.0% thanks to higher government consumption and stronger 2H20 purchases by downstream industries as the economy recovered.

Outlook for 2021-2023

- Output will rise by 3.0-4.0% annually, led by: (i) earlier expansion in planted area; (ii) better climate; (iii) serious outbreak of leaf fall disease in other producing countries will benefit Thai rubber producers and raise prices; and (iv) incentives offered to farmers to expand plantations, such as income guarantee scheme.

- Domestic demand will rise by 4.0-5.0% per year premised on the economic recovery, progress in government infrastructure projects, growth of downstream industries (especially tire and latex gloves), and government support for the industry. Exports will also return to growth, rising by 3.0-4.0% annually driven by stronger demand from downstream industries, again led by manufacturers of tires and surgical gloves. Thailand will also benefit from smaller output in other rubber-producing countries. In Indonesia and Malaysia, this will be due to outbreak of leaf fall disease and labor shortage, and in Vietnam it will be due to severe storms. However, the outlook will vary across product groups.

- RSS and TSR: Exports will rise by only 1.0-3.0% and 1.0-2.0%, respectively, due to competition from traditional producers (Indonesia, Malaysia and Vietnam) and from new entrants to the market (Cambodia, Lao PDR and Myanmar).

- Latex: Exports will grow by 5.0-7.0% p.a. on stronger demand from producers of latex gloves and other latex-based medical products, especially in Malaysia, the most important market.

Cassava

Situation in 2020

- In 9M20, the drought and outbreak of cassava mosaic disease reduced cassava output by 12.3% YoY. But demand was mixed across different product groups.

- Exports of cassava chips and cassava pellets jumped 21.8% and 43.9%, respectively, due to greater demand for use in the production of alcohol, especially in China (Thailand’s major market). In China, cassava is an alternative to corn feedstock now that prices have escalated as stocks have dwindled.

- Exports of native and modified cassava starch dipped 6.6% YoY as demand from Indonesia, Taiwan and Japan softened. Export prices also dropped 3.0% YoY due to lower prices for cassava, weak demand, and greater price competition. Total export proceeds from cassava starch slid 9.4% YoY in the period.

- In 4Q20, the situation will be similar. So for 2020, cassava output should total 27.4 mn tonnes, falling 12%, compared to 5.8% growth in 2019. Domestic sales will rise by 1.9% (vs +13.1% in 2019) on stronger demand from the Food & Beverage (F&B) industry and for use in power generation. Ongoing disease outbreak means that in 2020, exports of cassava chips and pellets will jump 19.0-20.0% by volume and 20.0-21.0% by value. But weak orders from downstream industries overseas will reduce exports of native and modified cassava starch) by 4.0-6.0% by volume and 6.0-8.0% by value, with native tapioca cassava starch the hardest hit.

Outlook for 2021-2023

- Output should rise by 4.0-5.0% p.a. on higher rainfall and government aid and incentives for farmers to extend cultivated area, especially the income guarantee scheme. Domestic demand will grow by 2.5-3.5% annually led by rising demand from downstream industries, especially F&B, and from ethanol producers. Exports of cassava products will also grow by 4.0-6.0% per year, but it will vary by product group.

- Cassava chips: Export volume will rise by 8.0-10.0% per year driven by: (i) expansion into new markets in Asia, including Vietnam, the Philippines, India and Singapore, which would offset a slower Chinese market; (ii) stronger demand for cassava for use in the manufacture of alcohol; and (iii) following COVID-19, a desire to build stockpiles and ensure greater food security.

- Cassava pellets: Exports will reach 10,000-40,000 tonnes, though demand might be fickle.

- Native tapioca starch: Exports will rise by 1.0-2.0% per year on stronger demand from the F&B industry and alcohol and ethanol producers. But there will be stronger competition from similarly-priced starches produced from other crops (e.g. corn and potato).

- Modified tapioca starch: Exports should rise by 3-5% p.a. thanks to greater demand from downstream industries including cosmetics, food and pharmaceuticals.

Sugar

Situation in 2020

- In 9M20 (annual grinding season), sugarcane output crashed 48.9% YoY because of severe drought and low prices which had encouraged farmers to switch to more profitable crops. This caused sugar output to tumble 41.3% YoY. Likewise, weaker global demand triggered by the pandemic and drought-induced shortages also reduced exports by 33.0% YoY to 5.2 million tonnes. Weak demand from the F&B industry also weakened export prices for raw sugar, which slipped 1.3% YoY. Prices were also hurt by Brazilian producers’ move to switch from producing ethanol (due to lower oil prices) to manufacturing sugar. Overall, export value of sugar fell 30.4% YoY to USD1.6bn

- In 4Q20, output is expected to drop again despite stronger rainfall. For full-year 2020, output is forecast to drop by 43% on: (i) smaller sugarcane cultivated area; and (ii) slow growth or complete death of cane that has been harvested and allowed to regrow. The low cane and sugar output will disrupt supply. So for 2020, exports will fall by 37-38% by volume and 35-36% by value, compared to 11.3% and 3.0% growth in 2019, respectively. Following a 3.2% drop in 2019, slowing demand from the F&B industry will reduce domestic demand by 3.0-4.0% in 2020. Meanwhile, domestic sugarcane and export sugar prices should jump as world stocks shrink and global prices rise.

Outlook for 2021-2023

- Conditions will improve over the next 3 years.

- Supply: The emergence of La Niña means rainfall and reservoir levels should improve, especially in the major sugarcane growing areas in the northeast. Sugarcane output is forecast to rise to 85-93 million tonnes/year (up 7.0-8.0% p.a.), which would translate into 8-10 million tonnes of sugar (up 6.0-7.0% p.a.).

- Demand: Exports of sugar will rise by 7.0% to 7-8 million tonnes/year thanks to recovery in overseas markets. Domestic demand should grow by 2.0-3.0% to 2.5-2.6 million tonnes/year on (i) economic recovery, especially in the F&B industry, and (ii) government support for sugarcane growers and the sugar industry, e.g., offering aid for purchases of production materials and mandating the mixing of ethanol in gasohol.

- The industry will also face several challenges, including: (i) rising production in Brazil (the world’s biggest producer) as the country switches from ethanol to sugar production, which could lead to a supply glut and higher stock levels; (ii) hikes in sugar tax and a greater concern for public health; and (iii) uncertainty over the regulatory environment as the government attempts to align relevant legislations with WTO requirements. Specifically, the government is revising the Sugarcane and Sugar Act, broadening the coverage from only sugar production to include power generation and production of bioplastics and ethanol. They are also reviewing rules for floating sugar price and maintaining reserve sugar stock.

Oil Palm

Situation in 2020

- Oil palm output dropped 1.5% YoY in 9M20 on (i) low rainfall in 1H20, (ii) lack of care for oil palm trees, and (iii) labor shortage that affected harvest. As a result, crude palm oil (CPO) output plunged 13.4% YoY, even as domestic demand grew especially for biodiesel following the directive to move from B7 to B10. The latter caused CPO stock to be run down and pushed up prices of fresh fruit bunches (FFB) and CPO to THB4.0/kilo (+66.3% YoY) and THB25.8/kilo (+54.6% YoY), respectively. Exports of palm oil products weakened, sliding 30.7% YoY to 0.24 mn tonnes and generating USD167.9mn (-11.7% YoY). CPO exports tumbled 28.7% YoY to 0.18 mn tonnes, while that for refined palm oil fell 38.7% YoY to 0.055 mn tonnes. This was because India (75% market share of CPO exports) switched to importing from Malaysia and Indonesia since (i) duties were reduced for CPO from these two countries, (ii) Thai CPO prices are higher than competitors’, and (iii) the pandemic had reduce downstream demand.

- In 4Q20, output will continue to decline, while demand will rise especially in export markets. Domestic demand will be boosted by the move to use CPO to generate electricity and higher biodiesel component in commercial diesel sales. Overall, 2020 FFB output is estimated to drop by 2.5% yoy to 16.4 mn tonnes, while export of palm oil products should rise by 3.0-6.0% led by improving orders from India and government measures to encourage the export of over 0.3 mn tonnes of CPO. This would reduce CPO stock to 0.18 mn tonnes by year-end, below the optimal level of 0.20-0.25 mn tonnes. This could lift price of FFB to THB4.5/kilo from THB2.7/kilo (+65.0%) and CPO to THB28.6/kilo from THB18.2/kilo (+57.0%). Export prices would also rise by 24.0-25.0% and lift total export value by 25.0-30.0%.

Outlook for 2021-2023

- FFB output should rise by 3.0-4.0% annually, premised on (i) an expansion in cultivated area, (ii) age profile with trees now entering the most productive phase their lifecycle, (iii) better climate, and (iv) government income guarantee scheme and other incentives. Domestic demand for CPO will rise by 2.0-3.0% per year, thanks to government support to encourage higher consumption (biodiesel, pure refined palm oil, and input for downstream industries) and policies to stabilize prices. However, players will face conditions particular to their segment.

- Oil palm growers will have to manage price fluctuations. Although profit margins would rise given farmers will try to keep prices above production costs of THB3.01/kilo, growers could see prices hovering at THB3.5-5.5/kilo.

- Crude palm oil millers will see weaker earnings, especially independent mills that are not integrated in the broader supply chain. CPO demand will rise but this is dependent on short-term government intervention (e.g., use CPO for power generation, measures to promote palm oil exports, and international trade policies) to align demand with future supply in the market.

Chilled, Frozen and Processed Chicken

Situation in 2020

- Output of chilled, frozen and processed chicken grew 1.4% YoY in 9M20 on solid overseas demand. Exports reached 0.66 mn tonnes and brought in USD2.5bn proceeds, similar to 2019. Exports to Japan (Thailand’s most important market) soared, benefiting from the JTEPA and AJCEP FTAs. But shipments to the EU (Thailand’s second biggest market) tumbled following more stringent food safety checks to test for salmonella in imported chicken products. Domestic demand slowed following the national lockdown.

- For 2020, output of chicken products should increase by 3.1%.

- Output will increase by 1.1% to 1.58bn broilers, supplying 2.42 mn tonnes of chicken meat (up 2.3% yoy).

- Domestic demand for chicken products will rise by 2.0-3.0%, slowing down from 7.7% growth in 2019, because of weaker purchasing power and temporary halting of most economic activity in 1H20. The latter had substantially reduced demand from restaurants and fast-food outlets. However, the reopening of most business sectors in 2H20 helped chicken consumption to rebound.

- Exports of chicken will inch up 0.5-1.5%, boosted by the slowdown or closure of chicken-processing plants in some countries (due to COVID-19) and by outbreaks of bird flu in major producing countries and African swine fever in China. This, and high standards of Thai processors, have encouraged some buyers to switch to Thai suppliers.

- Farmgate prices for chicken will average THB34.0-34.5/kg, up from THB 33.7/kg in 2019, on stronger demand.

Outlook for 2021-2023

- Business conditions will improve for the chicken processing industry, with output rising and demand, both domestic and export, strengthening in line with the economic recovery.

- Domestic chicken production should rise by 4.0-5.0% per year to 1.66-1.82bn broilers, or 2.54-2.79 mn tonnes of meat. Farmers will be incentivized by higher prices (possibly THB34.5-36.5/kg) backed by stronger domestic and export demand.

- Domestic demand will grow by 2.5-3.5% p.a. as the economy rebounds and the Food & Beverage industry recovers.

- Exports of chicken products will rise by 5.0-7.0% p.a, boosted by: (i) stronger global demand; (ii) supply disruption in major chicken-producing and exporting countries caused by outbreaks of bird flu and African Swine Fever; and (iii) the signing of FTAs between Thailand and its trade partners will give Thai exporters a comparative advantage.

- Nonetheless, chicken meat producers could face higher production costs due to higher prices for soy- and corn-based feed. This would pressure earnings but they will remain healthy.

Canned Fish

Situation in 2020

- In 9M20, the canned fish industry recorded strong growth, with overall output rising 11.6% YoY. Output of canned tuna rose 15.6% YoY because the COVID-19 pandemic had prompted consumers to stock more canned food. This had affected both the domestic market (up 19.7% YoY) and international sales which rose 10.8% YoY to 0.48 mn tonnes, generating USD1.87bn receipts (up 8.6% YoY). Shipments to North America saw the strongest growth (+33.9% YoY), led by exports to the US where importers switched from major competitors in the Philippines and Ecuador to sourcing from Thai suppliers. Demand was also strong in markets in Asia, South America and Africa. Thai exporters benefited from the country’s solid record in biosecurity and FTAs that Thailand signed with 18 countries.

- Export prices softened, falling back 2.1% YoY for canned tuna and sardines amid competition from the Philippines, Indonesia, Vietnam and ACP countries (Africa, Caribbean and the Pacific).

- Demand for canned fish should continue to rise in the rest of 2020. Strong orders from domestic and international markets are encouraging players to ramp up production capacity. We estimate output will rise by 12.0-15.0% in 2020, compared to only +1.4% in 2019. Exports should increase by 8.0-9.0%, but weaker prices in international markets means export value will rise by a smaller magnitude of 6.0-7.0% to USD2.06bn.

Outlook for 2021-2023

- The canned fish industry will continue to grow, with output forecast to rise by 5.0-6.0% per year. This would be supported by stronger demand especially in export markets. Players will benefit from: (i) expansion of Thailand’s market share during the COVID-19 crisis because of the country’s relatively high biosecurity standards; (ii) stronger overseas demand as the global economy and world trade recover; and (iii) greater investment in research & development to expand product range and produce more value-added products. Overall, exports are projected to rise by 3.0-5.0% p.a. by volume and 2.0-3.0% p.a. by value.

- However, there are still challenges for the industry. These include insufficient fish stock, labor shortage, and more trade barriers, especially non-tariff barriers (promote sustainable fishing, labor rights) which could reduce profitability, especially for SMEs.

ENERGY & UTILITIES

Power Generation

Situation in 2020

- Demand for electricity slipped 3.1% YoY in 9M20. Due to COVID-19 and the broad-based contraction in the economy, demand from business and industry (66.5% of total demand) fell by 10.4% and 6.3% YoY, respectively. However, work-from-home activity increase household power consumption, which rose 9.5% YoY. Overall, peak demand reached 28,636.7 MW, down from the historic high of 30,853.2 MW in 2019.

- Electricity generation also fell in 9M20, by 2.1% YoY. Generation by EGAT (33.8% of total) rose 4.6% YoY. But output from the private sector differed; supply from IPPs (Independent Power Producers which accounted for 22.4% of total electricity output) fell 17.3% YoY, while supply from SPPs (Small Power Producers, 25.6% share) fell 1.2% YoY. But, supply from VSPPs (Very Small Power Producers, 5.6% share) rose at a slower pace of 1.2% YoY.

- In 1H20, installed renewables capacity selling to the grid reached 9,010.5 MW[1], up 0.9% from 2019, as SPPs and VSPPs continued to supply power as specified in their contracts. Waste-to-energy capacity grew 3.1%, biogas generating capacity rose 2.3%, while biomass generation capacity increased by 1.6%.

- For the rest of 2020, the reopening of most business sectors means demand from business and industry will rebound. We estimate demand would shrink by 3.0% in 2020 vs +2.7% in 2019.

Outlook for 2021-2023

- Players will see improving business conditions. Domestic demand is forecast to rise by 3.0-4.0% annually[2], in line with the economic recovery. Attractive investment incentives for the industry under the Power Development Plan (PDP) will support greater investment and larger capacity in the three categories below:

- IPPs will see competitive bidding for new supply contracts in the next 3-5 years. In 2021-2022, players will start to bid for 700 MW of new generation capacity annually. This will replace 8,300 MW of natural gas-powered capacity in the western region which contracts will expire soon and the plants would be offline over 2025-2027. Some IPP’s are also investing in power plants overseas, such as Indonesia, the Philippines, Lao PDR, China and Myanmar.

- SPPs are likely to expand installed capacity and build new power plants, especially natural gas cogeneration plants which contracts will expire soon. In addition, SPP hybrid firms (i.e., plants that run on a mix of renewables) will benefit from higher government feed-in tariff of THB3.69/unit (vs THB3.66/unit in 2019). This support will be maintained over the next 20 years.

- For VSPPs, investment should pick up from 2021, especially in rooftop solar capacity and biomass, biogas and waste-to-energy generation capacity. Supply from these remain below target, so they offer an investment opportunity. And, such plants are also competitive on costs and inputs. The government will buy more wind-generated power in 2022-2024 when EGAT complete the installation of high-voltage lines to wind farms in the northeast and south of the country to the national grid.

Oil Refineries

Situation in 2020

- In 9M20, global demand for oil tumbled 9.9 mn bpd as the COVID-19 pandemic had severely disrupted the global economy. At the same time, OPEC+ throttled supply by only 5.6 mn bpd. These caused Dubai Crude to crash 34.8% YoY to USD41.6/barrel (from USD63.8), and gross refinery margins (GRMs) to plummet to an average of only USD0.3/barrel from USD4.3 in 9M19.

- Thai refineries’ earnings slumped along with GRM and a 12.4% YoY fall in 9M20 domestic demand for refinery products. Pump prices for gasoline and diesel also fell sharply to THB25.4 and THB20.2, respectively, from THB32.1 and THB24.5 per liter average in 9M19. Capacity utilization also slipped to 81%.

- In 4Q20, the reopening of most business sectors and return to near-normal economic activity suggest better prospects for refineries. For full-year 2020, we estimate the following:

- Dubai Crude price will drop to USD41.5/barrel average in 2020 from USD63.2 in 2019, and Singapore GRM will average only USD0.4/barrel compared to USD3.48 in 2019.

- Demand for refinery products would drop 11.6% in 2020 compared to +2.0% in 2019. Pump prices for gasoline and diesel are forecast to slip to THB27.0 and THB22.4 per liter from THB32.0 and THB24.5 in 2019. Capacity utilization will also slide to 81% from 83% as some refineries had closed for maintenance for longer than expected in 1H20.

Outlook for 2021-2023

- Dubai Crude price will bounce back. The world economy is projected to return to a growth trajectory next year, which would increase demand for oil. This is projected to lift prices to average of USD48 per barrel in 2021, USD54 in 2022, and USD60 in 2023. The market will be buoyed by stronger demand for petroleum products (except aviation fuel because of ongoing travel restrictions), which will widen Singapore GRM to USD0.9-2.5/barrel.

- Domestic pump prices will also rebound. Over the next three years, gasoline price is projected to climb to an average of THB30.0, THB31.5 and THB33.0 per liter, and diesel to THB23.5, THB24.5 and THB26.0 per liter.

- Thai refineries’ earning will recover on stronger domestic demand and wider GRM. The market will be boosted by average 3.0-4.0% average annual increase in the number of vehicles on the road, which would lift demand by 2.8-3.3% annually. No new production facilities are scheduled to come online over the next 3 years, so capacity utilization should continue to average 82-85%.

Ethanol

Situation in 2020

- In 8M20, demand for ethanol fell 9.8% YoY to an average of 3.98 mn liters/day due to global travel restrictions and slower sales of gasohol during lockdown. For the rest of 2020, the reopening of most business sectors government efforts to stimulate tourism will help demand to recover. However, average daily demand will only average 4.13 mn liters, 6.4% below 2019 average.

- In the same period, ethanol output fell 8.4% YoY to 4.11 mn liters/day. Of this, 2.59 mn liters were produced daily from molasses, 1.31 mn liters from cassava, and 0.21 mn liters from sugarcane. Overall capacity utilization averaged 69% (down from 76% in 8M19) but for full-year 2020 it should inch up to 70%. But this would still be lower than 75% in 2019.

- Manufacturers of ethanol which use cassava root feedstock saw wide margins, but profitability dropped for those who use cassava chips. Although cost of cassava root has dropped by 6.8% YoY, price for cassava chips fell only 1.2% YoY, leaving production costs at THB19.15 and THB21.45 per liter, respectively. However, those who use molasses were pressured by escalating global prices for sugar which pushed up production cost by 38.7% YoY to THB28.16/liter against selling prices of THB24-25 (reference price plus marketing margin of THB1-2/liter).

Outlook for 2021-2023

- Over the next 3 years, demand for ethanol is forecast to rise by 2.3-3.5% per year to 4.3-4.5 mn liters/day. This would be driven by an anticipated rise in sales of E20, from 20% to 30% of total gasohol sales. This is premised on the following:

- The government will encourage use of E20 gasohol (20% ethanol) in place of E10 (10% ethanol) to help the cassava and sugar industries.

- Demand for transport fuel1/ is expected to increase by 3.0% annually as the economy recovers and the national vehicle fleet expands.

- Competition within the industry is manageable and there is no known capacity coming online in 2021-2022. However, capacity could rise in 2023 as Nakhon Sawan Biocomplex starts commercial operations. Given this, over the next 3 years, capacity utilization would average 74-79%.

Biodiesel

Situation in 2020

- Domestic consumption of biodiesel (to blend with petrodiesel) rose 7.0% YoY to an average of 5.1 mn liters/day in 9M20. For full-year 2020, demand should reach 5.2mn liters/day, 0.25mn liters more than 2019 daily average. This would be driven by the move to B10 from B7 (i.e., increase biodiesel content from 7% to 10%).

- Biodiesel production rose 1.5% YoY to an average of 5.0 mn liters/day in 9M20. This was largely due to a sharp drop in output during the most severe phase of the lockdown (March-April). Production capacity grew 6.0% YoY to 8.3 mn liters/day, so for full-year 2020, capacity utilization would slip to 62% from 64% in 2019.

- Biodiesel reference price (price at which producers sell to oil traders) jumped 44.5% YoY to THB 29.7/kilogram. The drought had reduced palm oil yields and caused prices of CPO and palm stearin to surge 53.1% and 54.1% YoY to THB25.6 and THB26.2 per kilogram, respectively. Meanwhile, biodiesel-CPO spread for widened to THB4.1/kilogram in 9M20 from THB3.8 average in 2019.

Outlook for 2021-2023

- The biodiesel industry will continue to grow, with demand forecast to rise by 6-9% p.a. to 5.6-6.4 mn liters/day. This outlook is supported by the following:

- There will be new demand from higher biodiesel content in B10 (additional 1.0-1.5 mn liters of daily demand by 2023) and the government will use the Fuel Fund to subsidize prices for B20.

- The number of diesel-powered vehicles registered in Thailand is expected to increase by 4.5-5.0% per year, which will increase demand for diesel products by 5.0% p.a.[1]

- Recovery from the COVID-19 crisis and a rebound in the economy, especially in the transport sector, coupled with greater regional economic connectivity within ASEAN, will boost demand for commercial vehicles.

- Capacity utilization would also rise to 68-74% p.a. on expectations demand will grow more rapidly than production capacity, although new capacity will start to come online after 2021.

PETROCHEMICALS

Petrochemicals

Situation in 2020

- In 10M20, world demand for petrochemical products shrank due to the COVID-19-induced global recession. This pulled down prices and squeezed spreads for most upstream and downstream products, with the exception of some olefins for which spreads widened with greater demand for use in manufacturing packaging and medical goods.

- Naphtha prices averaged USD376.1/tonne, down 27.0% YoY on lower crude prices. Prices should average USD380/tonne in 2020.

- Upstream petrochemicals: Spreads for ethylene averaged USD290.7/tonne, down from USD331.1 in 10M19, while that for benzene averaged USD103.8 compared to USD123.3 a year earlier. For 2020, spreads are forecast to average USD320 and USD100/tonne, respectively.

- Downstream petrochemicals: Polyethylene (PE) spreads averaged USD147.3/tonne, up from USD99.9 in 10M20, and polystyrene (PS) spreads rose to USD292.1 from USD213.2. For 2020, PE and PS spreads are expected to average USD150 and USD300 per tonne, respectively.

- Domestic demand for petrochemicals fell 3.3% YoY in 10M20, declining for most categories as downstream demand contracted sharply with the lockdown. For the rest of 2020, the situation should improve with a rebound in industrial activity, and for the year, demand is forecast to slip by 2.4%.

- Prices for upstream and downstream goods will weaken in 2020. This will pressure operators’ revenues because the majority operate across the supply chain. However, prices for aromatics will fall faster and take longer to recover than olefins.

2021-2023 Outlook

- A recovery in the global economy will lift demand, and in turn, prices and spreads.

- Prices for naphtha will rise to USD 420-480/tonne driven by: (i) higher crude prices; and (ii) opening of new petrochemical facilities and a South Korean plant resuming production (that uses naphtha as input).

- Ethylene spreads will widen to USD350-380/tonne, but new production capacity coming onstream in 2021 and high inventory levels in China will keep benzene spreads at USD130-170/tonne.

- Spreads for polyethylene will widen but new capacities in China and Southeast Asia will cap these at USD175-200/tonne. Polystyrene spreads would rise to USD350-380/tonne.

- Stronger spreads for main products will boost operators’ earnings, while higher demand for plastic resins by downstream industries, including auto parts & assembly, construction and medical supplies, is expected to raise domestic and export demand by 1.5-3.5% and 3.0-4.2% p.a., respectively.

CHEMICAL

Pharmaceuticals

Situation in 2020

- The Thai pharmaceuticals industry is focused on downstream production, generally generic drugs made from imported active ingredients. About 90% is sold in the domestic market. This year, fears of contracting COVID-19 and social distancing measures had reduced visits to hospitals (main distribution channel) by both Thai and foreign patients. This had dampened demand. For full-year 2020, growth should reach 2.0-3.0%.

- In 9M20, the value of the domestic pharma market[1] rose 1.6% YoY following the COVID-19 pandemic and greater demand for analgesics, anti-inflammatories and anti-fever medications. However, the value of exports slipped 0.4% YoY to THB9.8bn, with exports to the Philippines, Lao PDR, Hong Kong, Malaysia and Singapore (combined 24.3% of exports by value) contracting 11.0% YoY, though combined exports to Vietnam, Myanmar and Japan (61.3% of exports) rose by 5.2% YoY.

- Production[1] grew 6.8% YoY by volume, led by a rise in the output of pills and capsules (analgesics, anti-inflammatories and fever medications). Imports edged down 2.7% YoY by volume but rose 6.1% YoY by value to THB43bn. Imports (by value) from Germany (14% of imports of pharmaceuticals) and India (8.6% of imports) rose by 3.9% and 9.9% YoY, respectively, but this was mainly due to price hikes. By volume, imports from these countries fell. However, those from China (2.8% of imports) rose in both volume (+19.7% YoY) and value (+11.5% YoY), most of this being for active ingredients for use in the production of generic analgesics and anti-fever medications.

Outlook for 2021-2023

- The value of the domestic market is forecast to grow by 3.5-4.5% annually. This would be led by stronger demand, resulting from: (i) more incidence of ill-health, especially chronic non-communicable conditions (NCDs) that need to be treated with expensive imported medicines, and an aging Thai society; (ii) extension of the government health insurance scheme across the population, which has led to rising expenditure on medicines; (iii) after a sharp drop in 2020, foreign patients will start to return to Thai hospitals; and (iv) following the COVID-19 pandemic, there are rising concerns over personal health. Exports will also strengthen, especially to ASEAN region where there is more confidence in Thai-made pharmaceuticals following Thailand’s admission to the GMP PIC/S scheme[2].

- But competition could also intensify on: (i) greater imports of low-cost Chinese and Indian medicines; (ii) entry of new (especially overseas) players to the domestic market, e.g., Japanese corporations which will produce in Thailand for export back to their home country to penetrate the CLMV market; and (iii) Thai businesses in other economic sector expanding into pharmaceuticals. Production costs will also rise due to: (i) the need to upgrade facilities to meet GMP-PIC/S standards; and (ii) higher prices for imported medicines and active ingredients because of the inflationary effect of COVID-19 on chemical inputs.

Chemical Fertilizers

Situation in 2020

- In 9M20, demand for fertilizer for use in fertilizer-intensive commercial crops (e.g., oil palm, rubber and off-season rice) remained steady as heavy rain in 3Q20 allowed more planting. For all of 2020, demand is expected to reach 5.0-5.2 million tonnes, close to that in 2019.

- In 9M20, imports of straight fertilizer (65.5% of total fertilizer imports by volume) and mixed fertilizer (34.5% of imports) rose 3.0% YoY to 4.3 million tonnes valued at THB38bn (-10.5% YoY). This higher imports was driven by heavier rainfall in 3Q20 which led to more extensive cultivation, which required the use of more fertilizer (+37.4% YoY in the quarter). Rising prices for many agricultural products also stoked greater demand. Hence, following a 3.2% drop in 2019, fertilizer imports is forecast to rise by 2.0-3.0% to 5.3 million tonnes in 2020.

- Retail prices for fertilizer[1] also weakened in 9M20. Price for urea (used on rice and most other crops) fell 5.1% YoY in line with prices on world markets which have been affected by COVID-19. Hence, earnings for manufacturers and distributors should weaken in 2020.

Outlook for 2021-2023

- Demand for fertilizer is forecast to grow by an average of 2.0-3.0% per year to 5.2-5.4 million tonnes. The incremental demand would be driven by higher prices for agricultural goods and an expected expansion in cultivated area: (i) crops that require heavy fertilizer application, including rice, corn for animal feed and cassava, account for a combined 60% of total fertilizer demand; and (ii) crops with high per unit application rates, including oil palm and rubber.

- Operators will try to build additional revenue streams and strengthen their business by expanding marketing and distribution channels. They include selling greater value-added products (e.g., by offering custom fertilizer mix) and increasing exports to neighboring countries. However, there are several challenges, including rising interest in organic farming and the use of bio-fertilizers, which could reduce demand in the future.

AUTOMOTIVE & PARTS

Automobiles

Situation in 2020

- Domestic auto output fell 38.8% YoY to 960,000 units in 9M20 because the global supply chain had been disruption by COVID-19. The pandemic also caused domestic sales to drop by 29.8% YoY to 0.53 million units as consumers cut unnecessary expenditure, lenders tightened new credit approvals, and the lockdown business closures and drought (upcountry) reduced spending power. Exports also struggled, with sales falling 36.5% to 0.52 million units and value by 32.3% YoY to USD9.38bn. Shipments to major overseas markets suffered, including to the Philippines (-48.3% YoY), Vietnam (-48.0% YoY) and Australia (-30.9% YoY). However, exports to Japan and China bucked the trend, rising by 141.8% and 51.7% YoY, respectively.

- For the rest of 2020, output and sales should drop by a smaller magnitude as supply chains are gradually restored, and domestic and export markets come back to life. As such, for 2020, output is expected to fall by 32-33% to 1.35-1.37 million units. Domestic sales will drop by 30-31% to 0.70-0.71 million units and exports will fall by 34-35% to 0.69-0.70 million units.

2021-2023 Outlook

- Industry output is forecast to rise by 3.0-4.0% annually over the next 3 years. This would be supported by the following:

- Domestic sales will rise by an average of 3.0-4.0% per year, premised on a brighter economic outlook. The would be strong demand for commercial vehicles with accelerating construction activity, online sales, and expansion in the logistics sector. Manufacturers also plan to stimulate the market with a steady stream of new models and offering both internal combustion engines (ICE) and electric vehicles (EVs). However, sales (demand) would be capped by a slow economic recovery which would limit growth in consumer spending, high levels of household debt, and a still-tight lending environment.

- Exports should recover at a faster rate of 4.0-5.0% per year as economies in overseas markets rebound. Exports to ASEAN will also be helped by the Free Trade Area and Mutual Recognition Agreement that cover safety tests for autos & parts; it removes the need to test goods moving between signatory countries. However, there is lingering uncertainty over US-China trade relations and the Philippines (a major export market for Thai auto makers) might hike duties on vehicles imported from Thailand in retaliation for Thailand taking a case to WTO against the Philippines for allegedly under-declaring the value of cigarette exports. The rising popularity of EVs worldwide could also have an impact on Thai auto exports, most of which are ICE vehicles.

- Dealerships of New Vehicles

Situation in 2020

- Domestic sales fell 29.8% YoY to 0.53 million vehicles in 9M20 because of the pandemic-induced temporary shutdown of most economic activity. This had stoked greater price competition as players looked to sell inventory. Revenues from services and sale of spare parts also fell following a 3.1% drop in the number of vehicles (to 5.2 million) on the road that are under 5 years old.

- In 4Q20, business conditions will remain depressed. For full-year 2020, distributors’ revenues will fall sharply due to weak consumer spending power and tight credit conditions. In 2020, sales of new vehicles will drop by 30-31% (to 0.70-0.71 million units). Revenue from services and parts will also fall by 4% relative to 2019, with an equivalent drop in the proportion of national vehicle fleet that is 5 years old or newer.

2021-2023 Outlook

- Overall revenue growth will be limited, with receipts from new vehicle sales rising by only 3.0-4.0% per year. Revenues from service centers and sale of spares is projected to weaken with fewer cars on the road that are less than 5 years old. Although older cars or those with higher mileage will require more servicing, many owners prefer to use general mechanics because they are normally cheaper. Margins will also be pressured by auto makers by: (i) requiring dealers to invest in upgrading showrooms and service centers; and (ii) greater online sales activity, which may increase competition between distributors.

Situation in 2020

- Conditions were sluggish in 9M20, as reflected in the 6.5% YoY drop in the Index of Used Car Prices. This was caused by slow sales, which encouraged sellers to cut costs (e.g., interest and maintenance) by selling inventory units. To do this quickly, they have to compete on price. Prices also fell because the First-Car Program had induced an exceptionally large supply of used cars in 2018-2020, and there will be more used (repossessed) vehicles for sale during the 2020 recession.

- The market for used vehicles should recover slightly in 4Q20. For full-year 2020, total unit sales would rise slightly. The drop in prices of used vehicles has attracted more buyers to the market, especially individuals who want to avoid using public transportation, or who need a vehicle for work but cannot afford a new car. Sales are also helped by dealers actively conducting marketing campaigns and building up consumer confidence by raising the standard of their goods, providing checks and quality guarantee to buyers, and expanding their online marketing and sales channels.

2021-2023 Outlook

- Sales is projected to grow in line with a recovery in consumer spending power. Prices will rise because the supply of used vehicles bought under the First-Car Buyer Scheme has peaked in 2017-2019 and will start to drop. New entrants to the industry (from overseas, as well as auto makers) will also stoke competition and threaten players’ margins, most of which are SMEs.

Motorcycles

Situation in 2020

- Motorcycle output dropped by 23.5% YoY in 9M20 to 1.11 million units. Domestic sales (80% of the market) also fell but at a slower rate of 13.7% YoY (to 1.15 million units) as the weak economy and drought ate into spending power of the core markets (non-farm laborers and farmers). Exports fell 14.0% YoY to 0.23 million units, largely due to the COVID-19 impact and on both the global economy and Thailand’s main export markets. However, by value, exports jumped 17.9% YoY to USD1.39bn led by stronger shipments pricier ‘big bikes’. By individual markets, nearly 70% of export proceeds were derived from China, Japan and the EU, which saw increases of 137.3%, 44.2% and 27.0%, respectively.